The latest analysis of housing data by the National Association of Realtors (NAR) found that pending home sales fell 7.7% in April, with all four U.S. regions reporting month-over-month and year-over-year declines.

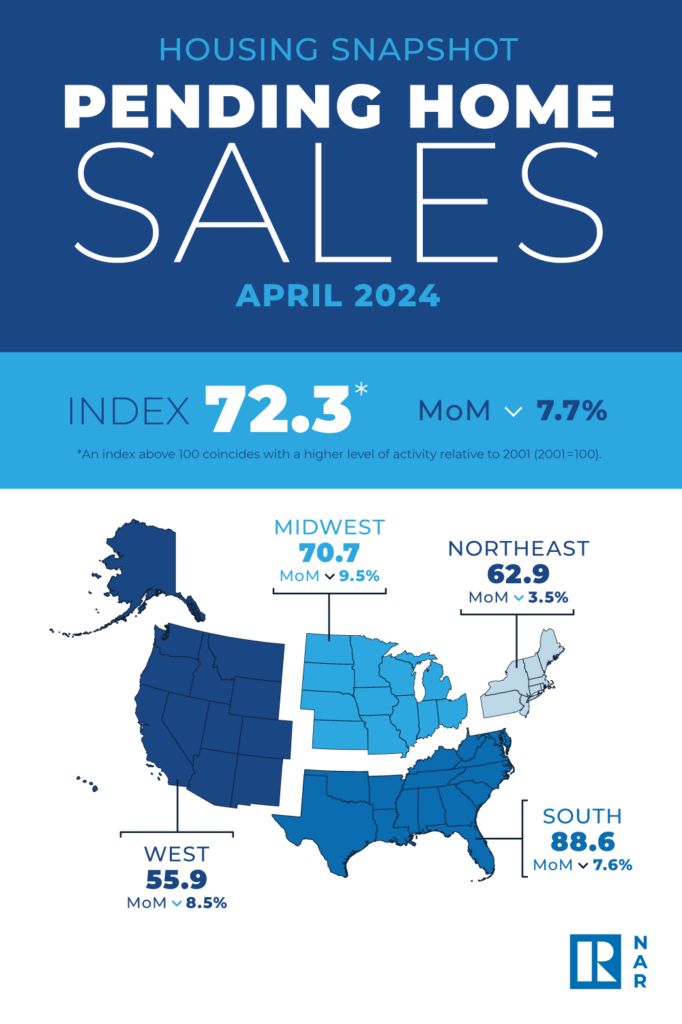

NAR’s Pending Home Sales Index (PHSI)–an indicator of home sales based on contract signings–decreased to 72.3 in April. Year-over-year, pending transactions were down 7.4%. A PHSI reading of 100 is equal to the level of contract activity in 2001.

“The impact of escalating interest rates throughout April dampened home buying, even with more inventory in the market,” said NAR Chief Economist Lawrence Yun. “But the Federal Reserve’s anticipated rate cut later this year should lead to better conditions, with improved affordability and more supply.”

According to NAR, a sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing. Pending contracts are good early indicators of upcoming sales closings. However, the amount of time between pending contracts and completed sales is not identical for all home sales. Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer difficulties with obtaining mortgage financing, home inspection problems, or appraisal issues.

The affordability struggle lingers

The 30-year-fixed-rate mortgage (FRM) spent the month of April teetering above and below the 7%-mark, as per Freddie Mac’s Primary Mortgage Market Survey (PMMS).

And according to First American Deputy Chief Economist Odeta Kushi, the rate environment will continue to dictate the direction of the market.

“The decision to buy a home comes down to a payment-to-paycheck calculation, which is influenced by income, mortgage rates, and house prices,” added Kushi. “While house prices continue to reach new heights, more supply amid a pullback in demand means the pace of price appreciation has decelerated, and will likely continue to do so if this supply-demand dynamic persists.”

According to the latest new residential construction data from the U.S. Department of Housing & Urban Development (HUD) and the U.S. Census Bureau, the nation’s home builders began to pull back on new construction in the month of April, amid the Federal Reserve’s ‘higher for longer’ stance, and ramped up completions of homes already in pipeline. According to HUD, privately‐owned housing completions in April 2024 were at a seasonally adjusted annual rate of 1,623,000—8.6% above the revised March 2024 estimate of 1,495,000, and 14.6% above the April 2023 rate of 1,416,000.

Declines reported regionally

NAR’s Northeast PHSI fell 3.5% from last month to 62.9, a decline of 3.1% from April 2023. The Midwest index dropped 9.5% to 70.7 in April, down 8.7% from one year ago. The South PHSI lowered 7.6% to 88.6 in April, dropping 8.2% from the prior year. The West index decreased 8.5% in April to 55.9, down 7.3% from April 2023.

“Home prices are hitting record highs, but the pace of gains should decelerate with more supply,” said Yun. “However, the prospect of measurable home price declines appears minimal. The few markets experiencing price declines will be viewed as second-chance opportunities for buyers to enter the market if those regions continue to add jobs.”

Realtor.com Senior Economic Research Analyst Hannah Jones added, “Pending home sales, or contract signings, measure the first formal step in the home sale transaction, namely, the point when a buyer and seller have agreed on the price and terms. Pending home sales tend to lead existing home sales by roughly one to two months and are a good indicator of market conditions. Mortgage rates hovered around 6.8% in March, allowing for an uptick in contract signings. However, mortgage rates climbed from 6.8% to 7.2% in April, dampening buyer enthusiasm.”

Employment’s impact on housing

“Recent employment and inflation data have fallen in line with expectations of a slowing economy,” said Jones. “Cooling inflation and employment data is good news for mortgage rates, which fell below 7% once again in May. Buyers holding off for lower rates may step into the market this summer, eager to take advantage of any improvements in affordability, as well as ample for-sale inventory in many markets. However, for some would-be buyers, purchasing a home remains unattainable, and renting is a more attractive option, especially as rents continue to ease.”

According to the Bureau of Labor Statistics (BLS), total nonfarm payroll employment increased by 175,000 in April, and the unemployment rate changed little at 3.9%. Job gains were reported in the fields of healthcare, social assistance, and in transportation and warehousing. Both the unemployment rate, and the number of unemployed people, at 6.5 million, changed little in April, as the unemployment rate has remained in a narrow range of 3.7%-3.9% since August 2023.

“Household income remains strong as the labor market continues to demonstrate resiliency, yet mortgage rates remain elevated in the Fed’s ‘higher-for-longer’ interest rate environment,” said Kushi. “If the Fed cuts rates later this year, all else held equal, it should result in lower mortgage rates, boosting affordability and bringing buyers off the sidelines.”

Only time will tell the direction rates will blow for the remainder of 2024, as the Federal Reserve, for the sixth consecutive meeting, made the call that the best course of action for the nation’s economy was to do nothing with interest rates, holding rates steady at 5.50% at their last five meetings.

“The Federal Open Market Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks,” said the Fed in a statement. “In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5.25-5.50%. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.”