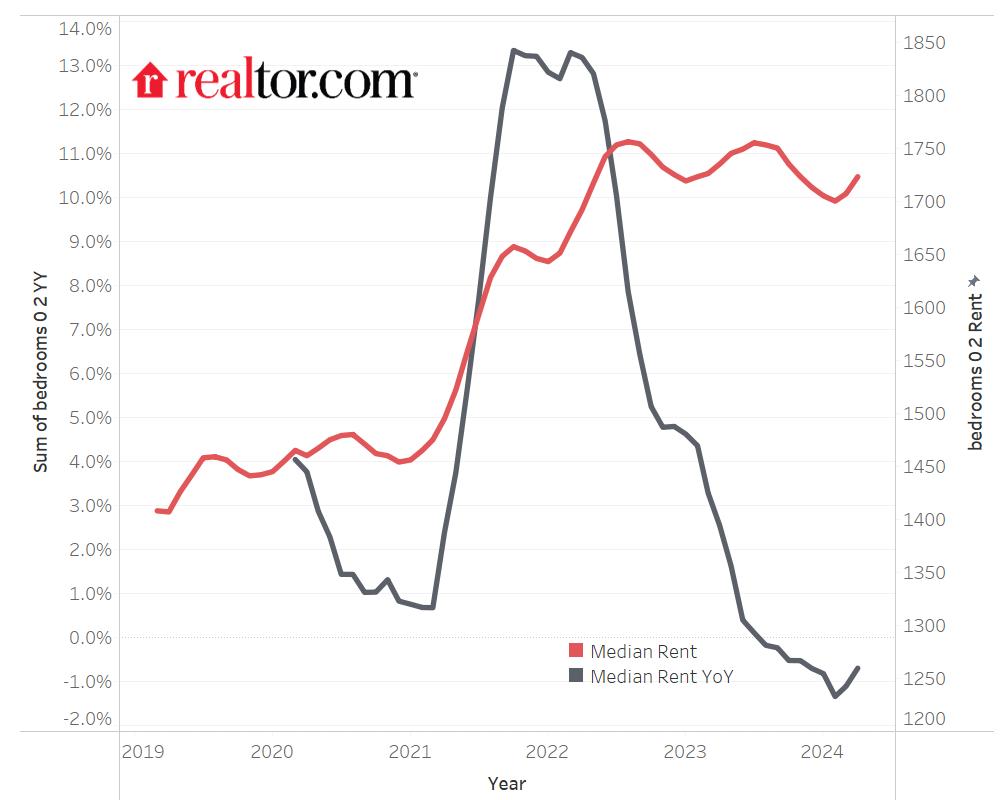

According to a new report from Realtor.com written by Jiayi Xu and Danielle Hale, April 2024 marked the ninth year-over-year rent decline for apartments observed since the metric began being tracked in 2020.

Overall, asking rents dropped by 0.7% or $12. The median asking rent in the 50 largest metros registered at $1,723, up by $16 from last month but still down $33 from its August 2022 peak.

Studio apartments are going at a rate of $1,443, down $25 or 1,7%. One-bedroom apartments are going for $1,601, down $22 or 1.4%. Two-bedroom apartments are going for $1,915, down $13 or 0.7%.

Renters in Austin, TX, experienced the largest rent relief by saving $195 per month, paying 11.5% less if they move in today compared with when rent peaked in September 2022. However, renters in Indianapolis, IN, Milwaukee, WI, and Minneapolis, MN, face new record high rents.

Despite the nine months of decline, the U.S. median rent was just $33 (-1.9%) less than the peak in August 2022. Notably, it was still $316 (22.5%) higher than the same time in 2019 (before the COVID-19 pandemic).

Rising shelter costs have been a major driver of the overall rate of inflation, and while the consumer price index shelter measure differs from the Realtor.com rent methodology, the latter can inform the likely path for the former, an issue discussed in a previous rental report.

According to Realtor.com, while the year-over-year change in market asking rents tracked by Realtor.com has been negative since last August, the decline appears to have bottomed out in February 2024 (-1.3%) and has begun to slow down since then. This deceleration trend could make it difficult to see further improvement in the overall rate of inflation, complicating the Fed’s policy decision and underscoring the need for more housing construction to alleviate the supply shortage that is contributing to higher costs.

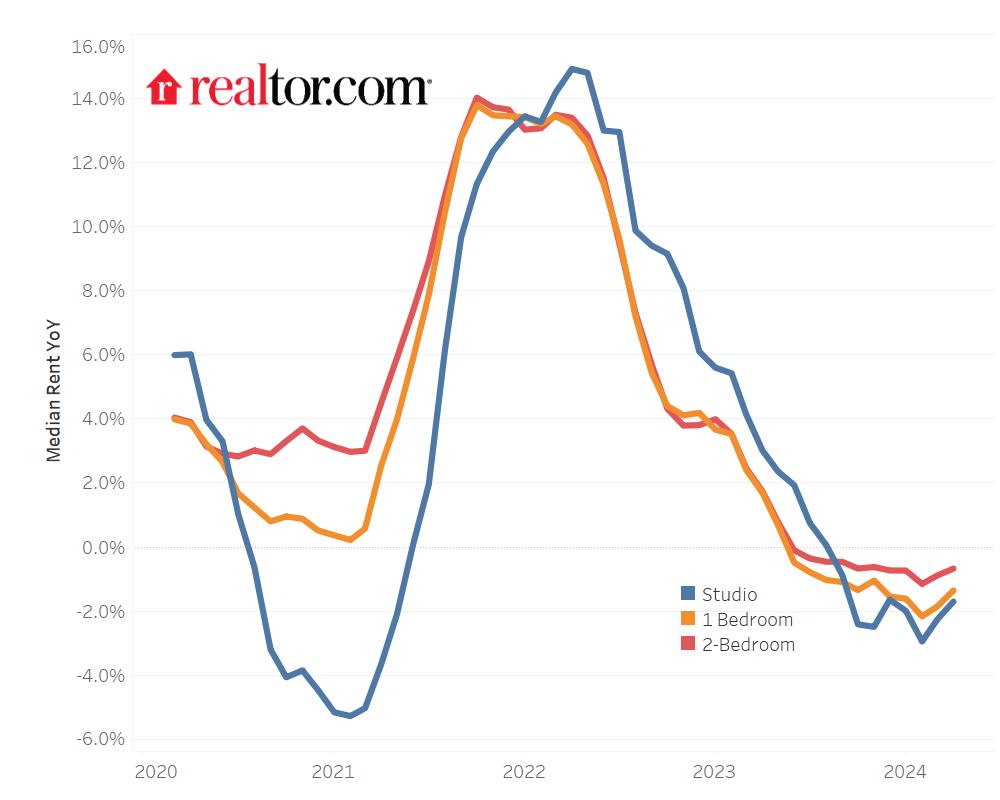

All units saw rent declines

By Realtor.com’s numbers, in April 2024, the median asking rent for two-bedroom units dropped 0.7%, a dip slower than the 0.9% seen in the past month, marking the 11th consecutive month of annual declines. The median rent for two-bedrooms was $1,916 nationally, $37 (-1.9%) lower than the peak in August 2022. Nevertheless, larger unit rents had the highest growth rate over the past five years, up by $376 (24.4%).

The rent for one-bedroom units slipped 1.4% in April 2024 on a year-over-year basis, marking the 11th decline in a row and also a slower pace compared with the decline of 1.9% in March. The median rent was $1,601, $53 lower than the peak last August, but still $277 (20.9%) higher than in April 2019.

In April 2024, the median asking rent for studios fell by 1.7%, marking the eighth consecutive month of annual declines. The median rent of studios was $1,443 in April, down by $48 (-3.2%) from its peak in October 2022. Nevertheless, the median asking rent for studios was still $229 (18.9%) higher than five years ago.

Click here for the report form Realtor.com in its entirety.