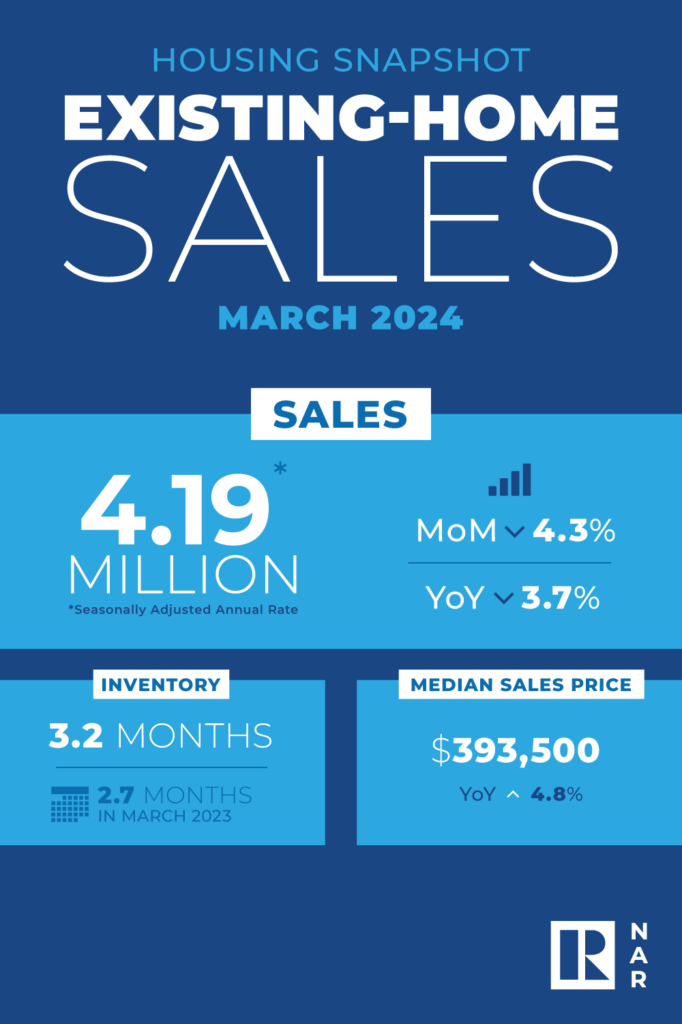

According to the latest Existing-Home Sales Report housing snapshot from the National Association of Realtors (NAR), existing home sales fell 3.7% year-over-year in March 2024 while median existing-home sale prices rose 4.8% year-over-year to $393,500, marking the ninth consecutive month for home price gains and the highest ever number for the month of March.

According to the NAR, the inventory of unsold homes grew 4.7% from one month ago to 1.11 million dwelling units, the equivalent of 3.2 months of inventory at the current monthly sales pace. This number is up 14.4% (970,000 units) from one year ago.

“More inventory is always welcomed in the current environment,” Yun added. “Frankly, it’s a great time to list with ongoing multiple offers on mid-priced properties and, overall, home prices continuing to rise.”

The current rate of existing-home sales fell to a seasonally adjusted annual rate of 4.19 million units in March. Year-over-year, sales fell from 4.35 million units in March 2023.

“Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves,” said NAR Chief Economist Lawrence Yun. “There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.”

Further, the NAR said the average property is on the market for 33 days in March, down from 38 in February 2024, but up from 29 days year-over-year.

First-time buyers were responsible for 32% of sales in March.

All-cash sales accounted for 28% of transactions in March, down from 33% in February but up from 27% one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 15% of homes in March, down from 21% in February and 17% in March 2023.

Distressed sales—foreclosures and short sales—represented 2% of sales in March, virtually unchanged from last month and the prior year.

Single-family home sales declined to a seasonally adjusted annual rate of 3.8 million in March 2024, down 4.3% from 3.97 million in February and 2.8% from the prior year. The median existing single-family home price was $397,200 in March, up 4.7% from March 2023.

At a seasonally adjusted annual rate of 390,000 units in March, existing condominium and co-op sales decreased 4.9% from last month and 11.4% from one year ago (440,000 units). The median existing condo price was $357,400 in March, up 5.8% from the previous year ($337,900).

Regional breakdown

Existing-home sales in the Northeast climbed 4.2% from February to an annual rate of 500,000 in March, ending a four-month streak where sales in the Northeast registered 480,000 units. Compared to March 2023, home sales were down 3.8%. The median price in the Northeast was $434,600, up 9.9% from one year ago.

In the Midwest, existing-home sales retracted 1.9% from one month ago to an annual rate of 1.01 million in March, down 1.0% from the prior year. The median price in the Midwest was $292,400, up 7.5% from March 2023.

Existing-home sales in the South faded 5.9% from February to an annual rate of 1.9 million in March, down 5.0% from one year before. The median price in the South was $359,100, up 3.4% from last year.

In the West, existing-home sales slumped 8.2% from a month ago to an annual rate of 780,000 in March, a decline of 3.7% from the previous year. The median price in the West was $603,000, up 6.7% from March 2023.

Commentary from Realtor.com Chief Economist Danielle Hale

“Existing home sales eased back in March after February’s big jump. Sales slipped 4.3% from February to a pace of 4.19 million, and trailed the year-ago figure by 3.7%,” Hale said. “Mortgage rates tumbled from late October through mid-January, holding through early February at some of the lowest rates since May 2023.”

“By mid-February, however, a pick-up in inflation reset expectations, putting mortgage rates back on an upward trend, and more recent data and comments from Fed Chair Powell have only underscored inflation concerns,” Hale continued. “Thus, these March home sales figures reflect a different set of expectations for the economy, inflation, and mortgage rates than buyers and sellers are likely bringing to the market today, and sales data over the next few months is likely to reflect the impact of now higher mortgage rates.”

“The median sales price rose further in March, mirroring listing prices that continue to climb. The typical home sold for $393,500, up 4.8% from the prior year. Prices rose in all four regions, with the biggest gains in the Northeast (+9.9%) followed by the Midwest (+7.5%) and West (+6.7%). The South saw home prices rise just 3.4% from last year, perhaps in part to the influx of lower priced inventory that occurred in both February and March, according to Realtor.com data. A jump in lower-priced homes for sale may also have contributed to gains for first-time buyers, who made up 32% of sales in March, up from 26% in February and 28% one year ago while investors made up a smaller share of purchasers.”

“Despite climbing sales and list prices, Realtor.com data show that sellers are approaching the housing market with more realistic expectations this spring even as we approach the week that Realtor.com has identified as the Best Time to Sell a home. Only 12% of sellers expect to see a bidding war compared with 27% in 2023, and just 15% of sellers expect to see an above-asking price offer compared with 31% in 2023,” Hale concluded. “Consistent with a more temperate outlook, sellers who have already listed homes are resorting to price reductions more often than historical data suggest is normal for this time of year, putting the trend back on par with pre-pandemic norms and making this one of the few aspects of the housing market that is comparable to that earlier period. It’s worth noting that there is significant variation in this trend across local markets. While just over 1 in 5 homes in Austin had a price reduction in March, this share is down from the more than 1 in 4 that had a reduction one year ago. Conversely, Florida markets like Miami, Orlando, Jacksonville, and Tampa are seeing a rising share of for-sale homes with price reductions.”

Additional commentary from Bright MLS Chief Economist Dr. Lisa Sturtevant

“The National Association of Realtors reported this morning that existing home sales were at a seasonally-adjusted annual rate of 4.19 million in March, which is a surprising 4.3% retreat from February. Sales were also 3.7% lower than a year ago,” Sturtevant said. “Prospective home buyers face a challenging—and confusing—housing market. Mortgage rates, which had been expected to fall in 2024, have inched up close to 7% and seem poised to remain higher for longer. Inventory has started to increase, but the market is still competitive with sellers still getting multiple offers. And now, in the wake of the proposed NAR settlement, there is new confusion about how buyers and sellers will work with a real estate agent.”

“It is definitely a strange spring housing market. It is a new normal, where market conditions are shifting and some rules are changing. The housing market had a strong start to the year, with prices in February rising faster than they have in more than a year,” she continued. “In March, the median price for an existing home was $393,500, up 4.74% from a year ago, the ninth consecutive month of year-over-year price gains.”

“The best way to try to forecast where the market is headed is to watch inventory (rising), keep track of mortgage rates (remaining high), and see how consumers are feeling (maybe a little less confident),” Sturtevant concluded. “These factors suggest that home sales activity could remain a bit downbeat this spring, but it is likely that transactions will increase over the rest of the year and that overall home sales in 2024 will outpace last year’s level.”