According to the Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI), U.S. homebuyer affordability fell in March, with the national median payment requested by purchase applicants rising slightly to $2,201 from $2,184 in February.

“Homebuyer affordability conditions remain volatile as recent economic data continues to show that the economy and job market are strong,” said Edward Seiler, MBA’s Associate VP of Housing Economics and Executive Director for the Research Institute for Housing America. “These factors will keep mortgage rates at elevated levels for the near future, sidelining some prospective buyers from entering the housing market. While rates remain elevated and housing supply is low, we do expect to see renewed activity as mortgage rates decline to low-to-mid 6 percent range by the end of the year.”

Additional Key Findings of MBA’s Purchase Applications Payment Index (PAPI) for March 2024

- The national median mortgage payment was $2,201 in March—up $17 from February. It is up by $108 from one year ago, equal to an 5.2% increase.

- The national median mortgage payment for FHA loan applicants was $1,898 in March, up from $1,872 in February and up from $1,755 in March 2023.

- The national median mortgage payment for conventional loan applicants was $2,222, up from $2,194 in February and up from $2,145 in March 2023.

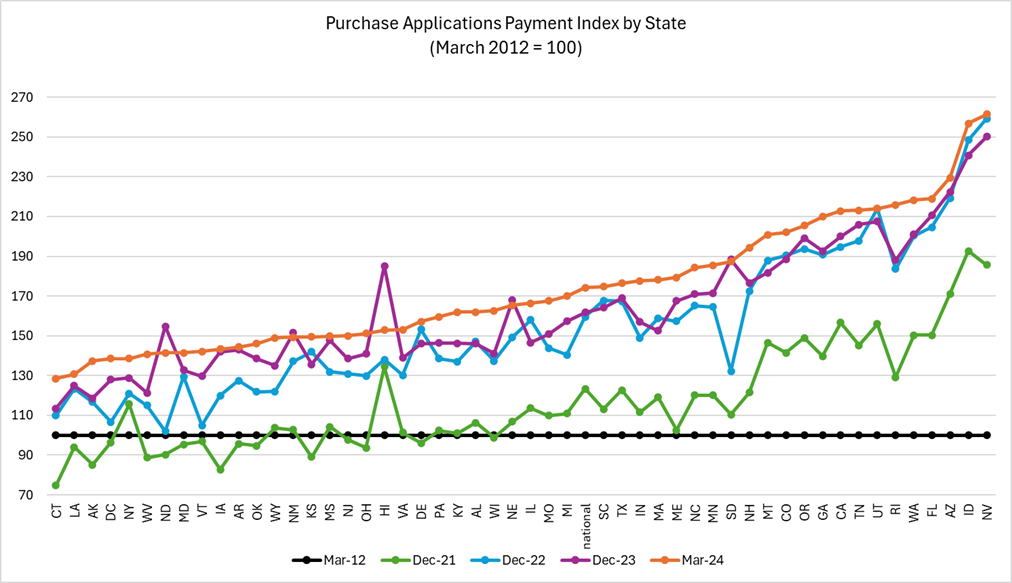

- The top five states with the highest PAPI were: Nevada (261.5), Idaho (256.9), Arizona (229.9), Florida (219.1), and Washington (218.2).

- The top five states with the lowest PAPI were: Connecticut (128.5), Louisiana (130.7), Alaska (137.3), DC (138.6), and New York (138.6).

- Homebuyer affordability decreased for Black households, with the national PAPI increasing from 179.0 in February to 180.4 in March.

- Homebuyer affordability decreased for Hispanic households, with the national PAPI increasing from 165.1 in February to 166.4 in March.

- Homebuyer affordability decreased for White households, with the national PAPI increasing from 175.5 in February to 176.8 in March.

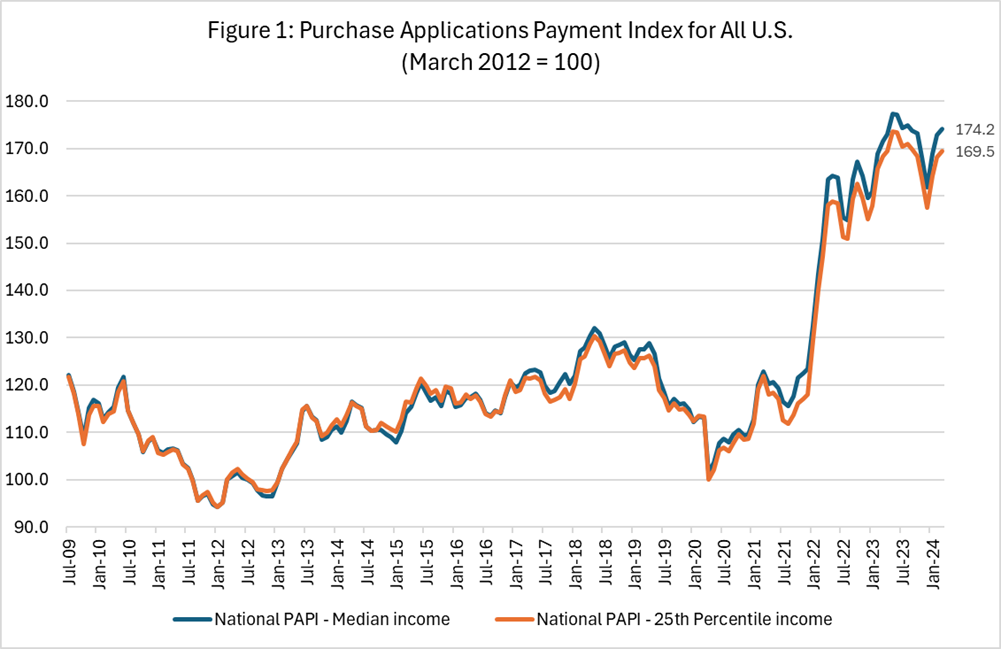

The national PAPI (Figure 1) rose 0.8% to 174.2 in March from 172.8 in February. Median wages grew 3.5% over the previous year, and while payouts increased 5.2 percent, the high earnings growth implies the PAPI is up 1.6% on an annual basis. For borrowers seeking lower-payment mortgages (the 25th percentile), the national mortgage payment rose to $1,488 in March from $1,473 in February.

The Builders’ Purchase Application Payment Index (BPAPI) revealed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey rose to $2,556 in March from $2,534 in February.

To read the full report, including more data, charts, and methodology, click here.