Economists say sales of existing homes ticked upward in March, albeit less than 2%, compared to February. Still, that’s a second consecutive month-over-month increase and “welcome news for a housing market that’s struggled to gain momentum.”

Existing-home sales remain approximately 16% down compared to this time last year.

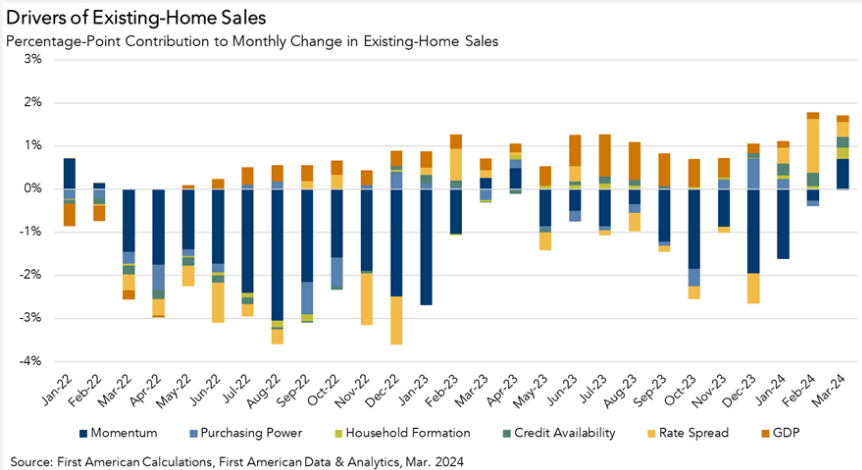

Odeta Kushi, Deputy Chief Economist at First American, publishers of a monthly “nowcast” on existing-home sales, says the uptick is predominantly related to life-altering yet universal and persistent factors such as babies being born or children reaching adulthood. She calls them the “Five Ds—Death, Divorce, Diplomas, Downsizing, and Diapers.”

“Household formation was a primary driver of growth in the existing-home sales outlook in March,” Kushi said, “as millennials continued to age into their prime home-buying years and make lifestyle choices that are highly correlated with buying a home, such as getting married and having children.”

The pandemic resulted in one typical factor—work—becoming less significant.

“The pandemic untethered many workers from their employer’s office location,” Kushi said. “Where one lives today is much less correlated with where one works.”

Work commutes aside, it’s not enough to drive the market back to more normal sales, Kushi said, because of three major and stubborn challenges: the mortgage rate lock-in effect, limited inventory of homes for sale, and constrained affordability.

The country’s collective life events are no match for the sub 6% rates that almost 90% of homeowners are locked into.

Rates could be less of an issue for those homeowners sitting on historically high levels of equity, Kushi concedes. “In that case, taking on a higher interest rate isn’t a big deal, especially if moving to a more affordable area or downsizing.”

Just last week, Freddie Mac reported that the 30-year, fixed-rate mortgage (FRM) has eclipsed the 7%-mark, a high point not seen in more than two decades.

Kushi added that should the Federal Reserve cut rates and mortgage rates fall, it could widely lessen American homeowners’ reluctance to sell.

In mid-March, the Federal Reserve, for the fifth consecutive meeting, made the call that their best course of action was to do nothing with interest rates, a trend that has developed as the Committee chose to hold rates steady at 5.50% at their last four meetings as well.

“Even then, mortgage rates aren’t likely to decrease enough to ‘unlock’ most homeowners,” she said.

The rate/inventory/affordability trio “will continue to dampen sales activity and will likely remain headwinds for the remainder of 2024,” Kushi said. “And the driving force behind sales activity will remain the Five Ds.”

The full existing-home sales report is available at FirstAm.com.