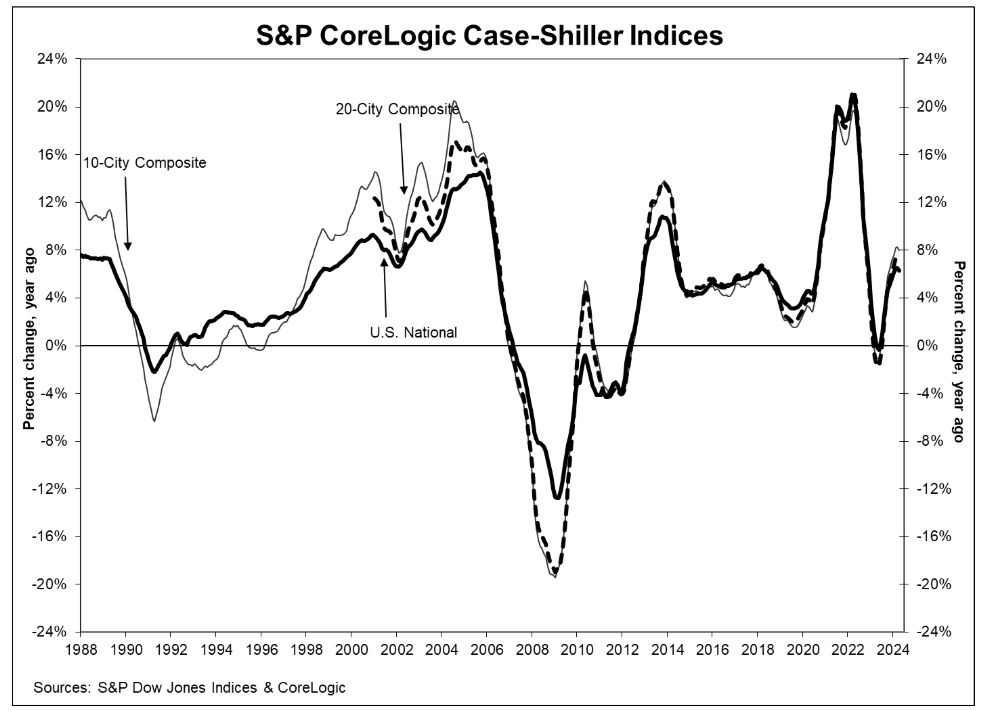

Originally benchmarked to a level of 100 January 2000, the S&P CoreLogic Case-Shiller Index has reached an all-time high of 320.42 which represents a continuous and steady push of ever-rising home prices on a monthly and yearly basis.

Put another way, the U.S. National Index, the 20-City Composite, and the 10-City Composite upward trends decelerated from last month, with pre-seasonality adjustment increases of 1.2%, 1.36% and 1.38%, respectively. After seasonal adjustment, the U.S. National Index and 10-City Composite posted the same month-over-month increase of 0.3% and 0.5% respectively as last month, while the 20-City reported a monthly increase of 0.4%.

“For the second consecutive month, we’ve seen our National Index jump at least 1% over its previous all-time high,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “2024 is closely tracking the strong start observed last year, where March and April posted the largest rise seen prior to a slowdown in the summer and fall. Heading into summer, the market is at an all-time high, once again testing its resilience against the historically more active time of the year.”

“Thirteen markets are currently at all-time highs and San Diego reigns supreme once again, topping annual returns for the last six months. The Northeast is the best performing market for the previous nine months, with New York rising 9.4% annually. Sustained outperformance of the Northeast market was last observed in 2011. For the decade that followed, the West and the South held the top posts for performance. It’s now been over a year since we’ve seen the top region come from the South or the West.”

“Last month’s all-time high came with all 20 markets accelerating price gains. This month, just over half of our markets are seeing prices accelerate on a monthly basis. At 6.3% annual gains, the index has decelerated from the start of the year, with only two markets rising on an annual basis.”

Outside commentary

S&P CoreLogic Case-Shiller Home Price Index commentary from Realtor.com Chief Economist Danielle Hale gave more insights into April’s record high:

“The latest S&P CoreLogic Case-Shiller Index showed home sales prices continued to climb higher through April, hitting a new high, even as the pace of growth slowed. The national composite rose 6.3% from a year ago in April after rising 6.5% in March, while the 10- and 20-city indexes rose by 8.0% and 7.2%, respectively, each 0.3 percentage points slower than the prior month’s annual pace.”

“This month’s indexes cover home sales in February, March, and April, in what is typically a seasonal ramp-up period for the housing market. In 2024, an inflation-driven surge in mortgage rates from 6.6% to 7.2%, with ups and downs along the way, cut into home sales, dampening the uptick. In fact, existing home sales slipped from a seasonally adjusted annual rate of nearly 4.4 million in February to a pace of just over 4.1 million in April.”

“Despite the slower pace of sales activity, home sellers were somewhat more willing to engage with the market. Newly listed homes rose between 11.3% and 15.5% above prior year pace between February and April, helping contribute to the 14.8% to 30.4% growth in active inventory in the housing market in this period. While the improvement in options compared to a year ago was certainly welcomed by buyers, April home inventory remained nearly 36% lower than pre-pandemic levels.”

“Regionally, home prices are showing more differentiated performance, San Diego was again the fastest growth market, where prices were up 10.3% from a year ago. New York (+9.4%) and Chicago (+8.7%) were close behind, with high single-digit price growth. Markets seeing slower home price growth were in the West, with Portland (+1.7%), Denver (+2.0%), and Minneapolis (+2.9%) seeing the most moderate gains among the 20 markets reviewed. This mirrors recent rental trends in Realtor.com data, where markets in the Northeast and Midwest are seeing bigger upticks, reflecting local economics and broader supply and demand dynamics.”

Click here to access a PDF of the original report.