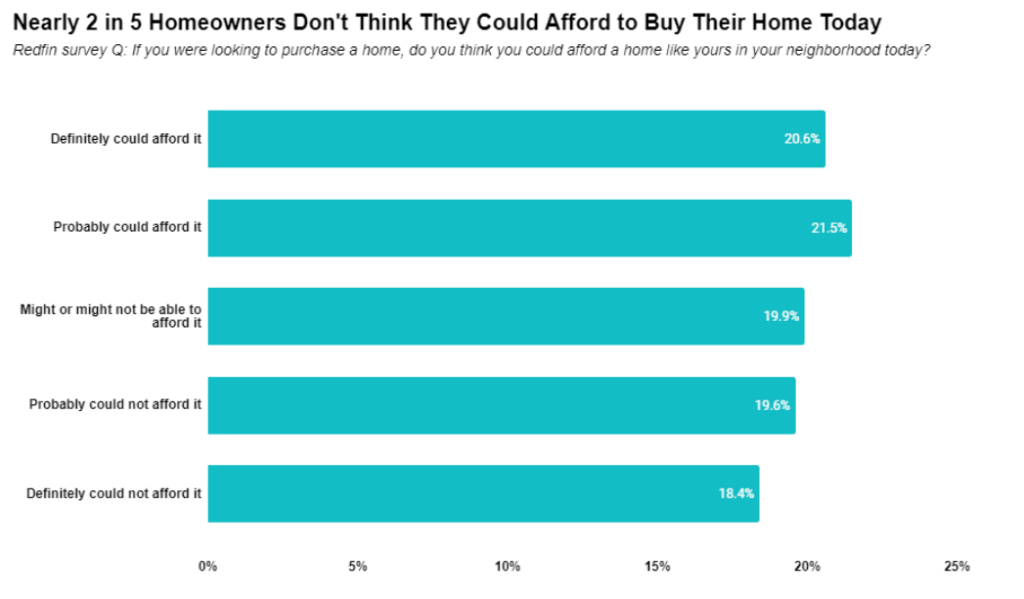

According to an analysis of homebuyers from Redfin, nearly two of every five (38%) homeowners don’t believe they could afford to buy their own home if they were purchasing it today.

This is based on a Redfin-commissioned survey of roughly 3,000 U.S. residents conducted by Qualtrics in February 2024. Nearly three in five (59%) homeowners who answered this question have lived in their home for at least 10 years, and another 21% have lived in their home for at least five years. That means the majority of respondents have seen housing prices in their neighborhood skyrocket since they purchased their home, as the median U.S. home-sale price has doubled in the last 10 years, and has shot up nearly 50% in the last five years alone.

Soaring to new highs

Home prices have risen upward over the last decade for several reasons. Already-high home prices skyrocketed during the pandemic, and remote work scenarios and low mortgage rates motivated many to move and buy homes. Even before the pandemic buying boom, home prices were increasing due to a prolonged supply shortage, along with a strong labor market and growing population pushing up demand.

Rising mortgage rates are another reason many homeowners couldn’t afford their own home if they were to buy it today. The typical person purchasing today’s median-priced home for about $420,000 has a record-high $2,864 monthly housing payment with a 7.1% mortgage rate, the current 30-year fixed-rate average as reported by Freddie Mac just last week. If they were to purchase a home for the same price with a 4% mortgage rate, which was common in 2019, their monthly payment would be $2,210, roughly $650 less.

A double-edged sword?

“Rising home prices are a double-edged sword. On the one hand, Americans who already own homes benefit from rising values and they can consider themselves lucky they broke into the housing market while they could still afford it,” said Redfin Senior Economist Elijah de la Campa. “On the other hand, price appreciation makes the prospect of buying a new home daunting or even impossible for many people who want to move. Prices have risen enough that a similar home and location would be much pricier than a home someone already owns–even accounting for inflation. Add elevated mortgage rates to the equation, and moving up to a bigger, better home is even more costly and perhaps out of reach.”

According to Zillow, the average home in the U.S. now costs $355,696, a 42.4% increase over pre-pandemic levels. The average monthly mortgage payment—assuming 20% down—is $1,851. That’s up 108%, or more than double, since before the pandemic. The most costly metropolitan metros—all of which are West Coast tech hubs—are the ones experiencing the fastest seasonal home value gains in the nation. Buyers in these U.S. metros are seeing prices rise faster than elsewhere. Monthly home value rise is strongest in coastal California metros and Seattle, peaking at 3.3% in San Jose. San Francisco, Seattle, San Diego, and Los Angeles follow, all with price increases of 2% or more. These five metropolitan areas are the most expensive among the 50 largest in the U.S.

Tough breaks for renters and first-time buyers

The situation is especially dire for first-time buyers, who haven’t built up equity from the sale of a previous home. Nearly 40% of U.S. renters don’t believe they’ll ever own a home, up from 27% last year. Of the Gen Zer’s and millennials who do expect to buy their first home soon, more than one-third (36%) expect to use a cash gift from family to help with their down payment.

Redfin also recently examined the homebuying aspirations of renters and found that nearly two in five (38%) U.S. renters believe they will never own a home. up from 27% reported less than a year ago. The top reason cited by those polled was lack of affordability by renters as they believe they are unlikely to become homeowners. Nearly half (44%) of renters who don’t believe they’ll buy a home in the near future said it’s because the supply of available homes is too expensive.

What generation would be left in the cold?

Broken down by generation, baby boomers were cited by Redfin as the least likely to be able to afford their current home if they were to buy it today. Nearly half (45%) of baby boomers said they couldn’t afford a similar home in their neighborhood now, compared to 39% of Gen Xers and 24% of Gen Zer’s, and millennials. That stands to reason, as baby boomers are more likely to have bought their home a long time ago for a much lower price. That dynamic contributes to the shortage of homes for sale: Empty-nest baby boomers own twice as many large homes nationwide as millennials with kids, largely because older Americans, with no financial incentive to sell, are hanging onto their homes.

Lower-income homeowners were the least likely to be able to afford their own home today, as 51% of respondents earning under $50,000 annually would not be able to afford their home, compared to 34% of people earning $50,000-$100,000, and 21% of people earning more than $100,000.

Click here for more information on Redfin’s study on housing affordability.