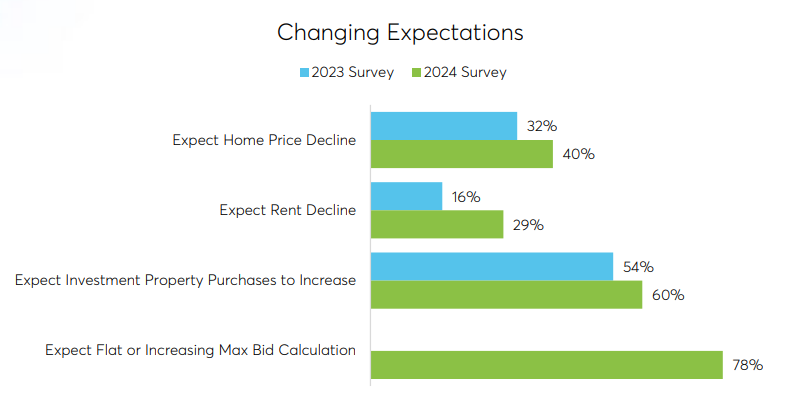

According to Auction.com’s 2024 Buyer Insights Report, an increasing share of local community developers buying at auctions expect home prices and rents to decline in 2024 in their local markets.

Of those polled, 40% expect home prices to decline in 2024, a total that is up from the 32% reported in 2023, and 17% reported in 2022. Buyers in the Southeast were most bearish on home prices, with 46% expecting a decline, and buyers in the West were least bearish, with 35% expecting a decline. Nearly half of buyers (49%) described their local market as “overvalued with correction possible.”

“More local community developers purchasing at auction expect a flat or softening retail housing market, but demand for distressed properties from those same buyers remains strong,” said Jason Allnutt, Auction.com’s CEO.

Nearly three in 10 buyers surveyed (29%) said they expect rents to decrease in the coming year, up from 16% of buyers surveyed in 2023. Buyers in the West were most bearish about rents (35% expecting a decline), and buyers in the in the Northeast were least bearish (25% expecting a decline).

Auction.com’s 2024 Buyer Insights Report is based on a January 2024 survey of more than 400 Auction.com buyers from across the country. More than nine in 10 buyers surveyed described themselves as local community developers who purchased fewer than 10 properties in 2023.

Buyers remain bullish

Despite being increasingly bearish on retail home price appreciation and rents, buyers were increasingly bullish on property acquisitions, as 60% of buyers surveyed expected to increase property purchases in 2024, up from 54% who expected to increase property purchases in 2023.

Most buyers are not expecting to lower their maximum bids at auction in 2024, as 56% of those polled plan to keep their maximum bid calculation relative to property value the same, while 21% said they plan to increase their maximum bid calculation.

Additional report findings

Survey results were analyzed by the Auction.com Market Research & Analysis team, led by Auction.com VP of Market Economics Daren Blomquist. His team leverages proprietary Auction.com data along with public record data to provide data-driven insights on distressed housing trends to the marketplace.

Other key findings of Auction.com’s 2024 Buyer Insights Report include:

- 78% of buyers describe themselves as local community developers

- 13% describe themselves as owner-occupants

- 96% purchased 10 or fewer properties over the past year

- 97% ranked “building generation wealth” as a top-three motivation for investing

- 63% support at least three local jobs annually

- 55% renovate and resell to owner-occupants as their primary investing strategy

- 63% spend more than $20,000 on rehab and closing costs

- 75% said a lack of inventory is the biggest barrier to more purchases

- 76% of owner-occupant buyers prefer remote bid or online auctions

- 88% of occupied property buyers offer graceful exit to current occupants

Click here to read the full Auction.com 2024 Buyer Insights Report.