Americans who bought homes in 2023 and 2024 are feeling the crunch of dwindling disposable budgets are more than one third (37%) of those buyers from the last two years purchased homes that exceeded their intended budget.

According to Clever Real Estate, since buying, 44% of new homeowners have taken on extra debt to maintain their lifestyles, and 43% have struggled to make mortgage payments on time according to their new survey.

About 38% of 2023 and 2024 home buyers admit they overpaid for their home, and 23% regret overspending. Half of respondents (50%) even accepted a higher interest rate than planned to secure a mortgage.

Nearly half of recent home buyers (47%) say they feel in over their heads financially since purchasing their home. Additionally, 77% of prospective home buyers have already started saving for a down payment, but 59% say it has made them feel financially overwhelmed.

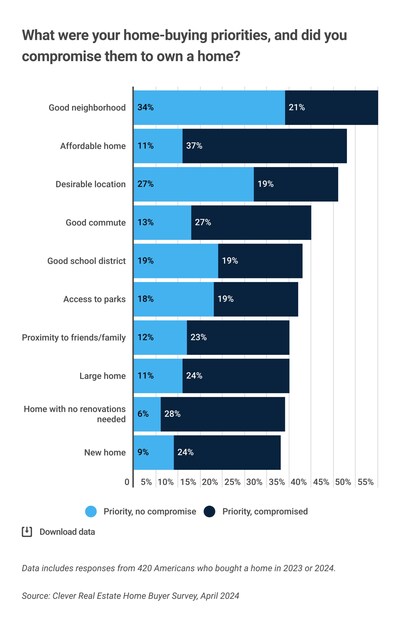

Moreso, a majority of buyers (85%) made concessions on their priorities when purchasing a home. More than one-third (37%) bought homes that exceeded their budget—making price the most-compromised priority.

According to Clever Real Estate, more than half of Americans (60%) who bought homes in 2023 or 2024 state that their finances have not improved since purchasing a home. In addition, 82% of buyer respondents expressed at least one regret about the home-buying process—excessive maintenance needs (28%) and lack of transparency (35%) being the most common regrets.

Commissions, commissions, commissions

A separate survey, also from Clever Real Estate, found that a near total 94% of home sellers support a new commission structure that would require the buyer to pay their own agent’s commissions. However, in this new survey, that percentage drops to 61% among buyers, half (50%) of whom would consider forgoing an agent entirely due to commission changes.

If they had to pay their agent, buyers say they’d lower their home-buying budget by an average of $13,167.

The overall experience of buying a home proved to be more stressful than anticipated for a majority (52%) of respondents.

Click here to read the report in its entirety.