Ever since post-World War II, it’s been the American dream to buy your own home. But is that still possible today for the average middle-class family?

Creditnews Research decided to find out, and have released a 21-page report titled “Can America’s Middle Class Still Afford Homeownership in 2024?” on the possibility of homeownership for middle-class Americans, and the findings were less than optimistic.

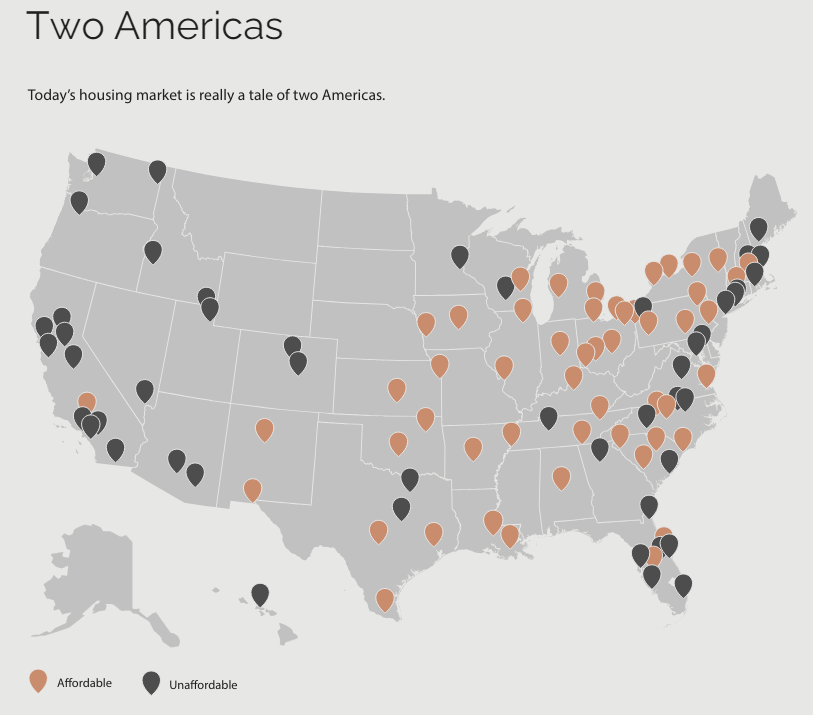

In short, the nation’s middle-class now lives in two Americas, the affordable and the unaffordable.

Creditnews defined the middle-class as any household earning $30,001-153,000 per year, further breaking that up into lower middle-class ($30,001-$58,020), middle-class ($58,021-$94,000), and upper middle-class ($94,001-$153,000). Affordability was defined in two ways: by calculating the minimum annual income households needed to qualify for a mortgage on a typical home in each metro, and if the monthly mortgage and housing payment was no more than 28% of a household’s gross income.

Key findings of the report

- In the last five years, there has been a serious drop in affordability.

- In 2019, the middle-class could afford an average home in 91 out of the top 100 metro areas. In 2024, that number dropped almost 50%, to just 52 out of the top 100 metros.

- In 2019, the lower middle-class was priced out of 33 of the top metro areas. In 2024, they are now priced out of 93 of the top metro areas.

- The middle-class is headed for the Midwest, the Rust Belt, and Texas, where they can still find affordable metros in 2024.

- The middle-class is getting squeezed out of California and the surrounding area, with the most unaffordable metros including San Jose, San Francisco, Los Angeles, San Diego, and Honolulu, Hawaii.

- California also leads in the largest increase in housing costs since Covid. The top five metros are all in the Golden State: San Jose, San Diego, Los Angeles, San Francisco, and Oxnard. Los Angeles was the first city to become unaffordable to the upper middle-class: qualifying income is now $256,286 (a $112,329 increase), and the median home price is $935,800.

- Covid also shifted a number of metros out of the reach of middle-class affordability: 39 of the 100 most populous metros became unaffordable since Covid alone. In 41 out of the top 100 metros, it takes a gross household income of $100,000 to qualify for an average home.

Ranking the most affordable metros for the middle-class

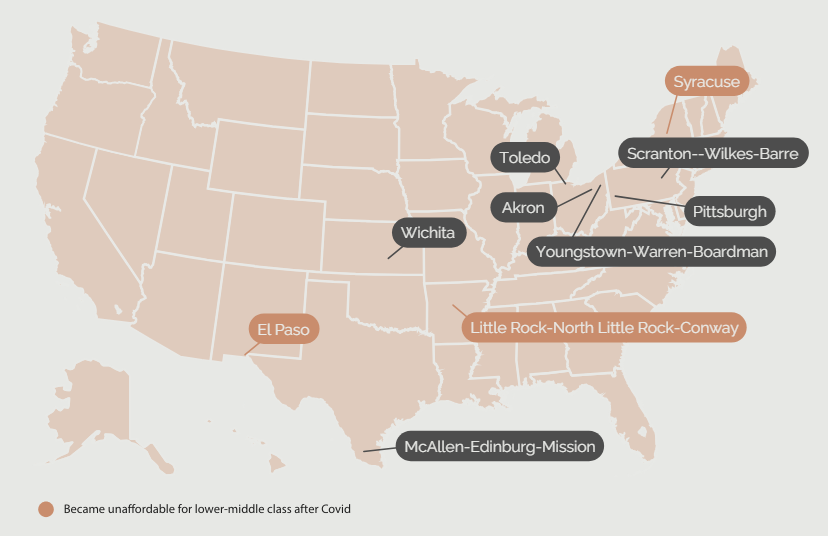

CreditNews ranked the 10 most affordable metros in America for middle-class buyers, including (in order):

- Youngstown-Warren-Boardman, Ohio/Pennsylvania, where buyers need an income of just over $40,000 to qualify for a typical home

- Toledo, Ohio, where buyers need an income of just over $48,500 to qualify for a typical home

- McAllen-Edinburg-Mission, Texas, where buyers need an income of just under $50,000 to qualify for a typical home

- Scranton-Wilkes-Barre, Pennsylvania, where buyers need an income of just over $52,000 to qualify for a typical home

- Wichita, Kansas, where buyers need an income of approximately $55,243 to qualify for a typical home

- Pittsburgh, Pennsylvania, where buyers need an income of approximately $55,457 to qualify for a typical home

- Akron, Ohio, where buyers need an income of approximately $56,743 to qualify for a typical home

- El Paso, Texas, where buyers need an income of approximately $58,114 to qualify for a typical home

- Syracuse, New York, where buyers need an income of approximately $58,157 to qualify for a typical home

- Little Rock-North Little Rock-Conway, Arkansas, where buyers need an income of approximately $58,286 to qualify for a typical home

Ranking the least affordable metros for the middle-class

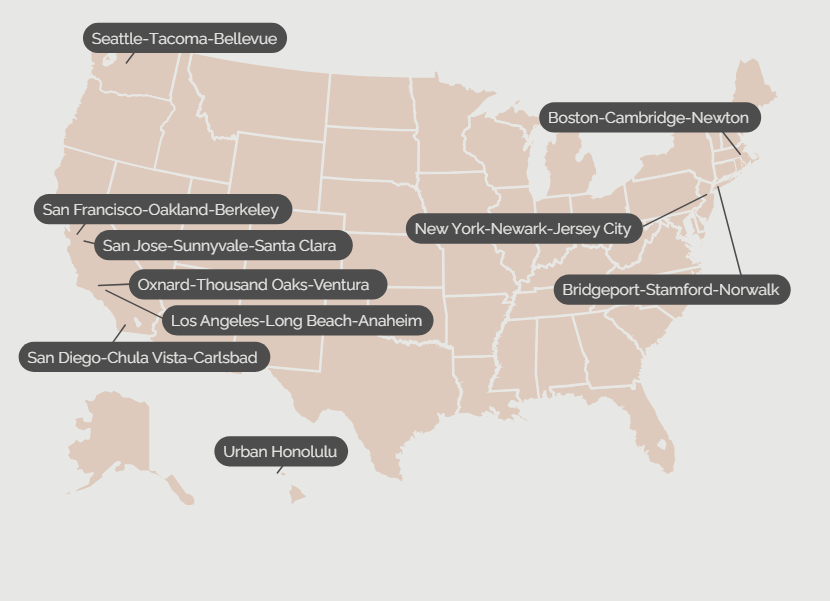

CreditNews also ranked the 10 least affordable metros in America for middle-class buyers, including (in order):

- San Jose-Sunnyvale-Santa Clara, California, where buyers need an income of approximately $425,614 to qualify for a typical home

- San Francisco-Oakland-Berkeley, California, where average monthly payments are just over $7,200, up from $4,679 just five years ago

- Los Angeles-Long Beach-Anaheim, California, where buyers need an income of approximately $256,286 to qualify for a typical home

- San Diego-Chula Vista-Carlsbad, California, where monthly payments for an average home are more than $5,900

- Urban Honolulu, Hawaii, where the average home price is approximately $860,000

- Oxnard-Thousand Oaks-Ventura, California, where the average home price is nearly $850,000, and monthly payments have soared 77% since 2019 to $5,425

- Seattle-Tacoma-Bellevue, Washington, where the average home price is $719,217, and monthly payments are nearly $4,600

- Boston-Cambridge-Newton, Massachusetts-New Hampshire, where buyers need an income of $181,971 to qualify for a typical home, reflecting an increase of nearly $80,000 since the pandemic

- New York-Newark-Jersey City, New York-New Jersey-Pennsylvania, where the average home price is $634,651, and monthly housing costs have climbed 65% higher since 2019 to $4,055

- Bridgeport-Stamford-Norwalk, Connecticut, where buyers need an income of $163,371 to qualify for a typical home

The silver lining?

So, is there any good news to be found? Yes. The Biden Administration has proposed tax credits and home buying initiatives to help the middle-class to enter the market in his most recent State of the Union speech.

“There’s no two ways about it: Housing affordability has worsened significantly since Covid,” said Sam Bourgi, Senior Analyst at Creditnews Research. “In 2019, middle-class households could comfortably buy a typical home in 91 of the top 100 largest metros. By 2024, that figure had fallen to just 52. Families in the lower middle-class can only afford to buy an average home in seven of the top 100 metros.”

And with work from home now the standard in many places, some builders are converting empty office space into residential units. Last July, the U.S. Department of Housing and Urban Development (HUD) released a notice of funding opportunity (NOFO) to study office-to-residential conversions.

A recent RentCafe report also found that over the past four years, there has been tremendous growth in the conversion of office buildings into living spaces, with an estimated 12,100 apartments crafted out of old office spaces in 2021. By 2022, that number had nearly doubled to 23,100. The climb continued as 2023 saw an increase to 45,200, and into 2024, the pipeline has reached an impressive 55,300. That’s more than four times as great since the increasingly popular trend began.

Click here for more information on the Creditnews Research report, “Can America’s Middle Class Still Afford Homeownership in 2024?“