Despite a well-documented rise in consumer debt and loan delinquencies, few Americans are optimistic about their current financial status. Many people blame mounting debt and the inability to live within their means, according to a new analysis from Achieve.

“Every month, Achieve teammates support thousands of consumers who are struggling with debt and looking for help to get back on track,” said Andrew Housser, Achieve Co-Founder and Co-CEO. “We know that household debt and credit are growing at an alarming pace. Skipping payments on financial obligations in order to afford essentials is the type of decision driving more everyday people deeper into debt. This research highlights the choices that many consumers have to make month after month to simply stay afloat.”

The Achieve Center for Consumer Insights polled an estimated 2,000 people with active accounts in six types of consumer debt: credit cards, mortgages and home equity lines of credit, cars, and student loans. The survey style and respondent panel are intended to supplement the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit by providing qualitative information about consumer borrowing patterns. To further investigate the causes and consequences of escalating loan delinquencies, the survey panel includes a sample of borrowers who were 30 days or more past due at least once in the previous six months.

High Prices, Low Wages Forcing Tough Choices Upon Consumers

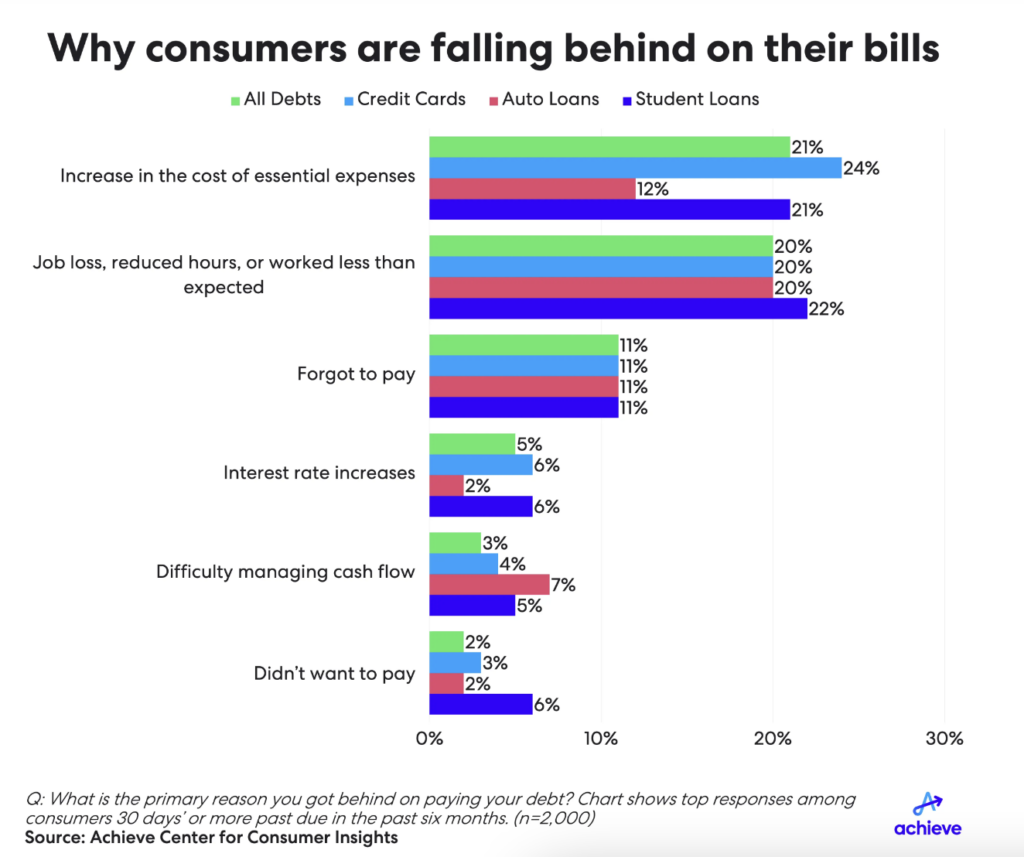

Consumers who fell behind on payments on any account in the previous six months cited a variety of reasons, including the impact of inflation on basic expenses (21%), a decrease in work and income (20%), and forgetting to pay (11%). Furthermore, customers with a recent credit card delinquency reported trouble paying owing to interest rate hikes (6%), while delinquent auto loan borrowers reported problems managing cash flow between when they received income and when their payments were due (7%). In student loans, 6% of delinquent borrowers indicated they missed a payment because they didn’t want to.

So, why are consumers struggling to pay their bills on time?

Almost one-third of customers (31%) said it is extremely difficult or difficult for them to pay their recurrent obligations on schedule. Among these respondents, 65% stated it boils down to not having enough money to cover their expenses. Other issues include owing money on too many separate accounts (39%), cash flow timing variations between when income is received and debt payments are due (27%), and trouble keeping track of how much is owed across all accounts (14%).

“For many consumers, money is going out the door as quickly as it’s coming in, if not faster,” Housser said.

When trying to make ends meet, consumers frequently have to make difficult decisions. Over the last three months, 25% of poll respondents indicated they had cut back on essential necessities; 18% have taken on new credit card debt; and 11% have skipped payments on one or more of their obligations.

From Delinquency to Spiraling Debt

According to Achieve’s research, consumers who are delinquent on one account are substantially more likely to be behind on other obligations as well. For example, among respondents who had been behind on a major credit card in the previous six months, 23% were also behind on store-branded credit cards, 17% on buy now, pay later loans, and 28% on unsecured personal loans. In contrast, credit card users who pay their accounts on time have delinquencies on their other consumer loans ranging from 1% to 2%.

For many consumers, having many bills due at the same time adds to their financial stress, both in terms of not having enough money to make on-time payments and the complexity of managing a portfolio. This is especially true given the increasing popularity of buy-now, pay-later (BNPL) loans. According to a recent Achieve Center for Consumer Insights study on buy now, pay later financing, consumers are more inclined to utilize BNPL again after making a purchase with it. Consumers who regularly use BNPL may find themselves handling numerous transactions and owing payments to multiple lenders.

Nearly One-in-Four Expect to Struggle with Student Loans

Looking ahead three months, the majority of respondents intend to pay all of their expenses on schedule. However, Achieve’s research suggests which debts and bills will take priority among people dealing with their home budget. Consumers stated that they are more likely to be late or skip personal and student loan payments while being on time with their mobile phone, mortgage/rent, and homeowners or renters insurance payments. Respondents also stated that the most likely payments to go unpaid are college loans (24%), personal loans (16%), and buy now, pay later loans (11%).

In the next three months, the majority of respondents intend to pay all of their expenses on schedule. However, Achieve’s research suggests which debts and bills will take priority among people dealing with their home budget. Consumers stated that they are more likely to be late or skip personal and student loan payments while being on time with their mobile phone, mortgage/rent, and homeowners or renters insurance payments. Respondents also stated that the most likely payments to go unpaid are college loans (24%), personal loans (16%), and buy now, pay later loans (11%).

“Whether student loan borrowers don’t have enough money to pay all of their bills or they’re waiting to see if more debt forgiveness will be approved in Washington, it’s clear that other debts are taking precedence,” Housser said. “This data shows why the inability to enroll student loans in a debt resolution program or get them discharged in bankruptcy is an outdated and ineffective policy that does little to deter loan defaults.”

To read the full report, including more data, charts, and methodology, click here.