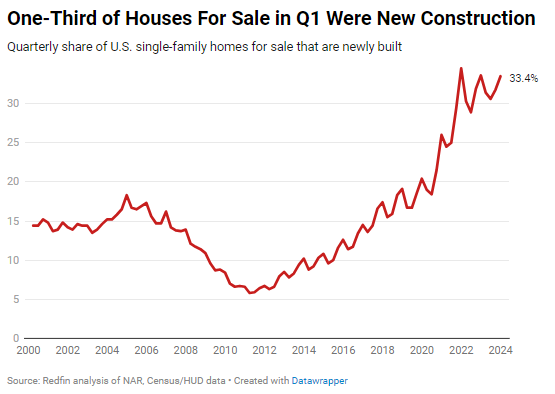

In the U.S., approximately one-third (33.4%) of single-family houses listed for sale in the first quarter were recently constructed; this percentage is down from a record-high 34.5% two years earlier but largely unchanged from a year earlier—according to Redfin.

The percentage of newly constructed homes in the market is still over twice that of pre-pandemic levels. Since the global homebuying boom put builders into overdrive, newly constructed homes have accounted for a large portion of inventory. The two primary drivers of this are:

- Simply put, the number of homes built has surged. At the beginning of the pandemic, construction of homes in the U.S. soared as builders catered to the unprecedented demand for homes due to remote employment and extremely low mortgage rates. As a result, single-family housing starts remain much greater than they were prior to 2020.

- There are fewer existing homes available for purchase. Because mortgage rates reached a two-decade high last year and are still significantly higher than pre-pandemic and pandemic levels, homeowners are choosing to remain in their homes. Rather than moving and taking on a new rate, a lot of prospective sellers are choosing to hold onto their existing one.

“We have a fair amount of new-construction homes for sale, and thank goodness we do,” said Nicole Dege, a Redfin Premier agent in Orlando, FL. “Buyers are having a hard time finding single-family homes in their budget because not many homeowners are letting go of their houses, and those who are listing tend to price high because they haven’t come to terms with the fact that prices have come down from their 2022 peak. Builders have a better understanding of the current market, so they’re pricing fairly, offering mortgage-rate buydowns and providing other concessions to attract buyers.”

Since more homeowners are listing their existing homes, the overall inventory has slowly increased from the historic lows of last year, which has resulted in a minor decline in the share of newly built supply for sale from its 2022 peak.

Due to low demand and high mortgage rates, builders have also somewhat “loosened off” on housing starts at the same time. Numerous of them are currently attempting to sell the excess of houses they began building in 2021 and 2022: In March, there were 8.3 months’ worth of new homes available nationally, compared to 3.2 months’ worth of existing homes.

To read the full report, including more data, charts, and methodology, click here.