Of the top 221 metropolitan markets, 205 (or 90%) posted home price gains during the first quarter of 2024—even as mortgage rates remained elevated and inventory remained low according to the latest quarterly report from the National Association of Realtors (NAR).

The NAR further stated that 30% of the 221 tracked metro areas experienced double-digit price gains over the same period, up from 15% in the fourth quarter of 2023.

The NAR’s Chief Economist Lawrence Yun attributes most of the gains to the lack of available inventory on the market.

“Astonishingly, greater than 90% of the country’s metro areas experienced home price growth despite facing the highest mortgage rates in two decades,” said Lawrence Yun. “In the current market, rising prices are the direct result of insufficient housing supply not meeting the full demand.”

Compared to one year ago, the national median single-family existing-home price climbed 5% to $389,400. In the prior quarter, the year-over-year national median price increased 3.4%.

Among the major U.S. geographical regions, the South registered the largest share of single-family existing-home sales (46%) in the first quarter, with year-over-year price appreciation of 3.3%. Prices also grew 11% in the Northeast, 7.4% in the Midwest, and 7.3% in the West.

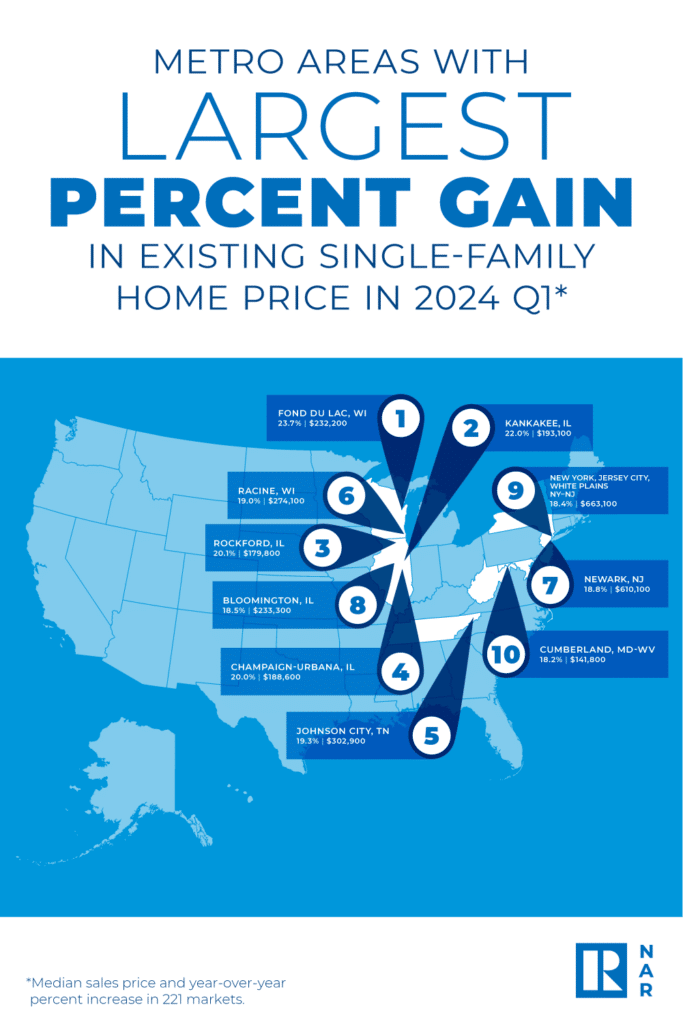

The top 10 metro areas with the largest year-over-year median price increases, which can be influenced by the types of homes sold during the quarter, all registered gains of at least 18.2%. Six of the markets were in Illinois and Wisconsin.

Overall, those markets were Fond du Lac, Wisonson (23.7%); Kankakee, Illinois (22.0%); Rockford, Illinois (20.1%); Champaign-Urbana, Illinois (20.0%); Johnson City, Tennessee (19.3%); Racine, Wisconson (19.0%); Newark, New Jersey (18.8%); Bloomington, Illinois (18.5%); New York-Jersey City-White Plains, New York/Jersey (18.4%); and Cumberland, Maryland (18.2%).

“The expensive markets in the West, where home prices declined last year, are roaring back,” Yun said. “Price dips in that region were viewed as second-chance opportunities by many buyers.”

Seven percent of markets (15 of 221) experienced home price declines in the first quarter, down from 14% in the fourth quarter of 2023.

According to the NAR, the monthly mortgage payment on a typical existing single-family home with a 20% down payment was $2,037, down 5.7% from the fourth quarter of 2023 ($2,161) but up 9.3%—or $173—from one year ago. Families typically spent 24.2% of their income on mortgage payments, down from 26.1% in the prior quarter but up from 23.3% one year ago.

First time buyers were one again at odds with the market during the first quarter, facing limited inventory and elevate home prices, even though affordability conditions improved from the fourth quarter of 2023.

For a typical starter home valued at $331,000 with a 10% down payment loan, the monthly mortgage payment fell slightly to $1,998, down 5.7% from the previous quarter ($2,118). However, that was an increase of $168, or 9.2%, from one year ago ($1,830). First-time buyers typically spent 36.5% of their family income on mortgage payments, down from 39.3% in the prior quarter.

A family income of $100,000 was necessary to afford the standard 10% down payment in 40.7% of markets, down from 47.1% in 2023. Yet, a family needed a qualifying income of less than $50,000 to afford a home in 4.5% of markets, up from 2.3% in the prior quarter.

Click here to read the report in its entirety.