In a new Perspectives Blog, Fannie Mae’s Gregory Phillips, Manager, Digital Management Solutions, and Hilary Hanel, Manager, Digital Management Solutions, focus on the industry’s perspective on the evolution of technology over the past decade.

In “Mortgage Lenders View TSPs as Indispensable (but Expensive) Partners,” the authors explain the importance of Technology Service Providers (TSPs) to the daily operations of mortgage lenders through a survey of 200 senior mortgage executives to gauge their perspective on the TSP marketplace.

Surveying those on the frontlines

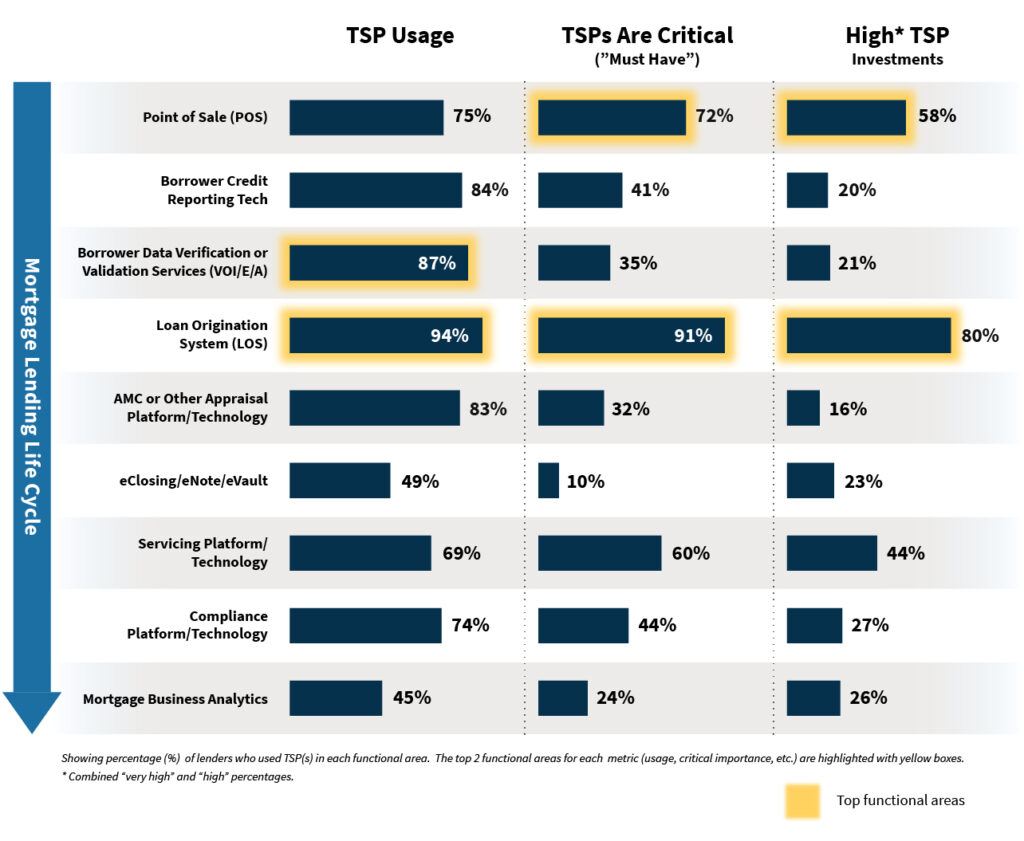

The survey, conducted by Fannie Mae’s Economic and Strategic Research (ESR) Group, considered tech solutions and applications spanning the entire mortgage lending life cycle, including those related to point of sale (POS) systems, borrower credit reporting, verification of borrower income/employment/assets (VOI/E/A), loan origination systems (LOS), appraisals, closing, servicing, compliance, and business analytics.

Among the major findings of the survey included:

- When citing the major criteria considered in selecting technology providers, most lenders felt cost, functionality, and integration capabilities were top considerations.

- Tech offerings for LOS and POS solutions are considered by most lenders as business critical. Given their importance, LOS and POS solutions also ranked highest in terms of total TSP investment, which includes headcount and/or budget invested toward implementation and usage.

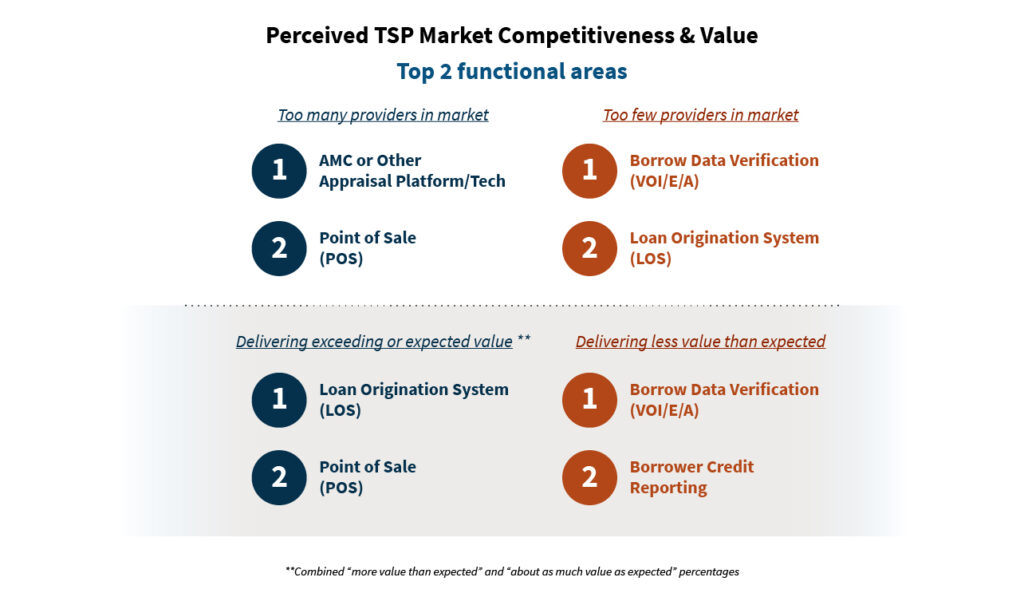

- The majority of respondents reported that the value they receive from their LOS TSP investments matches or exceeds their expectations, but many believe that there are too few competitors in this space.

- By contrast, lenders see the investment returns on VOI/E/A and credit reporting TSP solutions as delivering the least value relative to expectations. Here, too, many respondents believe there to be a lack of competitive offerings.

A lack of competitors drives pricing

Lenders felt frustration with the rising cost of tech solutions, which many believe is driven by a lack of competition. According to the survey, this frustration was most prevalent among solutions focused on LOS, borrower credit reporting, and borrower VOI/E/A. Lenders noted that the costs in these areas have climbed and continue to rise, leading to significantly increased loan origination costs and, because these expenses are sometimes passed through to consumers, higher borrower closing costs.

Many polled mentioned that they would like to see more competition in the TSP marketplace to help alleviate some of these costs, but they also acknowledged that the barriers to entry in the technology space are often high. Additionally, respondents noted that new entrants’ functionalities might be limited, and the up-front integration challenges, which are typically costly, could discourage many lenders from even considering new providers. Furthermore, even for the functional areas in which lenders believe there is ample competition, some commented that they lack the bandwidth to research new options. In the end, while the mortgage lending community views TSPs as indispensable partners, the rising costs required to implement, maintain, and use their services is top of mind for many lenders.

Click here for more information on Fannie Mae Mortgage Lender Sentiment Survey Special Topic Report, “Lenders’ Perspectives on Mortgage Technology Competitiveness and Value.”