Celebrating its 80th anniversary on June 22 as part of the original GI Bill, the VA loan program has contributed $3.9 trillion to the U.S. economy, and VA loans rank as the top benefit veterans and military members receive for serving their country, according to a new survey from Veterans United Home Loans.

For the survey, Veterans United surveyed 500 veterans and servicemembers to get their insights on the VA loan. In addition, the company also engaged University of Missouri Economics Professor Joseph Haslag to determine what the VA loan benefit has meant to the American economy over its eight decades in existence.

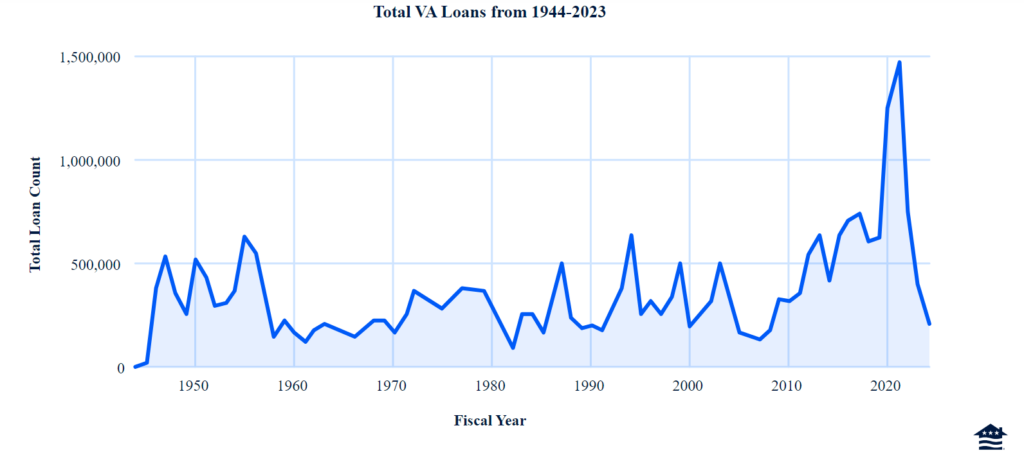

The economic impact analysis considers what the economy would have looked like if the VA loan hadn’t existed. It found the loan program has withstood various market changes, accounting for as much as 11% of new home mortgages in the postwar building boom. Total VA loan volume in 1947 was more than $3 billion, compared to its $447 billion peak in 2021, according to the study.

“The survey findings and economic analysis underscore the profound impact of the VA loan program on Veterans and service members, particularly younger generations,” said Chris Birk, VP of Mortgage Insight at Veterans United. “This historic benefit has helped millions of veterans and military families build wealth and shaped the growth of the American middle-class. VA loans are also helping to close the homeownership gap for women and minorities. Today, this hard-earned benefit is more important than it’s ever been.”

Vets rank benefits

The survey found that 93% of veterans and servicemembers used a VA loan to purchase their first home. At the same time, eight-in-10 veterans were 34-years-old or younger the first time they used their benefit. In addition to taking advantage of the benefit early in life, 89% ranked the VA home loan as the top benefit they are satisfied with, ranking higher than healthcare (73%), education and training (85%) and insurance (83%).

Overall, 90% of veterans and servicemembers said the VA home loan makes buying a home affordable. Competitive interest rates (48%) and the ability to reuse the VA loan benefit (48%) tied as the top advantages of VA loans, followed by no down payment (47%), VA Funding Fee exemptions (40%) and limits on closing costs (37%).

VA loans spanning across generations

The study found that VA loan usage has surged since the Great Recession and is expanding access to homeownership for younger buyers, female veterans, and veterans of color. Over the last five years, nearly one million millennials have used their home loan benefit. Nearly 60% of VA purchase loans in fiscal year 2023 went to millennial and Gen Z buyers.

In addition, the VA loan has helped to boost homeownership for minority groups. The homeownership rates for African Americans, Asian Americans, Hispanics and Latinos, Pacific Islanders, and female veterans and servicemembers are higher than their civilian counterparts.

The homeownership rate gap between Black and white veterans is 18 percentage points, compared to a nearly 30-percentage point gap between Black and white civilians, while the homeownership rate for female veterans was four points higher than female civilians.

VA loan education

Despite the popularity of VA loans, myths and misconceptions surrounding the benefit still exist among veterans, service members and the real estate community. The Veterans United survey found that 75% of veterans and servicemembers believe at least one myth about VA loans:

- 35% think they take longer to close than other loan types

- 32% think the government sets interest rates

- 18% think the VA loan can only be used once

- 18% think VA loans cost more than other loan products

The survey also uncovered other challenges and improvement areas that highlight the outsized role that real estate agents and home sellers can play when it comes to whether veterans can compete with their earned benefit. Nearly 20% of those veterans polled cited seller hesitation about VA offers and negative attitudes about VA loans among sellers’ real estate agents as major challenges with using their benefit.

“Although the VA loan program has achieved great success and growth, many Veterans and service members still face misunderstandings and hurdles when trying to use their benefits,” Birk said. “It’s important to dispel the myths and misconceptions about VA loans, especially among home sellers and real estate agents, to help Veterans make the most of the benefits they’ve earned. One way for Veteran buyers to get the most from their benefit is to work with real estate agents who know and understand the power of VA loans.”

Click here to view the full report, “The Economic Impact of the Veterans Administration Home-Loan Guaranty Program: Quantitatively Assessing the Value on the 80th Anniversary” by Joseph Haslag, Ph.D.