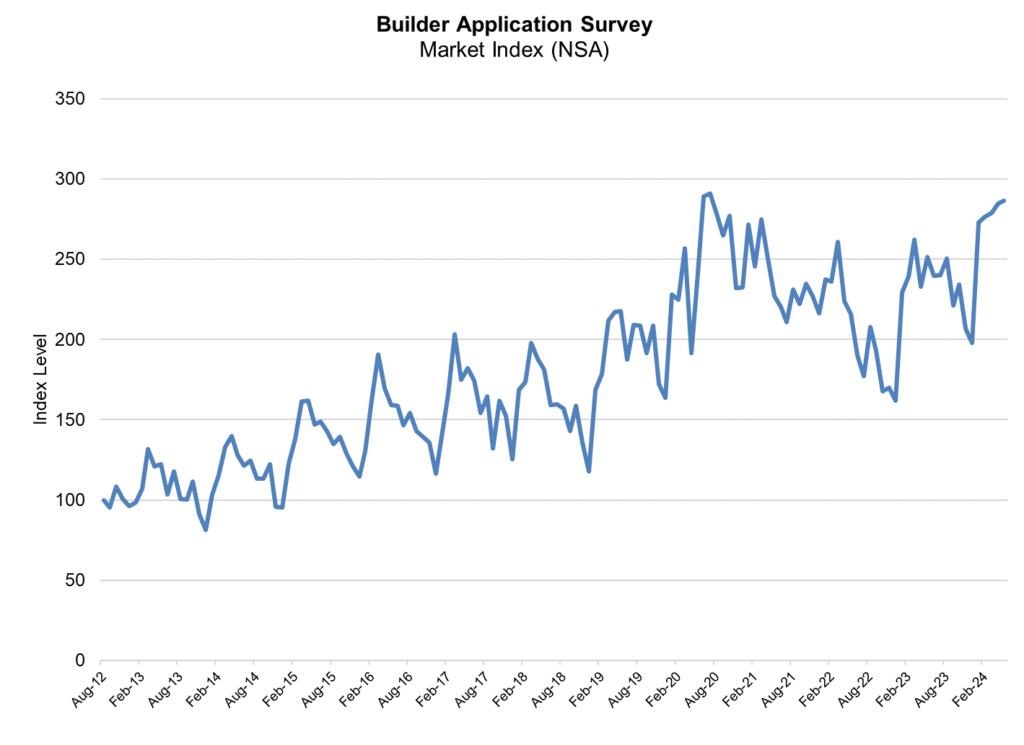

The Mortgage Bankers Association (MBA) has released a new report built on their Builder Application Survey (BAS) covering May 2024 which provides a picture of mortgage applications submitted for new home purchases.

The monthly report revealed that compared to a month earlier in April, mortgage applications for newly built homes increased by 1%—year-over-year, that number, that number is up by 13.8%.

“There continues to be strength in the new home purchase market, as purchase applications increased in May compared to both the prior month and from a year ago,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “With existing-home inventory still lagging in many markets, many homebuyers have turned their interest toward newly built homes, particularly FHA borrowers. The FHA share of applications was 26.5%, the highest share since the survey high of 27.1% in November 2023. The average loan size was $400,150, a decline from last month’s average of more than $405,000.”

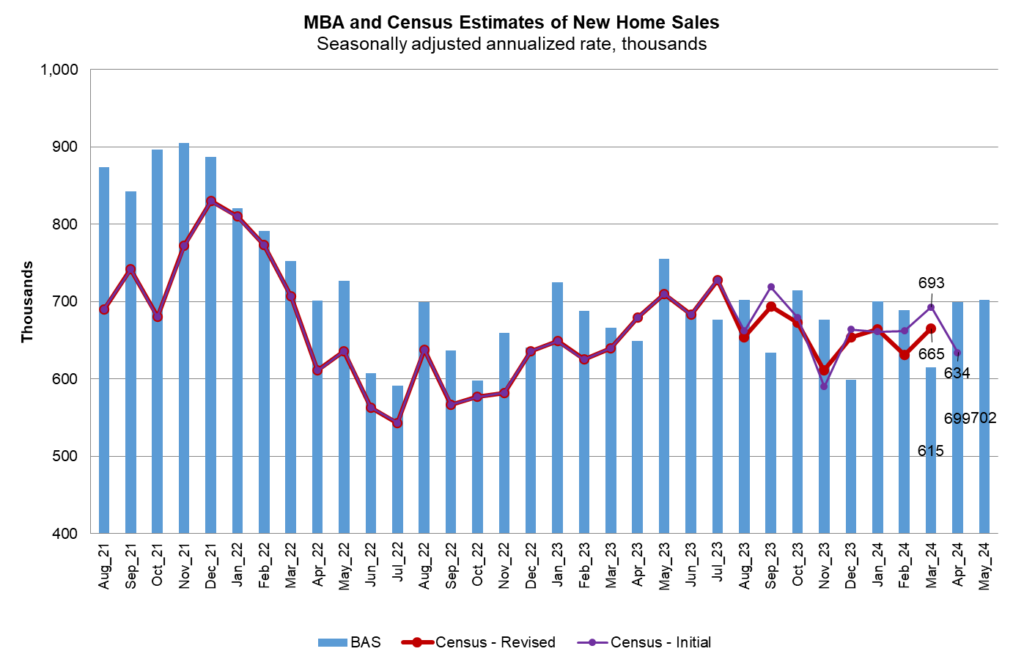

Added Kan, “MBA’s estimate of new homes show a slight increase to 702,000 units in May, the strongest pace since October 2023.”

New single-family home sales, which is a leading indicator of the Census Bureau’s New Residential Sales Report—which is also a leading indicator of the real estate market in general— is that new single-family home sales were running at a seasonally adjusted annual rate of 702,000 units in May 2024. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for May is an increase of 0.4% from the April pace of 699,000 units. On an unadjusted basis, MBA estimates that there were 63,000 new home sales in May 2024, an increase of 1.6% from 62,000 new home sales in April.