For many, homeownership is a pillar of the American Dream and an essential way for many people to accumulate wealth, but ongoing costs go much beyond the initial purchase price—according to Bankrate’s latest Hidden Costs of Homeownership Study. Median home prices have risen above $400,000 nationwide, and the average annual cost of owning and maintaining a single-family home in the U.S. is now 26% higher than it was four years ago.

Bankrate compiled the typical costs of property taxes, homeowners insurance, and home maintenance, which was estimated to be 2% of a home’s value per year. Energy, internet, and cable costs, as well as inflation adjustments for property taxes, energy, internet, and cable bills, and homeowners insurance rates, were also factored into the study.

In all 50 U.S. states, the average single-family home, priced at $436,291, according to Redfin, costs $18,118 each year. This adds an additional $1,510 per month to a mortgage payment throughout the country. In 2020, the same expenses totaled $14,428 per year for a typical single-family home—which equates to $1,202 monthly.

Homeownership and Maintenance Costs Up Nearly 30% Nationally

Everything has become more expensive in the last four years. Home values have risen by 40% since the beginning of the pandemic. The National Association of Realtors reported that the median price of an existing home in March 2020 was $280,700. By March 2024, the figure had risen to $393,500.

Consumers are also dealing with the aftermath of pandemic-related inflation. Overall, prices are significantly higher than in 2020, and dollars do not go as far as they did a few years ago. According to the U.S. Bureau of Labor Statistics, cumulative inflation reached 21% between March 2020 and March 2024. Insurance prices are another burden for homeowners. increased home values, increased construction expenses, and disasters have all contributed to an increase in annual insurance premiums.

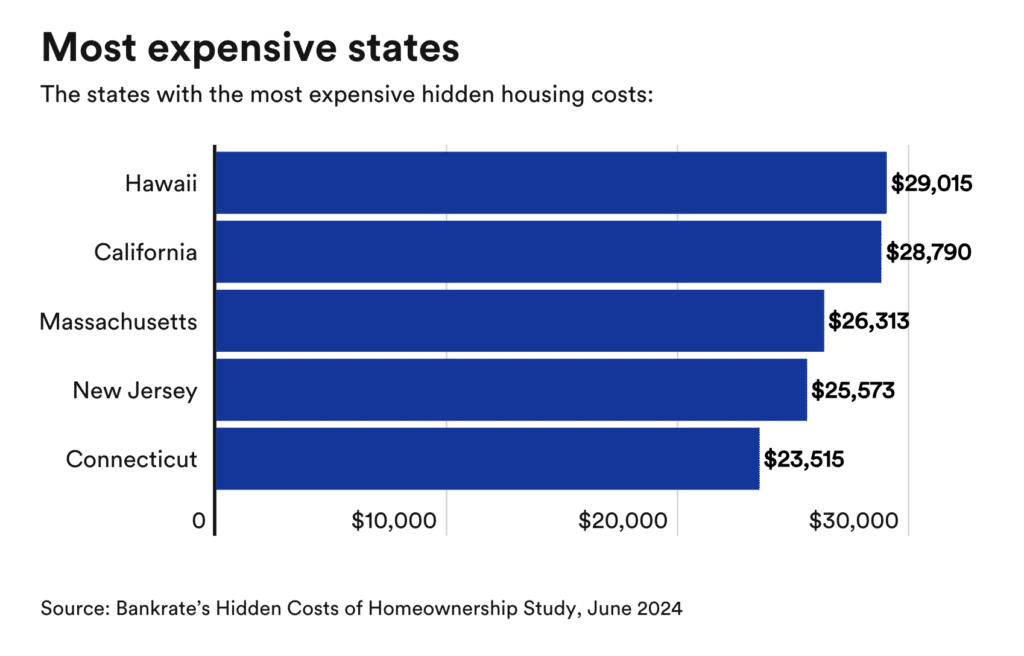

States with the Most Expensive Homeownership Costs

These are the top five states with the highest costs of homeownership:

- Hawaii. With an average annual cost of $29,015, Hawaii is an expensive place to own a home. Much of the tab stems from high home values. With a typical single-family home price of $993,000, applying our estimated maintenance costs of 2% of the home’s value leads to a hefty $19,860 per year. The other factors contributing to ongoing costs: average annual property taxes of $3,724; average annual homeowners insurance of $1,455; average annual cable and internet costs of $1,508; and average annual energy bills of $2,468.

- California. The Golden State is another place where ongoing costs are inflated by home values. The median single-family sale price in March was $848,300, which means maintenance costs of $16,966 a year. Homeowners in California also pay average annual property taxes of $6,832, average annual homeowners insurance of $1,572, average annual cable and internet costs of $1,434 and average annual energy bills of $1,986. The total annual tab: an estimated $28,790.

- Massachusetts. Massachusetts property taxes are a big lift—the typical bill is $7,413—and single-family home prices are high. At a median sale price of $624,200, you get estimated home maintenance costs of $12,484. Homeowners insurance is also pricier than average, at $1,918 a year, typically. Meanwhile, homeowners in this state pay $1,557, on average, in cable and internet costs, plus an average $2,941 in energy bills, per year. Taken together, Massachusetts homeowners can expect $26,313 in hidden costs.

- New Jersey. Garden State property taxes average $10,026 a year, the highest in the nation. Single-family home prices are a median of $502,400, translating to maintenance costs of $10,048. Homeowners insurance costs an average $1,466 a year, while annual cable and internet and energy bills run an average $1,594 and $2,439, respectively. Overall, New Jersey homeowners face $25,573 in hidden expenses.

- Connecticut. Another state with high property taxes, Connecticut homeowners pay an average of $8,073 per year. Single-family home prices aren’t as high—the median of $435,900 leads to annual costs of $8,718, just below the national average. Along with annual cable and internet costs averaging $1,508, annual energy bills averaging $3,367 and annual homeowners insurance averaging $1,850, homeowners in Connecticut typically spend $23,515 in hidden costs.

While the national average hidden costs of homeownership are up approximately 26%, the three states with the highest percentage increases from 2020 to 2024 are Utah (+44%), Idaho (+39%), and Hawaii (+38%). Utah and Idaho experienced significant increases in home prices throughout the pandemic, and home values are the primary driver of our calculations.

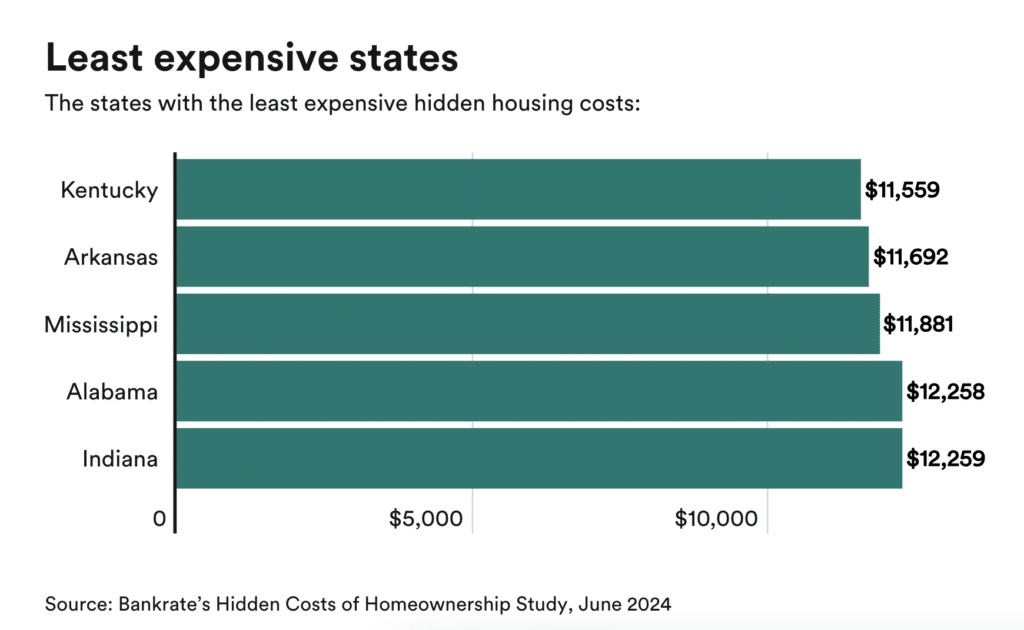

States with the Least Expensive Homeownership Costs

These are the top five states with the lowest costs of homeownership:

- Kentucky. With an average annual cost of $11,559, The Bluegrass State is the least expensive place to own a home. This is largely a function of affordable home values. With a typical single-family home price of $255,800, the 2% rule of thumb equates to $5,116. The other ongoing costs: average property taxes of $1,547 a year; average annual homeowners insurance costs of $1,380; average annual energy bills of $2,216; and average annual cable and internet costs of $1,300.

- Arkansas. Arkansas is another place where ongoing costs stay in check thanks to modest home values. The median single-family sale price in March was $249,300, which means maintenance costs of $4,986 a year. In addition, homeowners in Arkansas typically pay average annual property taxes of $1,292, average annual energy bills of $2,309 and average annual homeowners insurance of $1,805. The state also comes with average annual cable and internet costs of $1,300—the same as Kentucky. The total annual tab: $11,692

- Mississippi. Homeowners here catch a break because of affordable prices. With a median single-family sales price of $242,500, maintenance comes out to $4,850 a year. The state’s property taxes average just $1,380 per year, while annual energy bills average $2,263 and annual cable and internet costs average $1,410. Still, homeowners insurance is pricier than average, at $1,978 a year. The total expense is $11,881.

- Alabama. The picture here is similar to other affordable states: Alabama’s median single-family sales price of $271,800 works out to estimated maintenance costs of $5,436. The state’s annual property taxes aren’t as high, at $1,075, but annual homeowners insurance is above-average, at $1,804. Meanwhile, annual cable and internet costs average $1,447 and annual energy bills average $2,497.

- Indiana. Indiana’s more affordable single-family median of $252,900 equates to annual maintenance costs of $5,058, and homeowners insurance is just $1,185. On a yearly basis, homeowners in the state pay an average $2,063 in property taxes, an average $1,422 in cable and internet costs and average $2,531 in energy bills. In all, Hoosiers can expect $12,259 in hidden costs.

Alaska, Texas, and Louisiana had the smallest percentage increases in hidden homeownership expenses from 2020 to 2024, with Alaska and Texas up 14% and Louisiana up 15%.

While single-family homeowners in expensive states such as California, Hawaii, and New Jersey may pay more than $25,000 in annual ownership and maintenance fees, potential homebuyers can find better deals in lower-cost states including Arkansas, Kentucky and Mississippi. Despite elevated mortgage rates and high home prices hindering American homebuyers nationwide, the American Dream is possible—it may just depend on the location.

To read the full report, including more data, charts and methodology, click here.