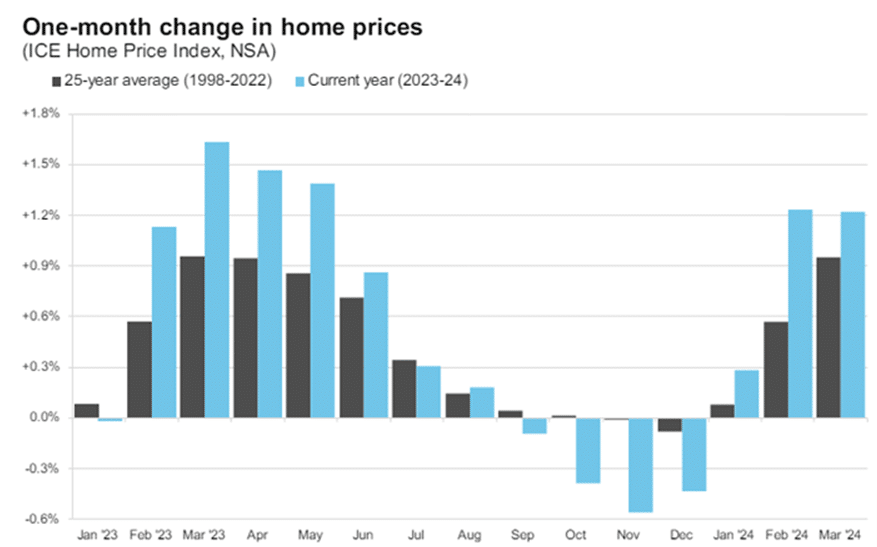

According to the latest iteration of Intercontinental Exchange, Inc. (better known as ICE) May 2024’s Mortgage Monitor Report—which uses publicly available data sets and its own proprietary data—found that home price growth slowed at a modest rate on an annual basis compared to May 2023 according to their Home Price Index (HPI), marking the third consecutive occurrence of above-average monthly gains.

According to ICE, rising prices combined with higher interest rates have added to the affordability pressure on prospective homebuyers. On the other hand, existing homebuyers continue to reap the benefits of historically strong price gains.

Andy Walden, ICE’s VP of Enterprise Research Strategy explains

“The recent trend of rising interest rates has dampened homebuyer demand and allowed the inventory of homes for sale to improve,” said Walden. “We’re still very much in a hole from an inventory perspective, but that deficit has fallen from 50% a year ago to 38% in March. Today, with 3.3 months of supply, inventory is still historically low and indicative of a seller’s market. This is helping to keep home price growth resilient even though demand is down. In fact, despite some minor slowing, March marked the third consecutive month of stronger than average growth.”

The ICE Home Price Index for March showed the annual rate of growth easing slightly from an upwardly revised 6.0% in February to 5.6% in March. Prices were up a seasonally adjusted +0.42% month over month in March, a pullback from February’s +0.58%. On an unadjusted basis, however, prices rose +1.2% from the month prior, more than 25% above the 25-year average gain of +0.96% for the month of March.

“Such strong price gains continue to plague would-be homebuyers in today’s higher-rate environment, but for existing homeowners the picture keeps growing brighter,” Walden added. “Homeowners with mortgages closed out the first quarter of 2024 with just a hair under $17T in home equity – an all-time high. Of that, a record $11T is tappable, meaning available for a homeowner to leverage while retaining a 20% equity cushion in the property. On average, that works out to roughly $206K in tappable equity per mortgage holder.”

Overall, approximately 48 million mortgage holders have some amount of tappable equity in their homes that could be accessed even under relatively conservative combined loan-to-value ratio limits. From a risk perspective, the current value of all mortgaged residential properties against all underlying first and second lien debt fell to 44.6% during the first quarter, down 45.9% from the beginning of the calendar year.

Also, the share of underwater mortgages continued to dwindle, with fewer that 390,000 borrowers nationwide—or 0.72% of loans—owing more than their homes are currently worth. Overall, two thirds of the nation’s tappable equity is held by borrowers with credit scores of 760 or higher, making for a relatively low risk cohort for lenders.

“Just five West Coast markets—Los Angeles, San Francisco, San Jose, San Diego, and Seattle—account for nearly a quarter of all tappable equity available,” Walden said. “Not only do these borrowers hold a cumulative $2.7 trillion in tappable equity, but they also tend to have first lien interest rates well below the national average due to more frequent refinance activity among high-balance loans. The same holds true in other metropolitan areas such as New York and Washington DC, which account for another $1.1 trillion in tappable equity. For folks like these, second lien equity products remain a particularly attractive option for tapping significant amounts of housing wealth without sacrificing a once-in-a-lifetime low rate on their existing mortgage.”

Other findings from the ICE Home Price Index for March show the northeastern U.S. continuing to experience the strongest monthly price gains, with New Haven (+1.3%) and Hartford, Connecticut. (+1.1%) leading the way. Together with the New York City metropolitan area (+1.0%), Boston, Massasschuests (+0.9%), Bridgeport, Connecticut (+0.9%) and Allentown, Pennsylvania (+0.8%), these markets notched six of the seven largest single month price gains among the nation’s top 100 metros.

Finnally, according to ICE, each of Florida’s nine largest markets saw seasonally adjusted prices edge lower, as for sale inventory has been growing sharply across the state. Inventory levels in Lakeland, Palm Bay, Deltona and Cape Coral, Florida. are all back above pre-pandemic levels, while North Port, Tampa, Orlando and Jacksonville are within 10% of 2018-2019 norms. Miami inventory has been trending higher as well, but it remains 27% below pre-pandemic levels.