According to a new report from CoreLogic entitled the Homeowner Equity Report (HER), American homeowners with a mortgage pulled in $28.000 in equity gains year-over-year during the first quarter of 2024, the highest recorded since late 2022.

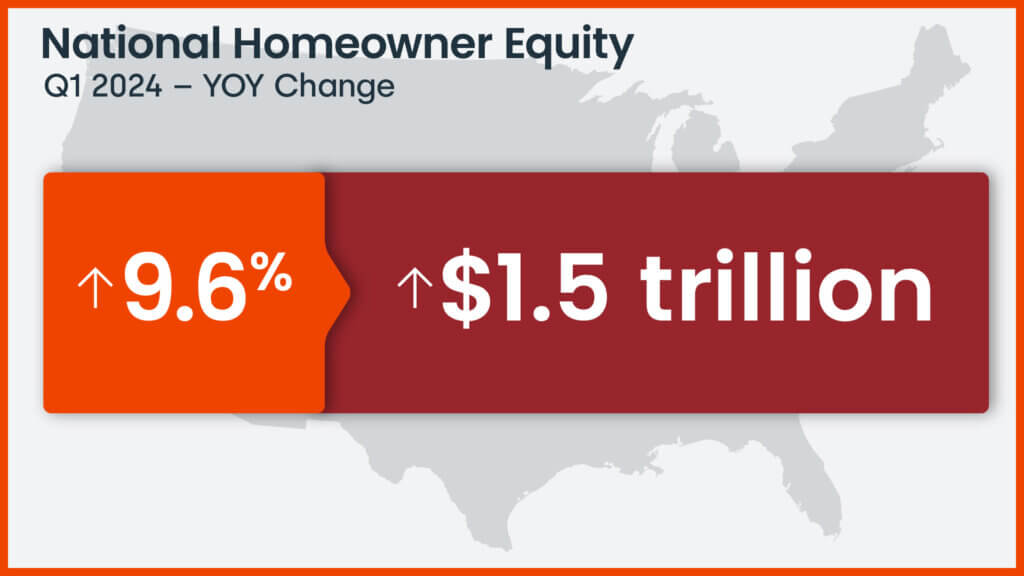

According to CoreLogic, mortgage holders account for roughly 62% of all U.S. residential properties and they saw, in percentage terms, a gain of 9.6% year-over-year representing a collective gain of $1.5 trillion collectively since the first quarter of 2023. This brought total net homeowner equity to more than $17 trillion at the end of Q1 2024.

U.S. based homeowners continued to see healthy yearly gains through the opening of the first quarter; California homeowners saw the largest equity gains in the country of $64,000 with the Los Angeles area pulling in $72,000 of equity. Most other large equity gain areas were concentrated in the Northeast, including New Jersey, which pulled in $59,000.

“With home prices continuing to reach new highs, owners are also seeing their equity approach the historic peaks of 2023, close to a total of $305,000 per owner,” said Dr. Selma Hepp, Chief Economist for CoreLogic. “Importantly, higher prices have also lifted some 190,000 homeowners out of negative equity, leaving only about 1.8% of those with mortgages underwater.”

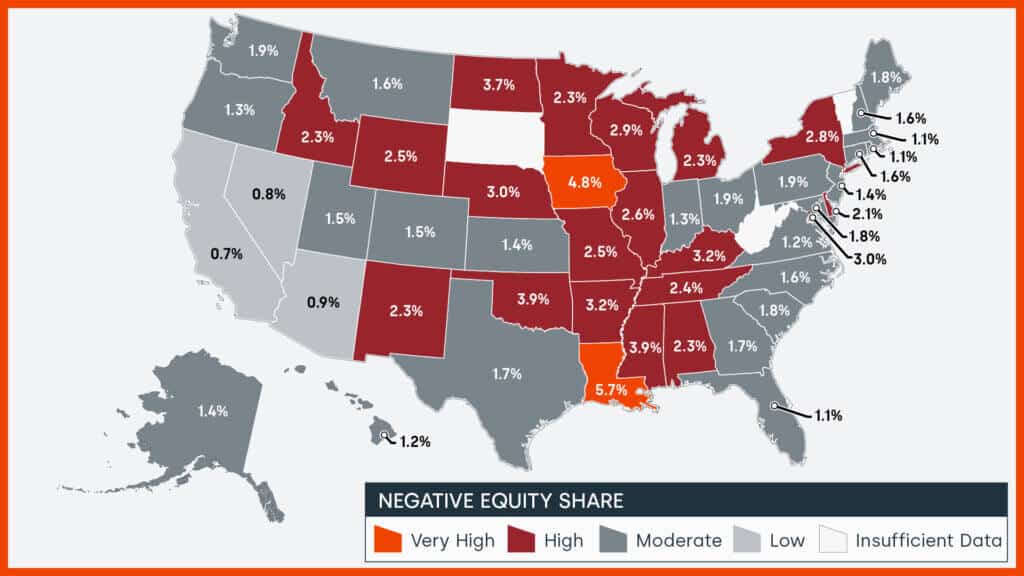

“Home equity is key to mortgage holders who have seen other homeownership costs soar, including insurance, taxes and HOA fees, as a source of financial buffer,” Hepp continued. “Also, low amounts of negative equity are welcomed in markets that have shown price weaknesses this spring, such as Florida (1.1% of homes underwater) and Texas (1.7% of homes underwater) — both of which are below the national rate — as further price declines could drive more homeowners to lose their equity.”

On negative equity

Negative equity, also referred to as underwater or upside-down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the first quarter of 2024, the quarterly and annual changes in negative equity were:

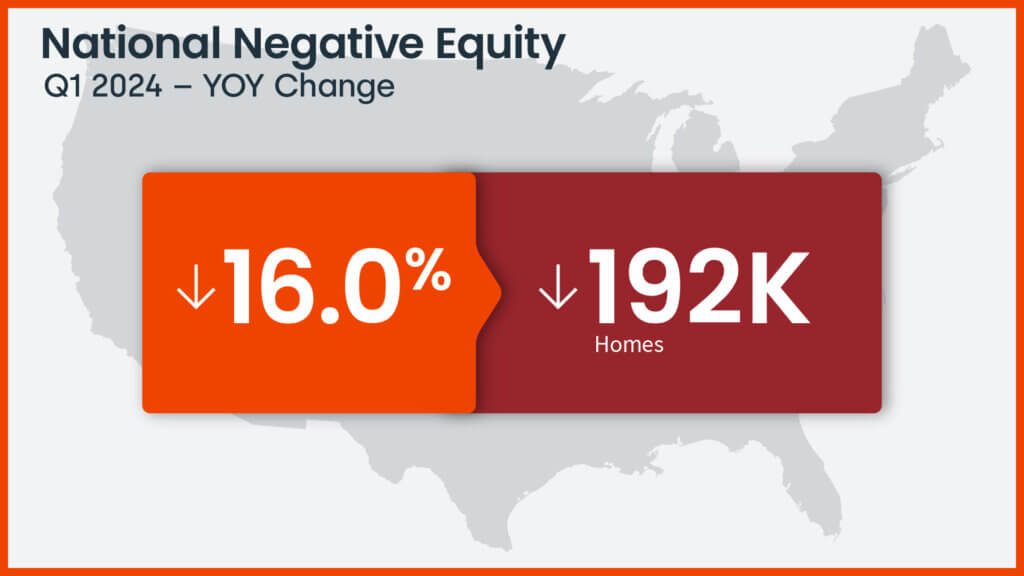

- Quarterly change: From the fourth quarter of 2023 to the first quarter of 2024, the total number of mortgaged homes in negative equity decreased by 2.1%, to 1 million homes or 1.8% of all mortgaged properties.

- Annual change: From the first quarter of 2023 to the first quarter of 2024, the total number of homes in negative equity decreased by 16.1%, to 1.2 million homes or 2.1% of all mortgaged properties.

Looking at the first quarter of 2024 book of mortgages, if home prices increase by 5%, 111,000 homes would regain equity; if home prices decline by 5%, 153,000 properties would fall underwater.

Click here to see the report in its entirety.