The National Association of Home Builders (NAHB) has announced its NAHB/Westlake Royal Remodeling Market Index (RMI) for Q1 of 2024, which showed a value of 66—one point lower than the previous quarter.

“Demand for remodeling remains solid, especially among customers who don’t need to finance their projects at current interest rates,” said Mike Pressgrove, NAHB Remodelers Chair and a remodeler from Topeka, KS. “Construction costs are still an issue in some places, just as they were toward the end of last year.”

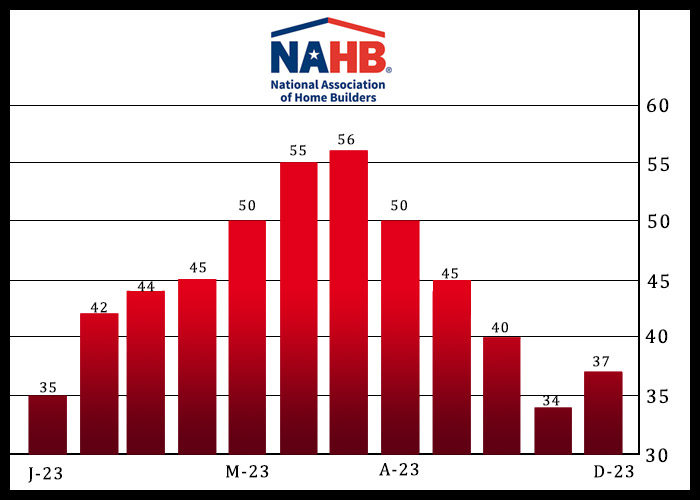

This comes after home builder sentiment rebounded in December 2023 after falling for four consecutive months. The NAHB/Wells Fargo Housing Market Index increased to 37 in December 2023 from 34 in November, an eleven-month low; however, economists predicted the index to rise to 36. The headline index rebounded in 2023 as the component measuring sales forecasts over the next six months increased to 45 in December from 39 in November of last year.

The Current Conditions Index is the average of three components: the present market for big renovation projects, medium-sized projects, and minor projects. The Future Indicators Index is calculated by averaging two components: the current rate of lead and inquiry generation and the existing backlog of renovation projects. The total RMI is determined by averaging the Current Conditions Index and the Future Indicators Index. Any figure more than 50 implies that more remodelers consider remodeling market circumstances to be positive rather than negative.

The Current Conditions Index averaged 74, which was unchanged from the previous quarter. In Q1, all three components remained well above 50 in positive territory:

- The component measuring large remodeling projects ($50,000 or more) remained unchanged at 70.

- The component measuring moderate remodeling projects (at least $20,000 but less than $50,000) dropped one point to 74.

- The component measuring small-sized remodeling projects (under $20,000) edged down one point to 77.

“An RMI at 66 is consistent with NAHB’s forecast for stable remodeling spending in 2024,” said Robert Dietz, Chief Economist of NAHB . “Rising costs for construction labor and building materials continue to be the major headwinds to faster growth.”

The Future Indicators Index averaged 59, unchanged from the previous quarter. The component representing the current pace at which leads and inquiries are received grew one point to 57, while the component measuring the backlog of remodeling jobs decreased one point to 61.

To read the full release, including more data and methodology, click here.