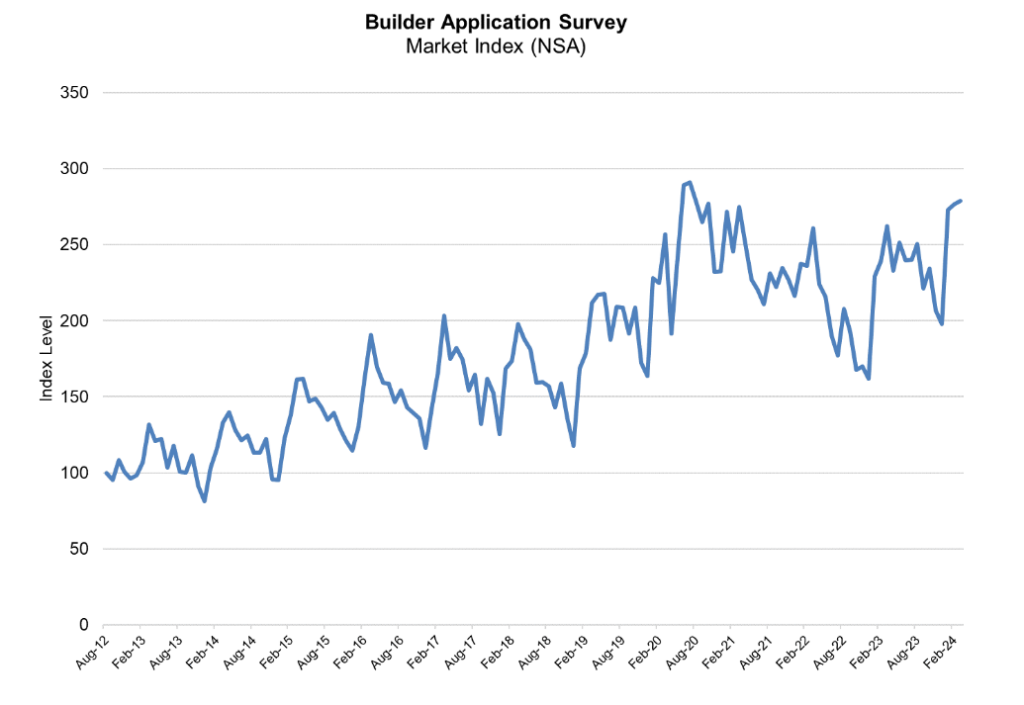

The latest Builder Application Survey (BAS) issued by the Mortgage Bankers Association (MBA) for March 2024 shows that mortgage applications for new home purchases increased 6.2% compared to a year ago. MBA’s Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country.

Month-over-month, compared to February 2024, new home purchase apps increased by just 1%. This change does not include any adjustment for typical seasonal patterns.

Despite the slight month-over-month uptick, the FHA share of applications rose in March, reaching 26.4%, compared to a 24% average for the prior 12 months. An increase in the FHA share of new purchase apps indicates that the market is experiencing more first-time home buyer activity.

HUD and the Census Bureau reported that privately‐owned housing starts in March 2024 were at a seasonally adjusted annual rate of 1,321,000—14.7% below the revised February 2024 estimate of 1,549,000 and 4.3% below the March 2023 rate of 1,380,000. Single‐family housing starts in March were at a rate of 1,022,000—12.4% below the revised February figure of 1,167,000.

In addition to the previously mentioned FHA share of loan apps, by product type, conventional loans comprised 63% of loan applications, RHS/USDA loans comprised just 0.3%, and VA loans amounted to just 10.4%. The average loan size for new homes decreased from $405,719 in February to $405,400 in March.

‘Tis the season

“March is typically a month when new home purchases see a seasonal boost, but this year March applications for new home purchases saw less than a 1% increase over the prior month on an unadjusted basis,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “Applications were still ahead of last year’s pace, but at 6%, the annual growth rate was the slowest since September 2023. Homebuyers remain adversely impacted by strong home-price growth and mortgage rates hovering around 7%. The FHA share of applications did increase in March, exceeding 26%, compared to a 24% average for the prior 12 months. A higher FHA share can be a sign of more first-time buyer activity, but that segment of buyers is also more sensitive to affordability challenges.”

MBA estimates new single-family home sales, which has consistently been a leading indicator of the U.S. Census Bureau’s New Residential Sales report, is that new single-family home sales were running at a seasonally adjusted annual rate of 615,000 units in March 2024. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for March is a decrease of 10.7% from the February pace of 689,000 units. On an unadjusted basis, MBA estimates that there were 60,000 new home sales in March 2024, a decrease of 3.2% from 62,000 new home sales in February.

“MBA’s estimate of new home sales fell more than 10% over the month to a seasonally adjusted pace of 615,000 units, the slowest annual pace in four months,” added Kan.

The state of rates

And while the year has begun with mortgage rates hovering in the mid-6% range, Freddie Mac reported that April began with the 30-year fixed-rate mortgage (FRM) leaping toward the 7%-mark, settling at 6.88% for the week ending April 11.

The National Association of Home Builders (NAHB) reported that builder sentiment was flat in April, as mortgage rates maintained in the 6.5%-7% range, and the latest inflation data failing to show improvement during Q1 of 2024. According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), builder confidence in the market for newly built single-family homes stood at 51 in April, unchanged from March—breaking a four-month period of gains for the Index.

“Builder sentiment was flat in April, but remains above the break-even point of 50, indicating positive sentiment,” said First American Deputy Chief Economist Odeta Kushi. “The long-term housing shortage, coupled with a lack of existing-home inventory and builders’ ability to offer incentives has helped to buoy new single-family construction. However, builders continue to grapple with challenges stemming from the ‘five Ls’–labor, lots, legal issues, lumber, and lending. ‘Higher-for-longer’ mortgage rates are also a major headwind for builders and potential home buyers alike.”