The median-priced home in the U.S. now costs $332,494, requiring prospective homebuyers to have an annual salary of at least $119,769 to afford it with a 10% down payment—according to a new survey from Clever Real Estate.

That is over $45,000 more than the average household makes annually, which an estimated $74,755. Even with a 20% down payment, homebuyers would need to earn at least $98,202, which is still significantly higher than the average earnings. According to National Association of Realtors data, the last time the median homebuyer put down 20% was in 1989. Today, the median buyer puts down only 15% of the buying price, on average.

The median U.S. wage earner ($74,755) with 10% down could only purchase a home for $207,529, some 38% less than the present median-priced home. A median-income family looking to buy a median-priced home would need a whopping 45% down payment, or mortgage rates would have to fall from 7.2% to 4% to make it work.

Even at a $1,000 monthly savings rate, a household would need five and a half years to save the $66,500 required for a 20% down payment on a home valued at the median of $332,494. Currently, approximately 61% of Americans are priced out of the market, even with a 20% down payment. If a household saves $500 each month toward a down payment, it will take 11 years to afford a 20% down payment of $66,500 on the typical home.

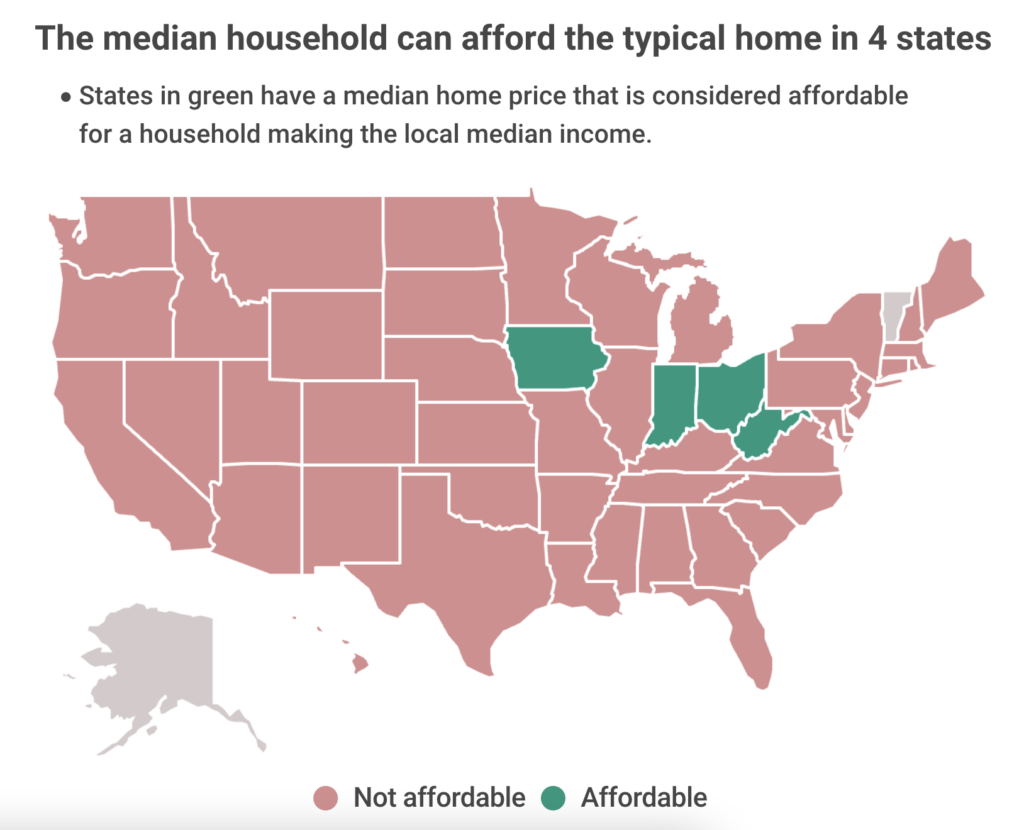

Only Four States Have Median-Priced Homes Considered Affordable

Of 48 states with available data, a median-priced home is not affordable for the typical household in 44 of them. The only four states where the typical home is financially attainable for the median household are:

- West Virginia

- Ohio

- Iowa

- Indiana

The most affordable state for the average household is West Virginia, where the median home sells for $175,432. After a 20% down payment, the monthly mortgage payment for the home is $1,106, or $13,273 a year. To comfortably afford that mortgage in West Virginia, a household should earn approximately $47,405 per year. The median household in the state earns $54,329 per year, indicating that it can generally buy a median-priced property.

While homebuyers can take advantage of the relatively modest pricing, sellers should be aware that West Virginia has the highest real estate commission rate in the country.

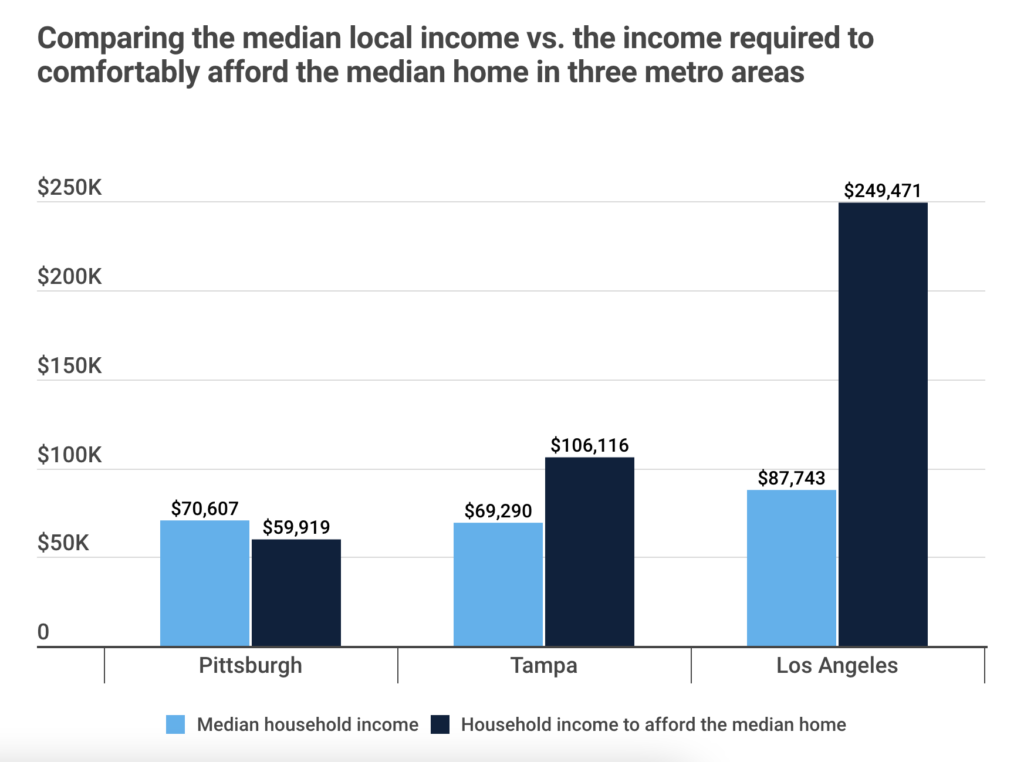

Less Than 10 U.S. Metros Boast an Affordable Median Home Price

The median home is affordable for median earners in just six of the 50 largest metro areas including:

- Pittsburgh

- Cleveland

- St. Louis

- Memphis, TN

- Indianapolis

- Birmingham, AL

Unsurprisingly, or maybe not, Los Angeles is the least affordable city in the U.S., requiring buyers to earn a whopping $249,471 to comfortably purchase a median-priced property—nearly three times the actual median income of $87,743. Pittsburgh is the most affordable metro for homebuyers. Comfortably affording the city’s median-priced home takes a household income of $59,919.

West Virginia is the most affordable state, affording the median-priced home requires an income of roughly $47,405. While it may come as no surprise, California is the least affordable state to purchase a home in. Affording the median home requires a household income of a whopping $222,132.

To many, owning a home is one of the most effective methods for Americans to accumulate wealth over time. However, as home prices have risen, homeownership has increasingly become a privilege limited to the nation’s wealthiest individuals.

To read the full report, including more data, charts, and methodology, click here.