According to findings in the Q1 2024 Verisk Remodel Index, the cost of home repairs and remodeling in Q1 of 2024 continued to increase, rising by 0.59% from the prior quarter, and just over 4% from the first quarter of 2023. Costs once again set new highs for the past decade, rising approximately 61% from Q1 of 2014.

The Verisk Remodel Index tracks costs on 31 different categories of home repair, comprising over 10,000 line items, ranging from appliances to windows. Data are compiled monthly in more than 430 local market areas across the country.

“Repair costs rose in each of the 31 categories of home repair that are included in our Index, but the rate of increase continues to be slow down from the more rapid increases we had during and immediately after the COVID-19 pandemic,” said Greg Pyne, VP, Pricing for Verisk Property Estimating Solutions. “Labor costs appear to be coming down slightly as well, which has an impact on the overall cost of home repairs.”

Quarterly costs rose in all 31 categories included in the Verisk Remodel Index. The cost of framing was still slightly lower on an annual basis, and the only covered category that was not higher than in Q1 of 2023. Framing was the only one of the six largest categories of expenditure to decline on an annual basis. The other four–cabinets, siding, paint, wood look flooring, and plumbing–all rose between 2.5% and 5.5% over the past 12 months. The cost of exterior doors rose the most compared to the last quarter, increasing by over 3.7%. Only two other categories had a quarterly increase of at least 1%—tile flooring at 1.55%, and interior home painting at 1.03%.

The National Association of Home Builders (NAHB) tracks the latest lumber prices and futures prices, and provides an overview of the behaviors within the U.S. framing lumber market weekly using the Random Lengths Framing Lumber Composite (comprised using prices from the highest volume-producing regions of the U.S. and Canada). For the week ending June 7, 2024, the Random Lengths framing lumber composite price fell 0.8% from the previous week, marking the first week-to-week decline in the last five weeks.

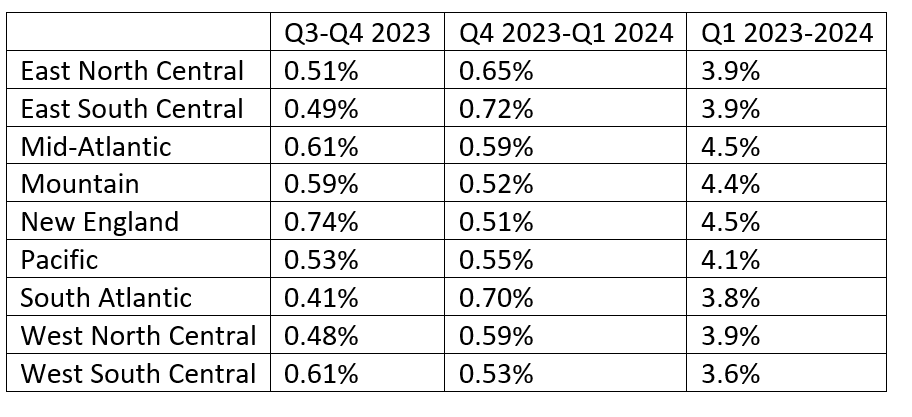

Regional shifts

All regions nationwide experienced cost increases both quarterly and annually, but all of the regions reported quarterly increases of less than 1%. The East South Central Region saw costs rise by 0.72% compared to Q4 of 2023, followed closely by the South Atlantic Region, where prices rose by 0.70%. The New England Region had the lowest quarterly increase at 0.51%, but the largest annual increase at 4.51%, slightly higher than the Middle Atlantic Region at 4.47% and the Mountain Region, where prices rose by 4.44%.

Verisk’s Index has risen by 65.88% since its inception in January 2013, and the Mountain Region continued to have the highest overall cost increases over the period covered by the Index, rising 70.92 points since Q1 of 2014. The Mountain Region also has the highest increases over the past decade, with costs increasing by 64.74% since Q1 of 2014. The Pacific Region (63.83%) and New England Region (62.81%) are the only two other regions that surpassed the national average of a 60.72% cost increase over that 10-year span.

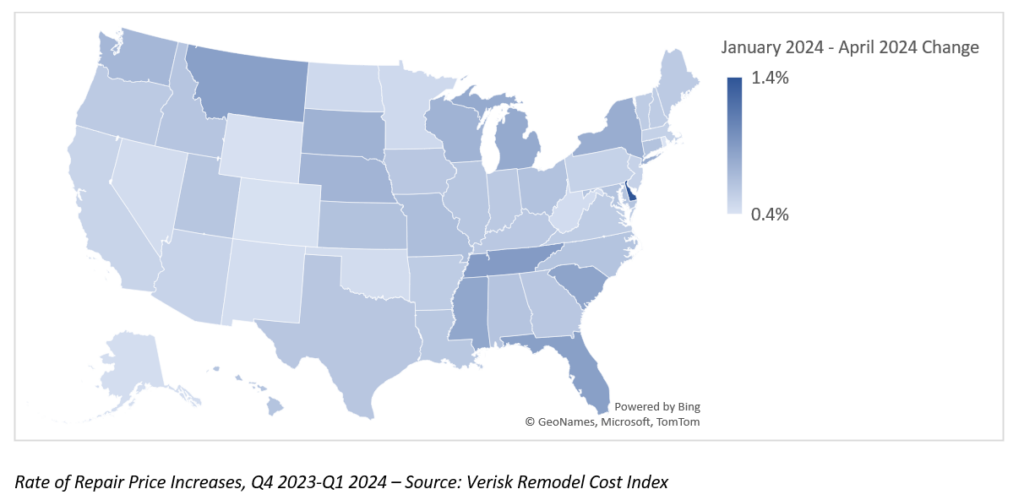

State-by-state breakdown

Delaware had the highest quarterly rate of increase in the country at 1.43%, the only state to surpass a one percent increase for the reporting period. Tennessee (0.90%), Florida (0.87%) and Montana (0.87%) barely missed that threshold. Other states with relatively high rates of quarterly increases included South Carolina (0.84%), Mississippi (0.82%), Michigan (0.79%), New York (0.77%), South Dakota (0.73%), and Wisconsin (0.72%).

Rhode Island had the lowest rate of quarterly cost increases at 0.37%, followed by Colorado (0.38%), Wyoming (0.38%), Alaska (0.41%), New Mexico (0.41%), West Virginia (0.42%), Oklahoma (0.42%), Nevada (0.42%), Washington DC (0.43%) and North Dakota (0.44%).

Will the numbers rise?

A combination of high home prices, mortgage rates edging toward and away the 7%-mark, and insufficient housing inventory have all become formidable barriers to homeownership for many. As potential buyers seek alternate means’ to enter the housing space, remodeling existing properties or recently purchased properties will remain just a few of the ways available to achieve homeownership.

A recent study from StorageCafe found that those new to the market are resorting to renovations and purchasing fixer-upper homes to enter the housing market at reasonable price points. The study found that fixer-upper homes come with an average median price point of $283,000, 29% lower than the average move-in ready home. The study also found that buying a fixer-upper as opposed to a turnkey home may result in savings of nearly $117,000 on average, and in 20 out of the 50 largest cities, fixer-uppers were priced at least 50% cheaper than regular homes.

On the other side of the fence, REO and fixer-upper properties emerge from foreclosure sales, and ATTOM’s May 2024 Foreclosure Market Report found that there were a total of 32,621 U.S. properties with foreclosure filings during the month—default notices, scheduled auctions, or bank repossessions—that number was up 3% from April 2024, but down 7% from a year ago.