Home sale prices are falling year-over-year in four major U.S. metros, according to a new Redfin report, three of which are in Texas: Austin (-2.9%), San Antonio (-1.2%), and Fort Worth (-1.2%), followed by Portland, Oregon (-0.9%).

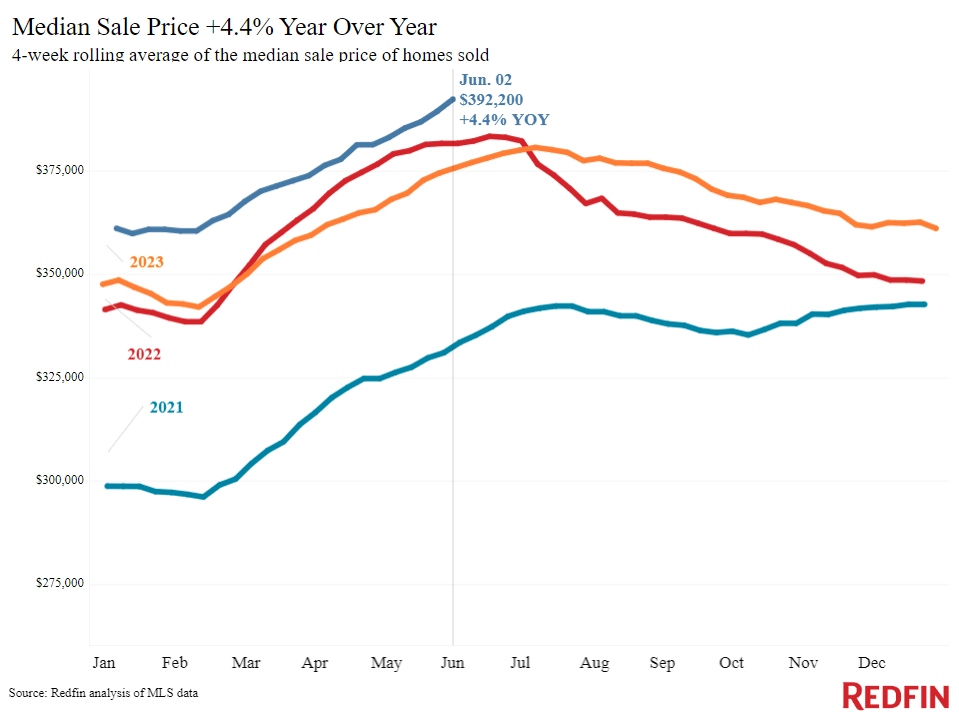

Home prices jumped 4.4% nationwide from a year ago, reaching an all-time high in the four weeks ending June 2. However, the report finds that there are early indications that nationwide price increases could slow soon, as an estimated 6.4% of US home sellers reduced their asking price on average, representing the largest percentage since November 2022. And the average active listing has been on the market for 46 days, up 2.3% year-over-year—the largest increase in nine months—indicating that property listings are becoming stale faster than they were a year ago.

Housing Market Highlights: The Four Weeks Ending June 2

- The median sale price was $392,200, representing a 4.4% year-over-year (YoY) change, reaching an all-time high.

- The median asking price was $417,274 representing a 5.9% YoY change.

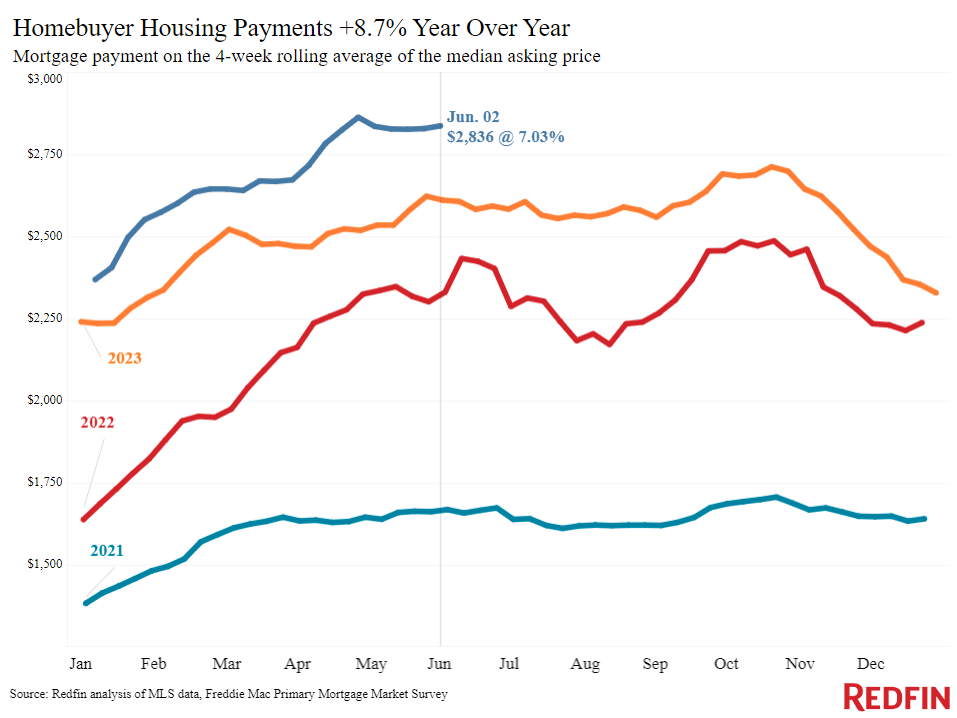

- The median monthly mortgage payment was $2,836 at a 7.03% mortgage rate, representing an 8.7% YoY change. This is $26 below all-time high set during the 4 weeks ending April 28.

- Pending sales were 86,464, representing a -3.8% YoY change, the biggest decline in over three months.

- New listings were 98,467, representing a 6.9% YoY change, the smallest increase in over four months (with the exception of the 4 weeks ending May 5).

- Active listings were 923,747, representing a 15.8% YoY change.

- Months of supply was 3.2, representing a +0.6 pts YoY change.

- The share of homes off market in two weeks was 43.4%, down from 48%.

- Median days on market was 32, representing a +3 day increase YoY.

- The share of homes sold above list price was 32%, down from 34%.

- The share of homes with a price drop was 6.4%, representing a +2 pt YoY change, the highest level since November 2022.

- Average sale-to-list price ratio was 99.6% representing a -0.2 pt YoY change.

Per the report, some home listings are becoming stale as a result of rising mortgage rates and home costs, which are discouraging potential purchasers. The weekly average mortgage rate rose back above 7% in the first week of June, bringing the median monthly housing payment in the U.S. to a near-record high of $2,838. Pending house sales decreased 3.8% year on year, the largest drop in three months, while mortgage-purchase applications dipped 4% week on week. Inventory is also losing momentum, which contributes to the decline in sales. New listings saw one of the weakest year-over-year increases (6.9%) since February, with high mortgage rates preventing homeowners from selling because it would entail giving up their cheap rate and attempting to sell their house in a slow market.

“There’s no getting around the fact that it’s expensive to buy a home right now, but some people are having luck negotiating with sellers,” said Bonnie Phillips, a Redfin Premier agent in Cleveland. “I’ve seen buyers get a home under asking price when it has been on the market for a few weeks. That’s especially true when their agent presents market data that supports a lower market value, like comps of similar homes nearby that have sold for less, or fewer than usual online views or tours. Other buyers are finding creative ways to afford a home, like buying a duplex, living in one unit and renting out the other.”

Metros with Biggest YoY Increases in Median Sale Price

- Anaheim, CA (17.3%)

- Nassau County, NY (15.8%)

- Newark, NJ (13.9%)

- Cleveland (13.9%)

- Oakland, CA (13.8%)

The median sale price of the average home decreased in four metros—three of which are in the Lone Star State of Texas.

Metros with Biggest YoY Decreases in Median Sale Price

- Austin, TX (-2.9%)

- San Antonio (-1.2%)

- Fort Worth, TX (-1.2%)

- Portland, OR (-0.9%)

While the median sale price remains elevated in other regions, new listings increased in the West year-over-year, particularly in sunnier metros.

Metros with Biggest YoY Increases in New Listings

- San Jose, CA (39.8%)

- Phoenix (22.4%)

- San Diego (21.2%)

- Denver (18.4%)

- Las Vegas (18%)

The Golden State of California also saw a rise in pending sales, with San Jose, CA (10.5%), Anaheim, CA (7.1%), San Diego (6.7%), and San Francisco (4.1%) experiencing YoY increases. Columbus, Ohio, also saw a 7% jump.

Leading Indicators of Homebuying Demand and Activity

- The daily average 30-year fixed mortgage rate was 7.03% (June 5), up slightly from 6.99% two weeks earlier, but down from a 5-month high of 7.52% five weeks earlier. This is up from 6.95%.

- The weekly average 30-year fixed mortgage rate was 7.03% (week ending May 30), up from 6.94% a week earlier, but down from 5-month high of 7.22% a month earlier. This is up from 6.79%, according to Freddie Mac.

- Mortgage-purchase applications (seasonally adjusted) declined 4% from a week earlier (as of week ending May 31, down an overall 13%, according to the Mortgage Bankers Association (MBA).

- The Redfin Homebuyer Demand Index (seasonally adjusted) was essentially unchanged from a month earlier (as of week ending June 2), down 13%, according to Redfin.

- Touring activity was up 23% from the start of the year (as of June 2). At this time last year, it was up 10% from the start of 2023, according to ShowingTime.

- Google searches for “home for sale” remained unchanged from a month earlier (as of June 3), down roughly 18%, according to Google Trends.

To read the full report, including more data, charts, and methodology, click here.