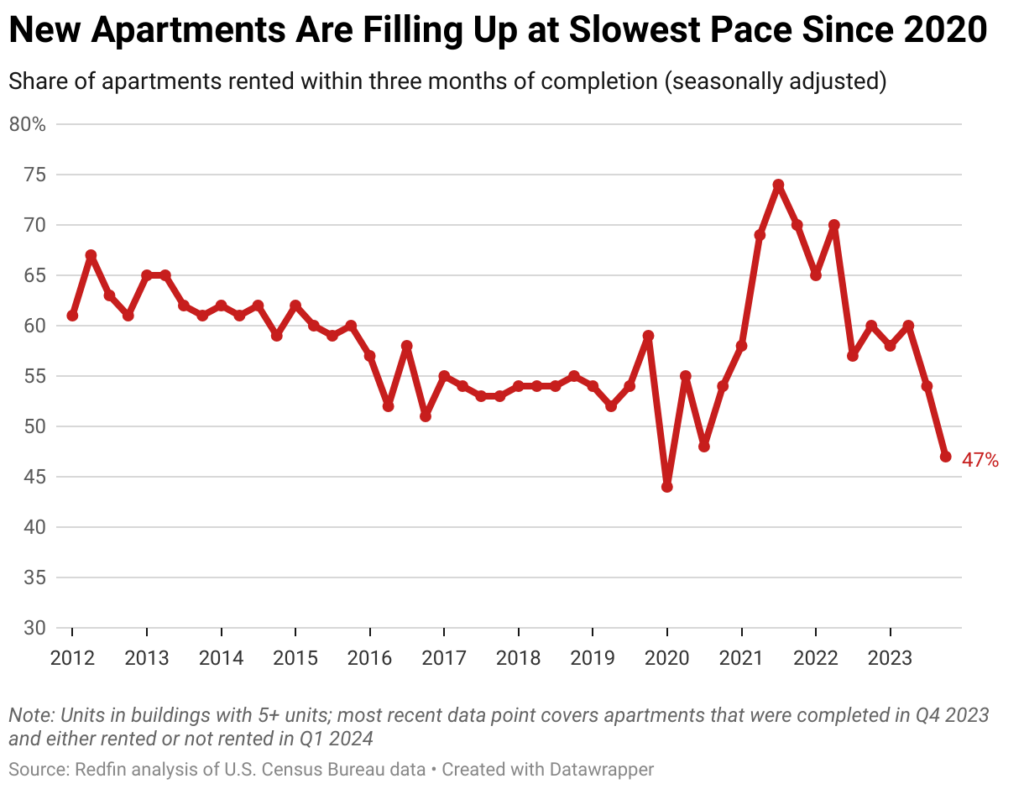

According to a new Redfin study, less than half—roughly 47%—of newly built apartments that were finished in Q4 were rented within three months. This is the lowest seasonally-adjusted percentage ever recorded, excluding Q1 of 2020 when the pandemic’s start completely shut down the housing market. It was 60% a year earlier.

Because there are so many new apartments available, building owners are in competition with one another to attract tenants, which is causing the rental period for existing flats to extend. The fourth quarter saw the completion of 90,260 new units, which is the second-highest total in records going back to 2012. The greatest amount was recorded in Q2 of 2023.

The rental vacancy rate has been steady at 6.6% over the last three quarters. Though it’s important to note that the vacancy rate is no longer rising as it was during the epidemic, that is the highest level since 2021.

Apartment developers have put a stop to the number of projects they are initiating; multifamily building starts are below their 10-year historical average. However, because so many construction projects were started during the pandemic moving frenzy and are only now coming to an end, completions are still close to their record high.

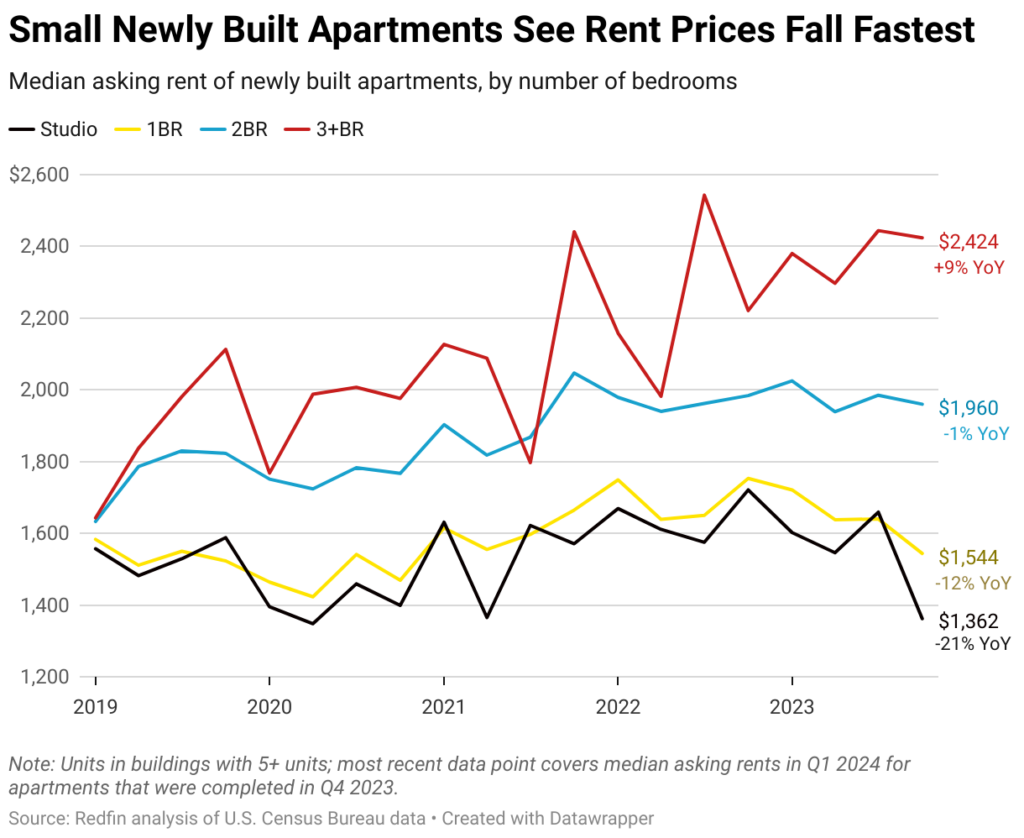

Small, Newly Built Units See the Largest Rent Drops Due to Surging Supply

Note: This section covers median asking rents in the first quarter of 2024 for apartments that were completed in the fourth quarter of 2023.

The most recent quarter for which we have asking rent data broken down by number of bedrooms was the first quarter, when the median asking rent for newly constructed studio apartments decreased by 20.9% year-over-year. In the meantime, there was a 1.2% decrease in new two-bedroom apartments and an 11.9% loss in new one-bedroom flats. However, the median asking rent for brand-new three-plus-bedroom apartments increased by 9.1%, suggesting that these units are in high demand.

Since there is a growing supply of small apartments in America, rent declines in this area of the market have probably been the greatest. In contrast to the 22.2% increase for one-bedroom apartments, the 2.3% increase for two-bedroom apartments, and the 0.9% reduction for three-plus-bedroom apartments, the number of finished studio apartments increased by 32.6% during Q4 of last year. In the U.S., the majority of apartment developers steer clear of targeting families in favor of accommodating singles.

Building Owners Limited When Increasing Rent Prices

The amount that rent rates can increase is being restrained by this backlog of new apartments. However, demand from tenants who are unable to afford to buy a property of their own is maintaining rents close to record high levels.

A separate Redfin report indicated that the median asking rent for an apartment in the U.S. increased by 0.8% annually in May 2024, reaching its highest point since October 2022. The median priced apartment today requires a tenant to make $66,120, which is $11,408 more than what we think the average renter in the U.S. makes. However, the affordability of rentals varies significantly throughout markets.

“If you’re looking for a rental and you’ve noticed a lot of new apartments popping up in your neighborhood, it may mean you have room to negotiate on price or ask for concessions like discounted parking or a free month’s rent,” said Sheharyar Bokhari, Senior Economist at Redfin. “But if you live in an area where the supply of new apartments is limited, deals may be harder to come by. Building more housing is a tried and true way to ease the housing affordability crisis, and with rent and home prices at historic highs, local and federal leaders should continue to encourage more construction.”

To read the full report, including more data, charts, and methodology, click here.