LexisNexis Risk Solutions has released the seventh edition of its annual True Cost of Fraud Study: Financial Services and Lending Report—U.S. and Canada Edition. According to the report, which is based on a commissioned survey done by Forrester Consulting, 63% of financial firms reported an overall fraud increase of at least 6% over a 12-month period, with digital channels accounting for half of total fraud losses.

The report found that not only have U.S. investment firms and credit lenders experienced a 9% year-over-year increase in the financial impact of fraud, but that scams comprise 35% of fraud losses for organizations in North America. Further, fraud makes it more difficult for an estimated 79% of respondents to win consumer trust.

Key Findings: The True Cost of Fraud Study — Financial Services and Lending

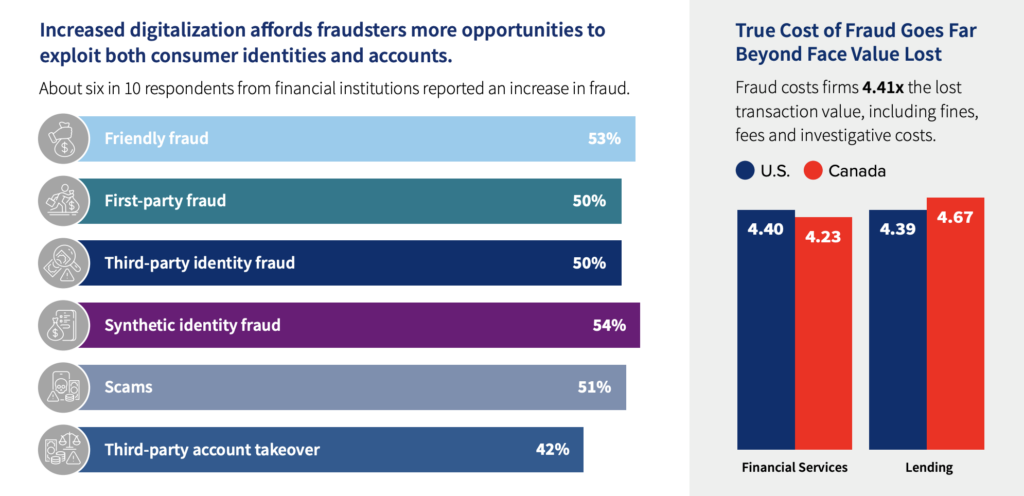

- Increasingly Sophisticated Fraud Methods: Criminals continuously develop and refine more sophisticated fraud methods such as scams and synthetic identities to circumvent anti-fraud tools. Scams now account for approximately 35% of fraud losses in the U.S. and Canada, even though almost half (48%) of financial institutions report undertaking efforts to educate customers about protecting themselves. Additionally, synthetic identity fraud is now the most common fraud type in the financial services sector, surpassing third-party identity fraud, including identity theft.

- The Customer Experience: Fraud significantly affects how customers perceive and interact with businesses, with more than three-quarters of respondents reporting that customer satisfaction has been negatively affected. In the long term, this also results in customer churn and damages reputation and the company’s bottom line.

- Increased Digitalization Creates More Opportunity: Although approximately two-thirds of revenue comes through remote channels, physical branches generate the most revenue of any channel. The use of traditional transaction methods such as cash, checks and gift cards rebounded, doubling for U.S. firms and more than tripling in Canada. This increase reinforces the importance of omnichannel identity verification and fraud risk assessment strategies.

- Need for Best Practices: Given the rising threat of fraud and cybersecurity risks, organizations should implement a range of integrated fraud solutions that assess physical identity, digital identity and transaction risk. This involves:

- Combining a risk-based and data-driven approach to fraud management

- Balancing fraud management effectiveness and customer experience

- Leveraging the capabilities of cutting-edge technologies like artificial intelligence, machine learning and biometric- and behavior-based authentication methods.

The LexisNexis Fraud Multiplier variable has increased for all financial services segments in the U.S. and Canada, with firms in Canada losing nearly an extra dollar for every $1 of fraud loss compared to last year: $4.45 in 2023 versus $3.49 in 2022, representing a 28% increase on average. US investment firms and credit lenders reported a 9% year-over-year gain, significantly greater than US banks and mortgage lenders.

Fraud losses in the phone channel increased across the business, along with significant increases in scam assaults and losses from scams. While these costs to financial institutions include fines, fees, and the time spent investigating fraudulent transactions, they do not account for the negative impact on the customer experience of installing tougher fraud protection procedures. A strong 79% of respondents recognized fraud’s detrimental impact on customer trust.

“New forms of fraud elevate the risk of loss for both financial institutions and their customers,” said Kimberly Sutherland, VP of Fraud and Identity Strategy of LexisNexis Risk Solutions. “Our study shows that organizations are facing challenges in combatting fraud from international transactions and scams, despite efforts to educate consumers. Across industries, geographies and customer journey stages, firms have implemented more advanced identity authentication and transaction verification solutions, especially behavioral intelligence, device identification, physical biometrics and browser tracking solutions. Firms using a multi-layered, risk-based solutions approach have a lower cost of fraud and fewer challenges across each customer journey stage.”

Every month, organizations confront thousands of fraudulent transactions. Fraudsters, seeking to overwhelm organizations during the account creation process, continue to automate illegal operations with technology, making it increasingly difficult for businesses to handle the magnitude and pace of attacks. Per the study, experts suggest businesses to adopt a multi-layered approach to managing fraud risk across the customer journey due to the unpredictable and multifaceted nature of threats; otherwise, they risk significant financial loss and customer frustration.

To read the full report, including more data and methodology, click here.