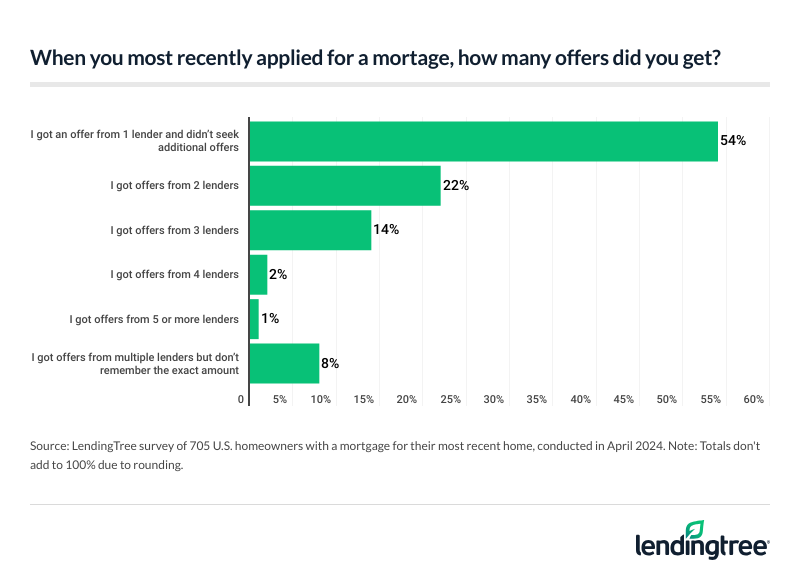

According to a new LendingTree report, some 45% of homebuyers with mortgages who shopped around received a lesser offer than their first. However, more than half (54%) of individuals with a mortgage for their most recent property received only one mortgage offer.

“Different lenders can offer different rates to the exact same borrower,” said Jacob Channel, LendingTree Senior Economist. “With that in mind, the first rate you’re offered may not be the lowest one you can get. The more offers you can look at, the better.”

Key Findings:

- Most homebuyers still aren’t shopping around for their mortgage despite the potential savings. Over half (54%) of those who took out a mortgage for their most recent home purchase only got one loan offer. Meanwhile, 22% got two offers and 17% got three or more. By generation, baby boomers are the least likely to comparison shop, with just 28% doing so. That compares with 62% of millennials.

- Homebuyers are likely leaving money on the table when not shopping around. Among those who compared more than one mortgage offer, 45% say the lowest offer didn’t come from their first lender. Going further, 46% of those who got a mortgage say they went with a lender they didn’t have a prior relationship with.

- Refinancers are more savvy with comparison shopping. Among the 45% of homebuyers who’ve refinanced the mortgage on their current home, 56% shopped around. Comparison shopping paid off for these refinancers, as 81% found a lower rate than their current lender offered.

- Shopper confidence (warranted or not) is the top reason for not seeking more mortgage offers. Among those who sought just one mortgage offer, the top reason for doing so was confidence that they got the best rate (28%), followed by a desire to use the lender with whom their real estate agent had a relationship (20%). Additionally, 14% say they rushed to get financing due to the competitive housing market.

- Mortgage rates influence buyer timelines. Over a third (35%) of buyers say they purchased a home earlier than planned to take advantage of low rates. That’s especially true for men, at 43%, versus 26% of women.

Most Homebuyers Aren’t Shopping Around for Mortgages

For the majority of homeowners looking for a mortgage, the process is straightforward. According to our research, some 54% of homebuyers who obtained a mortgage for their most recent house received only one offer from a single lender.

Women (62%) are more inclined than men (46%) to choose the first offer without browsing around. Older generations are also more inclined to do so: 72% of baby boomers aged 60 to 78, compared to 59% of Gen Xers aged 44 to 59 and 38% of millennials aged 28 to 43.

Some homeowners look around more, with 22% reporting receiving two offers when applying for their current mortgage. Only 14% of respondents received three offers, while 2% received four. Additionally, homebuyers are more likely to look at homes before meeting with lenders. In fact, 57% said they talked with a real estate agent before speaking with a lender.

Meanwhile, purchasers were asked about changes coming in July 2024 that will make it easier for sellers to opt out of paying their buyer’s real estate agent commissions. In light of this, do they expect to be as reliant on their lender for assistance if they decide to buy again? Nearly four out of ten (39%) answer no.

Rate shoppers are often more likely to find better offers, too. Of those who say they evaluated mortgage offers from more than one lender when buying their present house, 45% say their tenacity paid off – the lowest offer they got didn’t come from the first lender. Males (49%), however, have benefited more than women (39%).

“Because savings can be so large and you can compare lenders for no charge, pretty much everyone should at least try to shop around before they get a mortgage,” Channel said.

Some 54% of homebuyers say they got their current mortgage from a lender from whom they’ve used other services, such as a checking account, auto loan or credit card. Men (58%) are more likely to go with a lender they’ve used before than women (50%), while millennials (65%) are much more likely to do so than their older peers (50% of Gen Xers and 39% of baby boomers).

When people refinance, they tend to shop more. More than four out of 10 people (45%) who took out a mortgage for their most recent home purchase have since refinanced. Of those, 56% say they looked around for a refinance. An overwhelming 81% said they sought another lender who offered a lower rate.

Homebuying is not an easy task for many Americans, but experts say it’s still an attainable accomplishment. It can be time-consuming, expensive, and complex. However, these savings can be pricey, particularly when searching for a mortgage.

To read the full report, including more data, charts, and methodology, click here.