While Gen X—born after the boomers between 1965-1980—may not be the generation you think of when you think of a standard homebuyer, but this generation is still snapping up homes at a quick clip.

According to Jacob Channel at LendingTree (using internal user data of mortgage offers given to them during the 2023 calendar year) Gen Xers are responsible for 20% of offered mortgages last year in the top 29 metropolitan markets.

Top level data from LendingTree’s report includes:

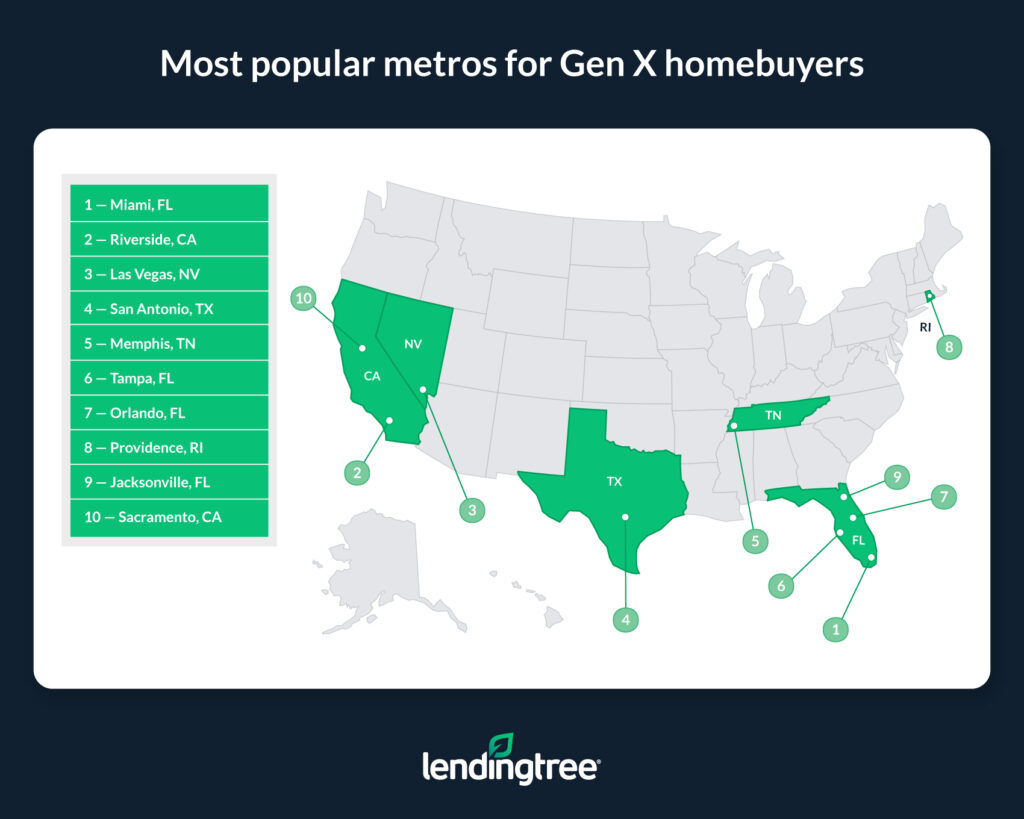

- Gen Xers made up the largest share of potential homebuyers in Miami, Riverside, California, and Las Vegas. In Miami, 27.43% of mortgage offers made on the LendingTree platform went to Gen Xers. The shares in Riverside and Las Vegas were 27.14% and 27.07%, respectively. These metros — which skew older — were the only ones featured in which Gen Xers received more than 27% of mortgage offers.

- Gen Xers made up the smallest share of potential buyers in Buffalo, New York, Salt Lake City and Boston. With 15.39% and 15.92% of mortgage offers going to Gen Xers in Buffalo and Salt Lake, these were the only two featured in which fewer than 16% of mortgage offers went to Gen Xers. At 16.73%, the share of offers given to Gen Xers in Boston was the third-lowest across the nation’s 50 largest metros.

- Gen Xers in expensive California metros such as San Jose, San Francisco and Los Angeles planned to put the largest down payments toward their homes. The average down payments among potential Gen X homebuyers across these metros in 2023 were $193,155, $168,762 and $129,124, respectively. Comparatively, down payments among potential buyers were smallest in Oklahoma City, Virginia Beach, Va., and Detroit, averaging $44,077, $46,127 and $46,698.

- Like down payments, offered loan amounts were largest in San Jose, San Francisco and Los Angeles. Offered loan amounts in these metros in 2023 were $679,443, $637,665 and $580,723, respectively. Conversely, at $246,300, $247,705 and $263,732, average loan amounts offered in Buffalo, Cleveland and Oklahoma City were the smallest among the nation’s 50 largest metros.

- Gen Xers often planned to put larger down payments toward their homes than millennials, but they tended to be offered smaller mortgages. As with Gen Xers, planned down payments among millennials were highest in San Jose, San Francisco and Los Angeles. But the average planned down payment amount among millennials in each metro ($170,591, $159,392 and $111,068, respectively) was lower than the average planned down payment amount among Gen Xers. That said, in part because millennials were putting less toward their down payments, the average loan amounts offered to them in these metros ($785,391, $731,062 and $627,322, respectively) were higher than the averages offered to Gen Xers.

Click here to view the report, and the most popular markets, in its entirety.