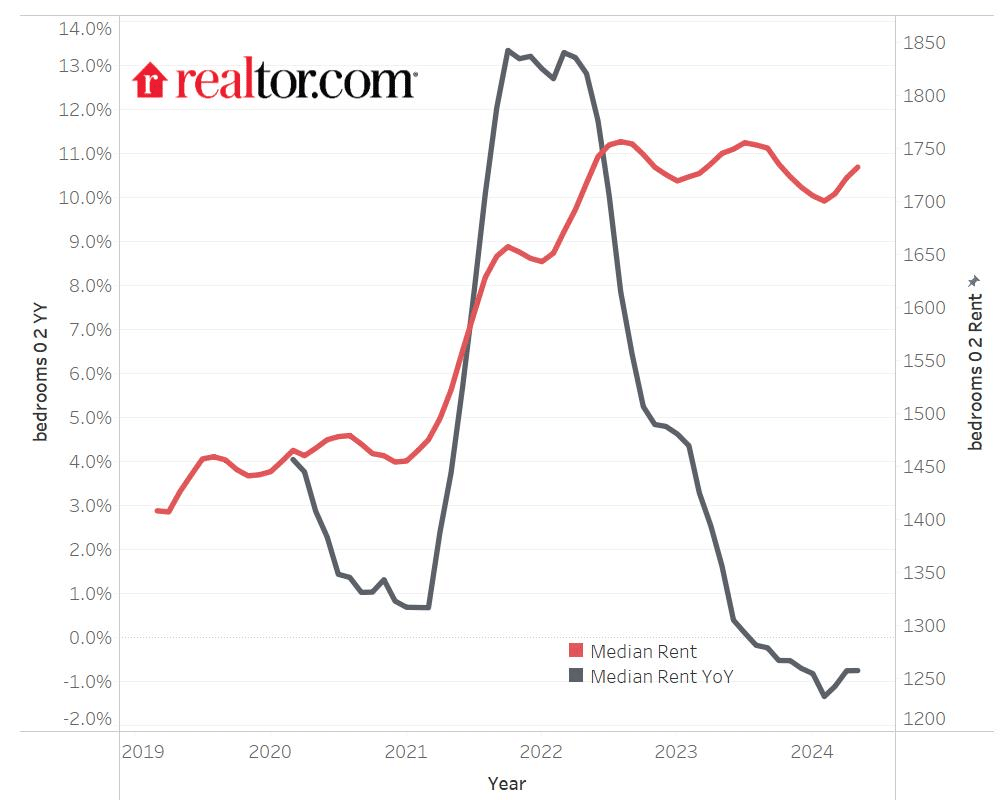

Rents declined in May for the tenth consecutive month, and the speed of the decline has slowed since earlier this year, suggesting potential challenges for additional reductions in total inflation. This is according to the Realtor.com Rental Report for May. The report suggests that this could possibly complicate the Fed’s policy decisions and also underlines the need for increased home construction, particularly in those locations where a lack of rental supply is leading to rising costs.

The national median asking rent for 0-2 bedroom units fell by -0.7% ($13) from May of last year to $1,732, with decreases across all size categories. That’s only $24 (-1.4%) from its August 2022 high. The median asking rent has grown by 21.5% during the last five years.

National Rental Data — May 2024

Overall

- Median rent: $1,732

- Rent YoY: -0.7%

Rent change – five years: 21.5 %

Studio

- Median rent: $1,449

- Rent YoY: -1.9 %

- Rent change: 17.3 %

1-bed

- Median rent: $1,612

- Rent YoY: -1.1%

- Rent change: 20.3 %

2-bed

- Median rent: $1,925

- Rent YoY: -0.7%

- Rent change: 23.3 %

“Slowing rent growth preceded slower shelter inflation, and falling market rents—as we’ve seen in the last 10 months of Realtor.com data—have furthered that deceleration in shelter prices,” said Danielle Hale, Chief Economist at Realtor.com. “As a significant driver of overall inflation, shelter costs need to slow further and are expected to do so. However, waning market rent declines foreshadow smaller Consumer Price Index shelter declines ahead and put a question mark on whether we’ve seen enough to rein in overall inflation, complicating the Fed’s policymaking.”

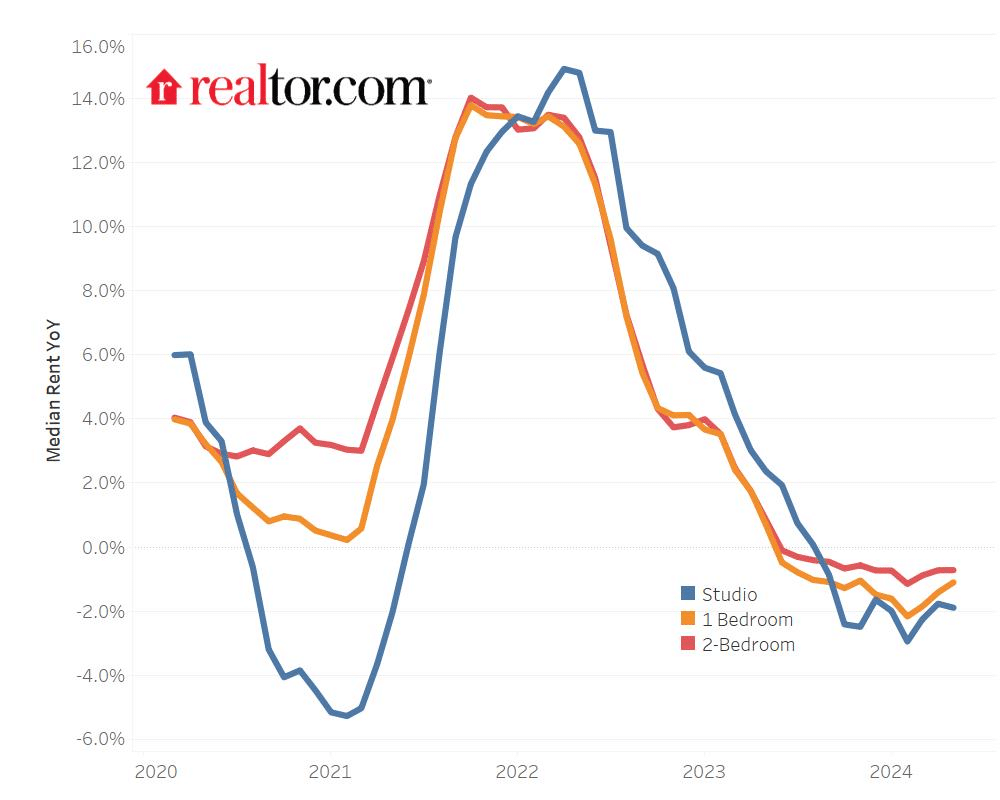

Rents Decline Across All Size Categories

In May, median rents for all unit sizes continued to fall. The median asking rent for studios nationally declined -1.9% year on year to $1,449. That’s down 2.8% from the October 2022 top, but 17.3% higher than five years ago. The median rent for one-bedroom flats declined -1.1%, the eleventh year-over-year decrease in a row, to $1,612, remaining 20.3% higher than five years ago. The median rent for two-bedroom flats declined -0.7%, the same amount as last month, to $1,925.

This was also the twelfth consecutive annual decline. Nonetheless, while two-bedroom rates were -1.4% lower than their August 2022 peak, they had climbed by 23.3% over the last five years, a faster growth rate than in smaller apartments.

Rents also dropped in the South and West, while they increased in the Midwest and Northeast. The South saw the largest year-over-year declines in median asking rent, topped by Austin (-9.3%), Nashville (-8.3%), and San Antonio (-8.2%). The West experienced reductions as well, with Phoenix (-4.5%), San Francisco (-4.3%), and Las Vegas (-4.1%) leading the way. In other markets, robust labor markets fueled demand while the supply of new units increased at a slow pace, pushing rents higher. Rents increased in several Midwest markets, including Indianapolis (+4.4%), Milwaukee (+4.3%), and Minneapolis (+2.9%). In the Northeast, Pittsburgh (+2.4%) and New York (+2.2%) were among the markets that increased.

Shelter Costs Remain Sticky

Shelter costs have been a significant driver of overall consumer cost rises. The Consumer Price Index for Shelter, which includes primary dwelling rent and owners’ equivalent rent of residences, up 5.5% year on year in April after gaining 5.7% in March, and is down from a high of 8.2% in March 2023. That government index usually trails behind market-based rent measurements, such as Realtor.com rent data, but the gap has recently expanded, resulting in a “stickier” shelter index. It is likely to fall further, but the rate of decline has slowed since February, making it more difficult for the overall inflation outlook to improve. For renters, an increase in housing building to alleviate supply shortages could help reduce expenses.

For example, in 2019, while the overall CPI ranged between 1.5% and 2.3%, the shelter index grew at a rate of 3.2% to 3.5% annually. In fact, the shelter CPI’s year-over-year increase rate has slowed to an average of 0.2 percentage points every month during the last year. If this trend continues, which would require a large decrease in monthly shelter prices, shelter inflation will fall below 3.5% by March 2025.

However, year-over-year decreases in market asking rents recorded by Realtor.com reached a low of -1.3% in February 2024 and have since slowed. This slowdown trend may impede further improvements in the overall rate of inflation and add long-term uncertainties, emphasizing the ongoing need for increased home construction to alleviate the supply constraint that is contributing to rising costs. In conclusion, experts suggest that while the CPI shelter index has become stickier, it is expected to decline for the remainder of the year.

To read the full report, including more data, charts, and methodology, click here.