In a strange turn of events, one part of the East Coast real estate market is cooling faster than the rest of the country, while markets such as Rochester and Buffalo, New York are heating up by attracting buyers with relatively low prices.

The part of the East Coast that is cooling down is the West Coast of Florida, rife with natural disasters that are only intensifying driving people away as the new construction and pandemic-era homebuying boom fade into the distance. In addition, insuring a home is becoming a harder chore than before as more-and-more insurance companies pull out of the state due to the cost of doing business from the repeated natural disasters that occur in the state.

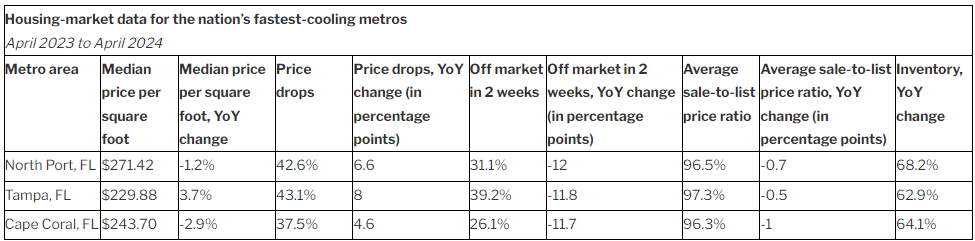

North Port, Florida’s housing market is cooling fastest, followed by Tampa and Cape Coral. There are three other Florida metros on the list of 10 housing markets cooling quickest: Orlando, Florida comes next, followed by Denver, Colorado; Houston, Texas; Minneapolis, Minnesota; Jacksonville, Florida; Lakeland, Florida; and Dallas, Texas.

This is according to a Redfin analysis that ranks the 100 most populous U.S. metros for which full data is available, based on how quickly measures of homebuying demand and competition cooled from April 2023 to April 2024. The measures are year-over-year changes in home prices, price drops, inventory, sale-to-list price ratio and the share of homes that sell within two weeks.

Measures of homebuying demand and competition are dropping off quickly in the state of Florida, and as such price drops and available listings are surging.

According to Redfin, for example, North Port, the nation’s fastest cooling market, has seen the supply of homes for sale go up 68% year over year, the second-biggest increase of the metros in Redfin’s analysis. Meanwhile, the median price per square foot is down 1.2%, making North Port one of just four metros where price per square foot declined (the others are Cape Coral, San Antonio and Austin, TX), and 42.6% of sellers are dropping their asking price—up from 36% a year earlier. In Cape Coral, inventory is up 64%, median price per square foot is down 2.9%, and 37.5% of sellers are dropping their price, up from 32.9% a year earlier.

There are several reasons housing markets on the west coast of Florida are cooling quickly, most of them tied to the growing prevalence of natural disasters in the area

- Increasing intensity of natural disasters: Hurricanes, floods and other severe weather events have become more frequent and intense in Florida. Destruction from climate disasters cost Florida more money than any other state (tied with Texas and Louisiana). In the Cape Coral metro alone, 2022’s Hurricane Ian destroyed 5,000 homes and damaged nearly 30,000 more. Natural disasters are not only destroying homes—which is one contributor to a surge in new construction, as builders replace homes that have been lost—but they’re scaring away some prospective homebuyers from the area.

- A surge in new construction: Florida is building more new homes than any other state in the country (aside from Texas, which is also home to two of the nation’s 10 fastest-cooling housing markets), a building boom coming at a time when high prices and mortgage rates are dampening homebuying demand. The oversupply of inventory is cooling competition.

- Sky-high insurance costs: Natural disasters have pushed up Florida’s home insurance costs. Many homeowners are reporting their insurance jumping by thousands of dollars, and a recent Redfin survey found that 70% of Florida homeowners have seen home insurance costs rise recently.

- Soaring home prices: Although prices in some parts of Florida have started declining in recent months, homes are much costlier than before the pandemic homebuying boom, when many affluent remote workers moved in and pushed up prices. North Port prices are up about 60% since 2019, and Tampa prices are up nearly 70%—much bigger than the national increase of about 40%. Elevated prices and insurance costs, combined with today’s high mortgage rates, are pricing out many locals. They’re also discouraging some older Americans from moving into a state that has traditionally been popular with retirees.

“Inventory is back up to pre-pandemic levels along the west coast of Florida as natural disasters continue to shape the region’s housing market by leading to more supply and less demand,” said Redfin Senior Economist Elijah de la Campa. “Construction is booming in the wake of recent climate disasters, and there’s less demand to buy new homes as the region braces for another intense hurricane season. While that’s disappointing for sellers, who may have to part with their home for less money than they would like, a bigger pool of listings to choose from is good news for the region’s homebuyers. More supply is the best way to bring down prices and combat the housing affordability crisis buyers are facing today—and that’s exactly what’s happening in parts of Florida.”

“Despite prices softening and the influx of listings, today’s local buyers face challenges with elevated mortgage rates, special assessments and the complexities of securing affordable flood insurance,” said Isabel Arias-Squires, a Redfin Premier agent in the Cape Coral area. “Many buyers are discovering that new-construction homes offer a compelling solution. These properties are not only abundant in our area, but builders like Lennar and DR Horton offer attractive incentives, such as contributions towards closing costs and competitive mortgage rates through in-house financing options. Those incentives can alleviate the financial strain caused by high interest rates.”

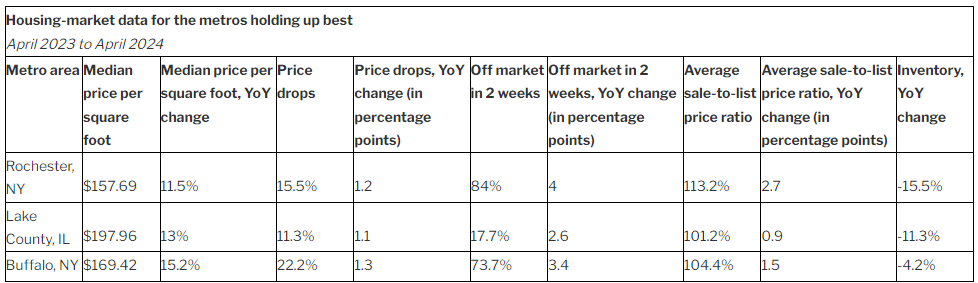

Western New York is heating up

Housing markets in western New York and the Midwest are holding up best: Rochester takes the number-one spot, followed by Lake County, IL and Buffalo. Compared to last year, inventory in those metros is down, price per square foot is up by double digits and more homes are selling within two weeks.

Homebuying demand and competition is heating up in Rochester and Buffalo because although prices are increasing, homes are still much more affordable than they are in most of the country. The typical home sells for roughly $250,000 in both Rochester and Buffalo, compared to $440,000 in the U.S. as a whole and $750,000 in the New York City metro, where many remote workers who move to upstate New York come from.

Rounding out the top 10 housing markets holding up best are several metros in the greater New York City area, along with a few other places. Nassau County, NY comes in fourth, followed by New Brunswick, NJ and Chicago. Next come Anaheim, CA, New York, Newark, NJ and Seattle.

Click here to view the full report from Redfin.