According to a new report from Zillow, 57% of respondents living in the largest cities in the country claim to have experienced housing discrimination of some kind, even though they are protected by fair housing laws.

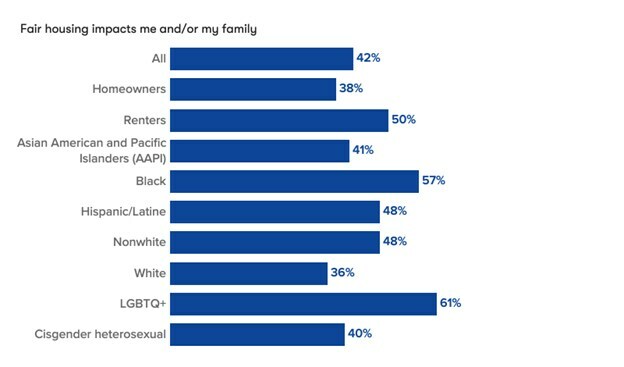

Among the most affected groups are people who self-identified as renters, young adults, LGBTQ+ individuals, and people of color.

However, fewer than half of respondents said fair housing is important to them or their families—highlighting how much work is needed to educate people about these laws.

This information comes to us by way of Zillow’s latest Housing Aspirations Report, which surveyed adults in the largest 26 cities in the country.

Zillow continued by saying that overall, only 42% of respondents reported that fair housing impacts them or their families, highlighting how much work is needed to continue to educate people about their rights under fair housing laws.

“April is Fair Housing Month, and this research shows how far we have to go to make housing fair and accessible for all,” said Manny Garcia, senior population scientist at Zillow. “Over half of respondents report experiencing housing discrimination. Fair housing issues are more likely to be top of mind for younger generations, likely attributable to their higher likelihood of moving, renting and buying a home more frequently than older generations, given their current stage of life.”

Helping people of color and other at-risk demographics

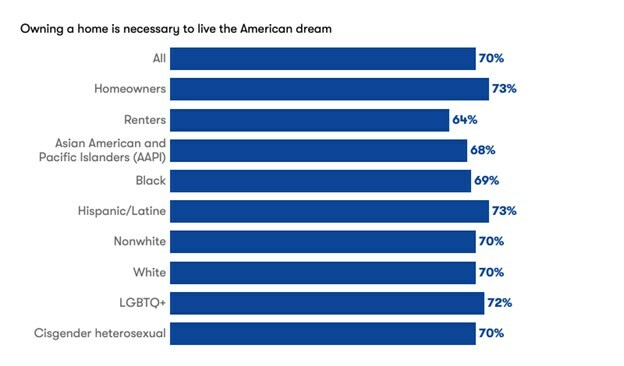

Even though 70% of respondents indicated and agreed that owning a home is necessary to achieve the American Dream, 80% indicated that owning a home is critical to building and passing on generational wealth. But exclusionary housing policies and practices, plus a tight supply of housing—among a litany of other factors—have prevented people of color from owning their home at the same rates as white people: while 74.5% of white households own their homes, only 46% of Black and 49% of Hispanic households own theirs.

One of the biggest obstacles to owning a home according to Zillow is downpayments and addressing this barrier for first-time buyers can help people of color access the world of homeownership—benefitting them in other aspects of their life as well—and help to close the gap between Black, Hispanic and white households.

Zillow themselves is trying to push the industry forward by addressing some of these fair housing issues. Zillow now includes information on down payment assistance resources and programs on every for-sale listing on its site to help potential buyers connect with one of the more than 2,000 programs nationwide in order to secure a home.

Zillow is working on another front, a political one, by advocating for the passage of the Washington Covenant Homeownership Act, which would create a program to provide financial assistance to support homeownership for people impacted by housing discrimination in Washington state once excluded by racially restrictive zoning and HOA covenants.

Zillow is also reporting on-time rent payments to the credit bureaus (for renters who pay their landlords through their platform) to help build or enhance their credit history, something that will make them more attractive borrowers one day.

Click here for more information on this trend, and what Zillow themselves is doing to address this mounting problem.