Even during a period when home values are typically at their lowest, many prospective first-time buyers were unable to reach their long-term financial goal of becoming homeowners in Q1, according to the Q1 2024 First-Time Home Buyer Affordability Report from Nerdwallet.

The last several years have seen a sharp increase in home prices, which has been partly caused by a dearth of available properties. In the beginning of 2024, these circumstances, in addition to high mortgage rates, maintained an unwelcoming market for potential buyers. And those who were first-time purchasers probably felt it the most.

First-time homebuyers also typically make smaller down payments than seasoned homeowners, who could benefit from equity in an existing property. Additionally, first-time buyers could have less stable credit histories and lower wages, which could be detrimental when qualifying for the lowest available rates.

First-timers are often the individuals most impacted when housing affordability declines nationwide, whether as a result of rising prices, rising loan rates, or both. In fact, the National Association of Realtors estimates that just 26% of all homebuyers in 2023 were first-time buyers. This is a record-low percentage, down from 34% the previous year.

Prices did not decrease in Q1, but neither did they increase. In a tight housing market, both mortgage rates and inventory remained high, offering little respite for potential buyers and sellers.

Affordability Challenges Persist Even in the Cheapest Homebuying Season

The first quarter of the year often sees the lowest prices for real estate. There is less demand during the colder months as fewer people purchase. Even though prices did not increase in Q1 of 2024, for prospective first-time buyers, home prices remained extremely high nationwide.

In Q1, on average, homes were advertised for five times the income of a first-time buyer. As a general guideline, one should look at properties that are around three times their annual salary in order to determine affordability.

Among the more affordable areas in Q1 were:

- Pittsburgh (where homes were listed at 2.8 times potential first-time buyer income)

- Detroit (2.9)

- Cleveland (3.0)

- Buffalo, NY (3.2)

- Baltimore (3.4)

At the other end of the spectrum was Los Angeles, where homes were listed at 12 times first-time buyer income; San Diego (9.3); San Jose, CA (7.7); New York City (7.1); and Boston and Miami were listed at 7.0.

While prices nationwide were essentially steady from the previous quarter of 2023, they decreased very marginally from Q1 of the previous year. After excluding inflation, prices decreased by 10% in two metro areas: Miami and Oklahoma City. In comparison, they increased by double digits in Los Angeles (13%), Pittsburgh (11%) and Richmond, VA (11%).

Mortgage Rates Continue to Impact Affordability and Homeownership

The average rate on a 30-year fixed mortgage has increased from less than 3% in 2020 and 2021 to approximately 7%. There was a brief and mild respite as rates dropped from above 7% to a little below in Q1 of the year. Even so, this rate is more than twice as high as what consumers experienced when making purchases during the pandemic.

These rising prices have a big impact on affordability, especially for individuals who are first-time buyers or have tighter budgets. A typical-priced home’s monthly payment would increase by $800 due to the rate rise from 2020 to 2024, and the interest on a 30-year loan would increase by several hundred thousand dollars.

The average list price of a property was approximately $419,300 in Q1 of 2024. A 30-year fixed mortgage’s average rate increased to 6.75% from 2.76% in Q3 of 2020—the difference that comes with a higher rate.

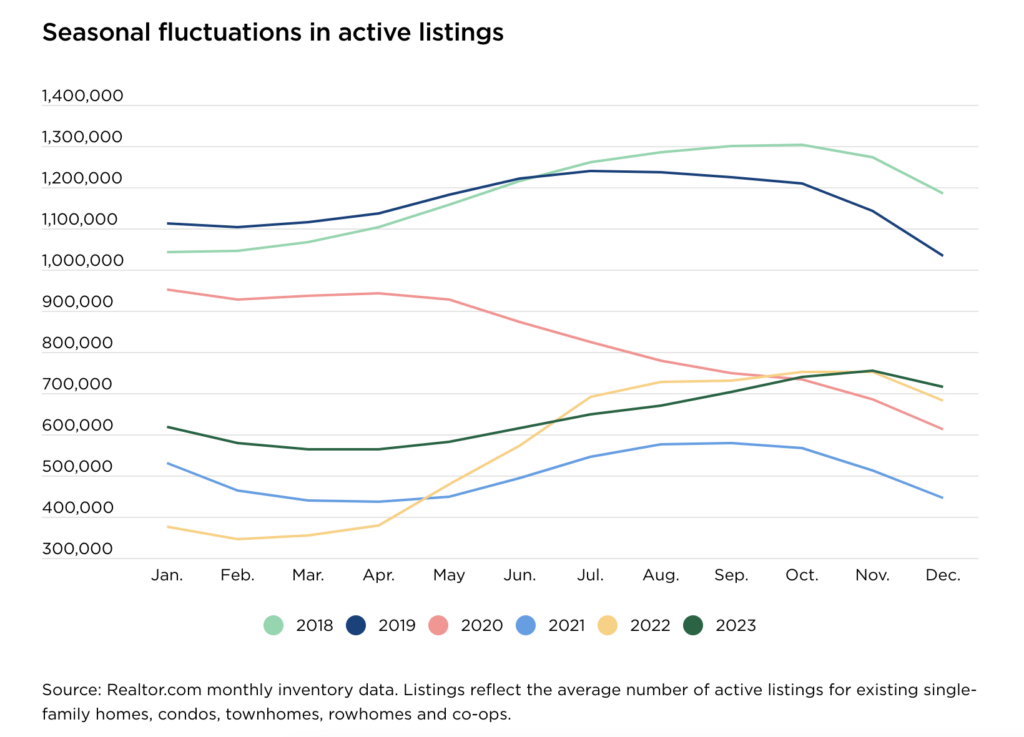

The main factor influencing home prices is inventory. Despite an increase of 15% from Q1 of last year, the share of homes listed for sale remains quite small. Buyers in this market may need to make concessions above and beyond a high asking price because they might not find a place that fulfills all or even the majority of their wish list.

For buyers who are thinking about waiting out high rates, that may not be practical. The most recent forecasts for mortgage rates indicate that while rates may decline by the end of 2024, they won’t likely fall below 6%. The affordability of monthly mortgage payments might also be significantly impacted by somewhat lower rates and a greater down payment.

To read the full report, including more data, charts, and methodology, click here.