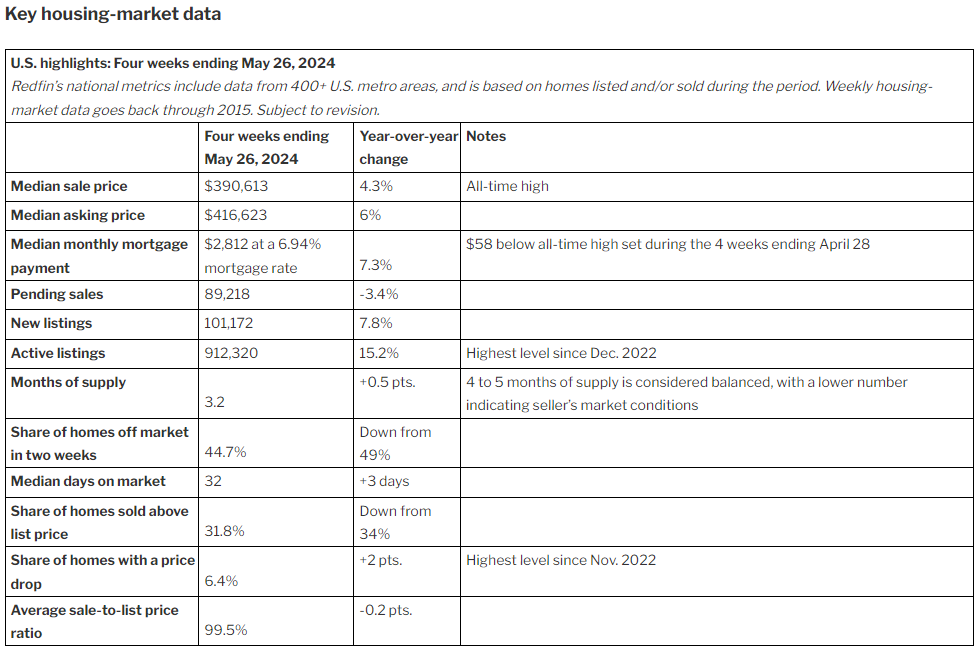

According to a new report from Redfin, nationwide, 6.4% of home sellers cut their asking prices during May, the highest share since November 2022.

By the numbers, the median asking price dropped roughly $3,000 to $416,623, the first such decline in six months. Additionally, for-sale supply is growing more stale: the typical home is on the market longer—a trend that also started in May—to a median of 46 days.

When put together, those metrices suggest that sale-price growth could soften in the coming months as persistently high mortgage rates turn off hungry homebuyers sitting on the sidelines. For now, the median-home sale price is up 4.3% year over year to another record high, though sale prices are a lagging indicator because they’re typically negotiated at least a month before a deal closes.

Buyers have found some relief, however. The typical U.S. homebuyer’s monthly housing payment dropped to $2,812, its lowest level in six weeks. Payments are declining because even though sale prices remain at all-time highs, mortgage rates have come down from their peak: The weekly average mortgage rate is 6.94%, the first time it has dipped below 7% since early April.

High costs are also dampening demand. Pending sales numbers are down 3.4% year-over-year, on par with declines over the last month while mortgage-purchase applications are sitting near their lowest level in six months.

Low inventory is another factor pushing down sales. Even though 7.8% more new listings hit the market than during the same period last year, listing growth has been losing momentum for the last few months, leaving buyers with fewer homes to choose from than there typically are in May.

“The market is slower than usual, but well-maintained properties listed for under a million dollars still get multiple offers,” said Christine Chang, a Redfin Premier agent in the Bay Area of California. “People who are buying right now are typically doing so because they’re having a baby or looking for a more family friendly home. My advice for those buyers is to be open-minded: Consider single-family homes that are a bit outdated but don’t need major renovations, and/or homes in lesser-known, non-trendy neighborhoods. That type of home tends to sit on the market longer, and buyers may be able to avoid competition and get a home for asking price instead of engaging in a bidding war. Buyers who can get by with less space should consider a condo; they’re relatively unpopular right now and many are going under asking price.”

Click here to see the report in its entirety.