According to a new survey from Forbes Advisor, renting, not buying, is now cheaper in America’s 50 largest metro areas. But with home prices across the country now up 6.1% as of April 2024 compared to the same time last year based on reports from 2,000 renters.

Even more surprising, 34% of these surveyed renters have no plans to buy a home in the future.

For those renters who do plan to buy a home over the course of the next few years, the top three reasons they can’t buy sooner are all related to finances: high home prices (56%), the lack of a down payment (42%), and high interest rates (29%).

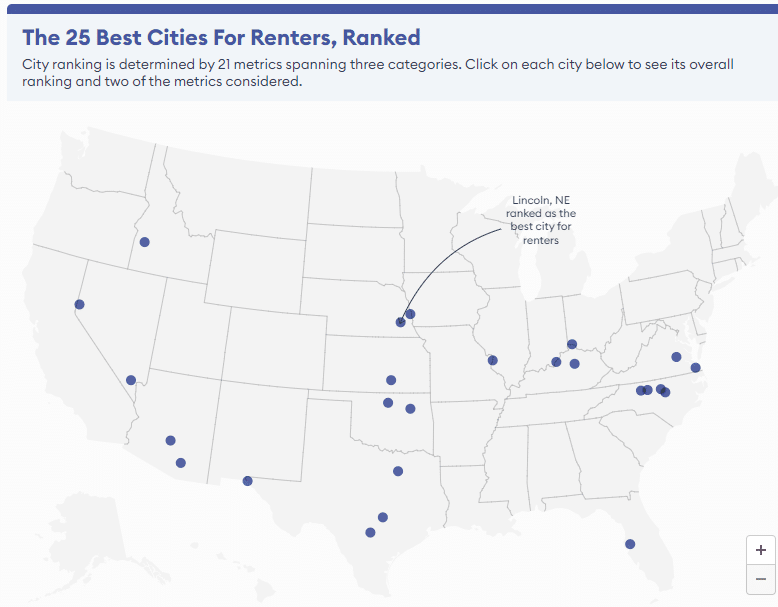

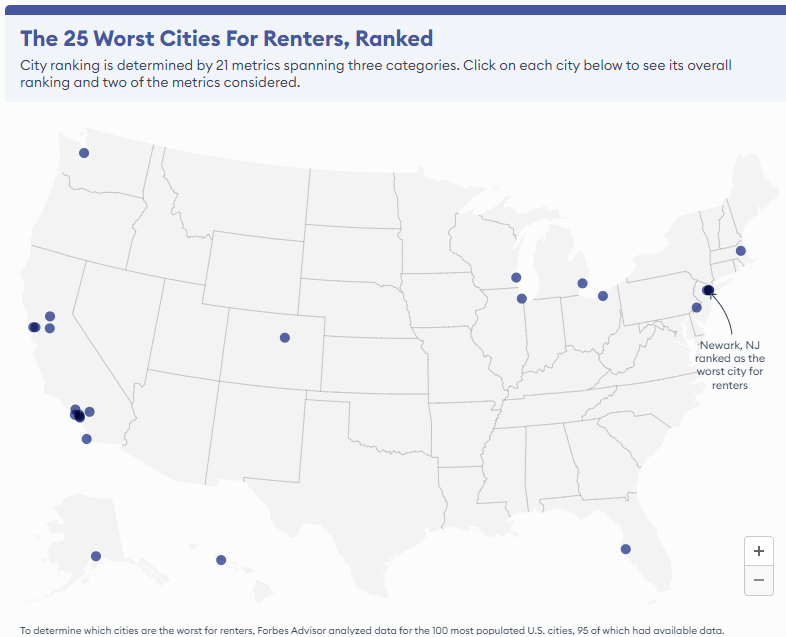

To find the best and worst cities for renters, Forbes Advisor analyzed the 95 most populous metropolitan areas in the country—to identify the best cities, Forbes Advisor considered factors including rent-to-income ratios, median rental prices, availability, and amenity prevalence, among others.

Key Takeaways

- The best city for renters is Lincoln, Nebraska, and the worst city is Newark, New Jersey.

- For the second year in a row, Newark (No. 1 worst city for renters) ranked higher than its neighboring city, New York City (No. 3 worst city for renters), due in part to higher rental price changes in the last year (up $250, compared to NYC’s $22 drop) and fewer available rental units per 100,000 households (8.5 for Newark vs. 137.2 for NYC).

- The states of Nebraska, Kentucky are home to two of the top 10 best cities for renters, and North Carolina is home to three.

- Half of the 10 worst cities for renters are located in California, thanks in part to the state’s above-average median rent costs and lower-than-average availability of rentals.

- The median price for a rental among the 95 U.S. cities considered in our study is $1,995 and the average price per square foot is $2.09.

The best cities for renters include

1. Lincoln, Nebraska

- Lincoln’s score: 100 out of 100

- Lincoln ranked in the top 10 in the following metrics:

- Fifth best for median monthly rent price at $1,225, compared to the study average of $1,995.

- 10th best for rent as a percentage of income at 17.6%, compared to the study average of 21.3%.

- Fourth best for the number of available rentals per 100,000 households with 394, compared to the study average of 164.

- Ninth best for the average monthly price per sq. ft. at $1.33 (a tie with Winston-Salem), compared to the study average of $2.09.

- Fourth best for its 2.6% unemployment rate, compared to the study average of 4.1%.

2. Omaha, Nebraska

- Omaha’s score: 98.01 out of 100

- Omaha ranked well in the following metrics:

- 15th best for median monthly rent price at $1,384, compared to the study average of $1,995.

- Fourth best for rent as a percentage of overall income at 16.6%, compared to the study average of 21.3%.

- Eighth best for an average monthly price per sq. ft. of $1.32 compared to the study average of $2.09.

- Eighth best for the percentage of units with on-site parking at 68.8%, compared to the study average of 52.8%. A Forbes Advisor survey found that having at least one guaranteed parking spot ranked as the second-most necessary amenity for renters (65%).

3. Raleigh, North Carolina

- Raleigh’s score: 96.93 out of 100

- Overall, Raleigh ranked in the better half of 16 of the 21 metrics considered in this study:

- 18th best for rent as a percentage of income at 18.4%, compared to the study average of 21.3%.

- Fourth-best in the availability and amenities category.

- 16th best for percentage of non-apartment rentals at 70%, in comparison to the study average of 48.4%.

4. Austin, Texas

- Austin’s score: 94.24 out of 100

- Austin ranked in the top 10 in the following metrics:

- Eighth best for rental price changes in the last year at -$250, compared to the study average of -$43.

- Second best in terms of available rentals per 100,000 households with 399 vs. the study average of 164.

- Third best for the percentage of units with on-site parking at 71.8%, in comparison to the study average of 52.8%.

- Sixth best for the percentage of units with in-unit laundry at 67.8%, compared to the study average of 42.9%. A Forbes Advisor renters’ survey found that in-unit laundry was the third most necessary amenity for renters (60%).

- Sixth best for the percentage of units with AC at 76.4% vs. the study average of 56%. Having AC or central air was the most necessary amenity among 2,000 renters (77%) according to the Forbes Advisor renters’ survey.

5. Oklahoma City, Oklahoma

- Oklahoma City’s score: 92.1 out of 100

- Overall, Oklahoma City ranked in the top half of 11 of the 21 metrics considered in this study:

- Oklahoma City ranked as the second-best city in the affordability category, and in the top 10 in the following metrics:

- Ninth best for median monthly rent price at $1,300 (a tie with Cincinnati), compared to the study average of $1,995.

- Fourth best for the average monthly price per sq ft at $1.16 vs. the study average of $2.09.

The worst places for renters were found to be

1. Newark, New Jersey

- Newark’s score: 0.0 out of 100

- Newark ranked as the eighth-worst city in the affordability category:

- It was the worst city for rental price changes in the last year at $250 (the study average was -$43.)

- Newark also ranked as the worst city in the availability and amenities category. It ranked in the bottom five for the following metrics:

- Fourth worst for available rentals per 100,000 households at 8.5 vs. the study average of 164.

- Fourth worst for the percentage of non-apartment rentals at 9.3% as compared to the study average of 48.4%.

2. Long Beach, California

- Long Beach’s score: 7.27 out of 100

- Long Beach ranked as the sixth-worst city in the affordability category:

- It was fifth worst for rent as a percentage of income at 25.8% (a tie with Anaheim and Los Angeles) compared to the study average of 21.3%.

- Long Beach also ranked as the second-worst city in the availability and amenities category:

- Seventh worst for the percentage of non-apartment rentals at 15.4% vs. the study average of 48.4%.

- Seventh worst for the percentage of units with AC at 26.7%, compared to the study average of 56%.

3. New York, New York

- New York’s score: 13.07 out of 100

- New York ranked as the fifth-worst city in the affordability category:

- Worst city for the average monthly price per sq. ft. at $6.88, compared to the study average of $2.09.

- Second worst for the monthly median rent price of $3,573 vs. the study average of $1,995.

- New York also ranked 11th-worst in the availability and amenities category:

- Worst city for the percentage of non-apartment rentals at 5.2% vs. the study average of 48.4%.

- The worst city for the percentage of units with on-site parking at 15.8% as compared to the study average of 52.8%.

4. Anaheim, California

- Anaheim’s score: 13.54 out of 100

- The home of Disneyland ranked as the second-worst city in the affordability category:

- The sixth worst for rental price changes, with average rental prices jumping $105 year over year, compared to the study average decrease of -$43.

- Seventh-worst for rent as a percentage of income at 25.8% (a tie with Long Beach and Los Angeles) vs. the study average of 21.3%.

- Anaheim is also the second worst city for the number of available rental units per 100,000 households at 7, compared to the study average of 164.

5. Oakland, California

- Oakland’s score: 19.79 out of 100

- Oakland ranked in the bottom 10 in the following metrics:

- The 10th worst for the average monthly price per sq. ft. at $3.27 vs. the study average of $2.09.

- Ninth worst for the percentage of units that allow pets at 17% vs the study average of 33.6%. In a Forbes Advisor survey of 2,000 renters, 52% of renters said a pet-friendly unit was a necessity.

- Third worst for the percentage of units with AC at 14.5% vs. the study average of 56%.

- Third worst for the property crime rate per 1,000 residents at 65.5 as compared to the study average of 33.8.

- Fifth worst for the violent crime rate per 1,000 residents at 15.3 compared to the study average of 7.4.

- 10th worst for the percentage of non-apartment rentals at 18.2% vs. the study average of 48.4%.

So what exactly are renters looking for? The things they are looking for are mainly creature comforts such as a pet-friendly unit (52%), central air conditioning (77%), guaranteed parking (65%), and in-unit washer and dryers (60%).

In choosing the ideal location, renters listed their top three most important considerations as crime (52%), the cost of living in the area (48%) and the distance to work (28%)

Do Renters Plan to Buy?

34% of renters plan to continue renting and nearly half of all renters (49%) said in a recent Forbes Advisor survey they are renting because they can’t afford to buy a home.

However, most renters do plan to buy in the near future, with 11% saying they plan to buy in the next 12 months, and 55% saying they have plans to buy, just not in the next year.

These are the top three reasons renters cited for not buying something sooner: home prices (56%), a lack of down payment (42%), and high interest rates (29%).

Click here to see the report in its entirety, including methodology for the 2,000 respondents.