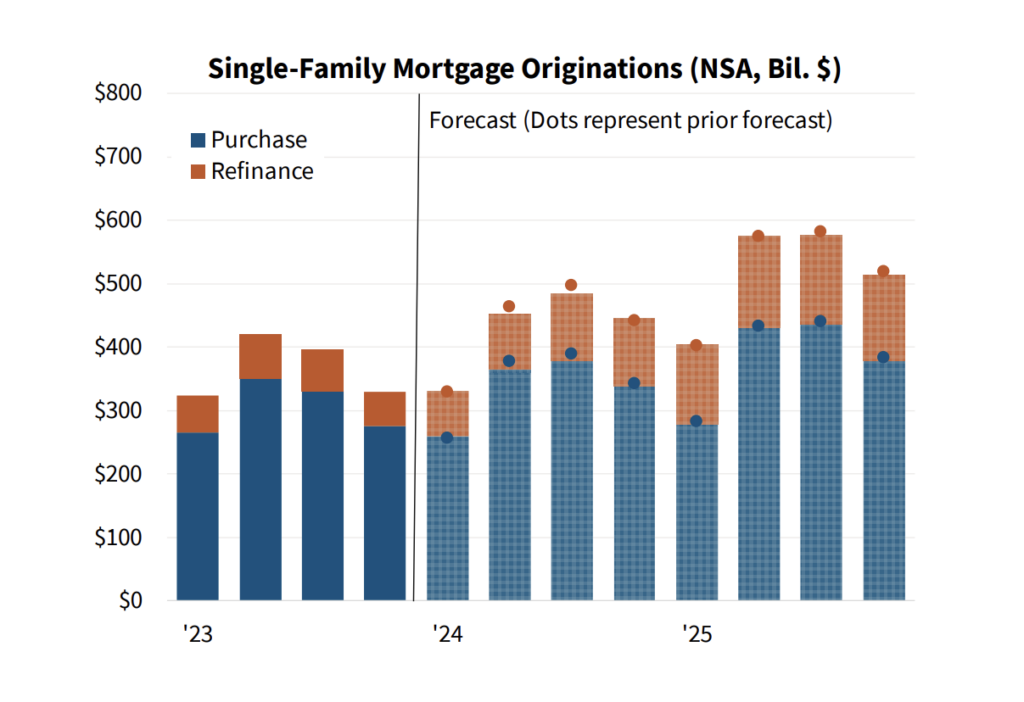

According to the Fannie Mae Economic and Strategic Research (ESR) Group’s June 2024 analysis, affordability restrictions continue to limit the amount of buyers wanting and able to make home purchases, despite an increase in for-sale home listings. As a result, the ESR Group reduced its total home sales prediction to 4.82 million in 2024, marking a moderate 1.3% annual rise vs the previously projected 2.8%.

“The economy appears to be slowing, and recent readings offer hope that inflation is cooling after progress on that front stalled in the first quarter—a trend that will likely need to be sustained for the Fed to feel comfortable cutting rates,” said Doug Duncan, Senior VP and Chief Economist at Fannie Mae. “Additionally, the labor market is showing signs of a gradual slowdown, with the unemployment rate creeping up to 4% in the June report.”

Despite the recent increase in listings, home sales have remained weaker than expected, indicating that many homeowners are no longer willing to delay moving due to the so-called “lock-in effect”—possibly due in part to consumers’ general upward recalibration of mortgage rate expectations following the pandemic’s historically low mortgage rates.

While the number of homes for sale remains low by historical standards, the months’ supply of inventory is progressively growing, which the ESR Group sees as consistent with a slowing of home price increase.

The ESR Group also reduced its 2024 real GDP growth forecast to 1.6% on a Q4/Q4 basis, citing downward revisions to Q1 2024 GDP data and recent data showing decreasing income and spending growth. While recent inflation data has been positive, the ESR Group believes the Federal Reserve will need to see three consecutive cold reports to be confident that inflation is reverting to its 2-percent goal.

Given the sustained durability of non-farm payroll growth and unpredictability in inflation readings, the ESR Group now expects the Fed to lower rates only once this year—in December—rather than the previously forecast two rate reduction.

Fannie Mae predicts continued new growth in new house building and sales, remaining strong in the coming months. According to the report, homebuilders have sufficient margins to make concessions to move inventory, even in markets with increasing existing home inventories compared to the past. In April, the month’s supply of new dwellings reached 9.1, the highest level since November 2022. However, if inventory expansion in Sun Belt markets, which account for a significant chunk of new sales, continues, our predictions for new home sales and construction may suffer.

Further, multifamily construction is expected to remain modest in the near future due to slow rent increases in major areas and limited financing options. Although the existing development pipeline is anticipated to be exhausted by 2025, Fannie Mae anticipates that a dearth of housing supply in comparison to population trends will continue to drive multifamily home construction.

“Unfortunately, we’re still not forecasting a ramp-up in housing activity,” Duncan said, “which will require some combination of continued household income growth, a further slowing of home price appreciation, or a decline in mortgage rates to bring affordability within range of many waiting first-time and move-up homebuyers.”

To read the full report, including more data, charts, and methodology, click here.