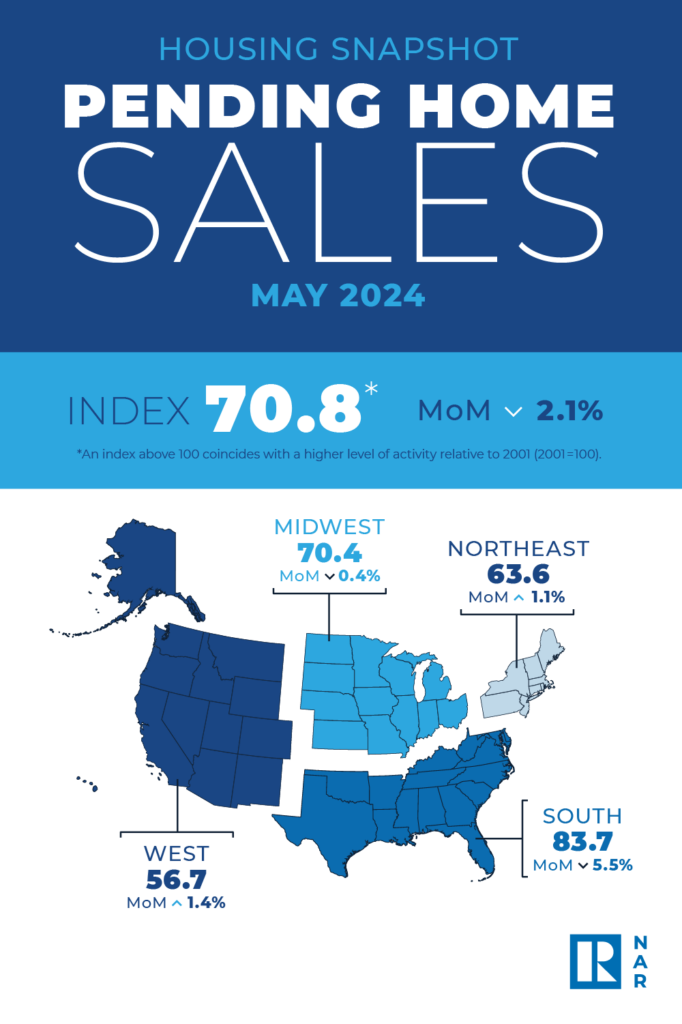

May saw a 2.1% decline in pending home sales, according to the National Association of REALTORS. While the Northeast and West saw advances in transactions each month, the Midwest and South reported losses. Per the report, every U.S. region had decreases over the previous year.

Indicator of prospective home sales based on contract signings, the Pending Home Sales Index (PHSI) dropped to 70.8 in May. Pending transactions were down 6.6% from the previous year. The level of contract activity in 2001 is represented by an index of 100.

“May’s pending home sales slid 2.1% month-over-month, not just falling below forecasters’ hopes but hitting an all-time low since the NAR began collecting this data in 2001,” said Kate Wood, Home & Mortgage Expert at NerdWallet. “A continued dearth of inventory, high home prices and stable mortgage interest rates have kept would-be home buyers at bay this spring.”

U.S. Economic Forecast

NAR projects that even with the Federal Reserve’s reduction in the Fed Funds rate, mortgage rates will still be higher than 6% in 2024 and 2025. According to the association, existing-home sales will increase from 4.09 million in 2023 to 4.26 million in 2024 and from 2024 to 4.92 million in 2025. The number of housing starts is predicted to increase from 1.413 million in 2023 to 1.382 million in 2024 and from 2024 to 1.492 million in 2025.

According to NAR, the median price of an existing home will rise from $389,800 in 2023 to a record high of $405,300 in 2024 and from 2024 to $412,000 in 2025. The median new house price is expected to rise from $428,600 in 2023 to $434,100 in 2024 and from 2024 to $441,200 in 2025, according to NAR projections.

“The market is at an interesting point with rising inventory and lower demand,” said Lawrence Yun, NAR Chief Economist. “Supply and demand movements suggest easing home price appreciation in upcoming months. Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.”

May Pending Home Sales Slips, but June Mortgage Rate Dip Hints at Modest Summer Rebound

“Pending sales are a forward-looking indicator of home sales based on contract signings, so two consecutive months of declining pending home sales suggest a negative outlook for sales activity,” said Odeta Kushi, Deputy Chief Economist at First American. “However, these declines occurred when mortgage rates were rising in April and May. With rates moderating in June, purchase mortgage applications indicate that rate-sensitive buyers are hesitantly responding. If mortgage rates continue their descent alongside rising inventory levels, some buyers may be enticed off the sidelines and boost the summer home-buying season. Nevertheless, a robust summer recovery is unlikely given ongoing affordability constraints.”

The Northeast PHSI decreased 2.3% from May 2023 to 63.6, an increase of 1.1% from the previous month. In May, the Midwest index fell 0.4% to 70.4, a 5.6% decrease from the previous year.

In May, the South PHSI dropped 5.5% to 83.7, a 10.4% decrease from the previous year. May had a 1.4% increase in the West index, which was down 2.1% from May 2023 to 56.7.

“The first half of the year did not meet expectations regarding home sales but exceeded expectations related to home prices,” Yun said. “In the second half of 2024, look for moderately lower mortgage rates, higher home sales and stabilizing home prices.”

To read the full report, including more data, charts, and methodology click here.