According to Apartment List, single-family homes account for the majority of the country’s housing stock—some two-thirds by their numbers—and are occupied by the families that own them. But a now sizeable share of single-family homes are purpose-built single-family rentals according to recent construction data.

Sixteen percent (16.6%) of single-family homes are now rented or leased, which has been driven by a strong demand for single-family housing, but a lack of affordable homeownership opportunities. This comes as home prices have roughly doubled over the past 10 years and two-thirds of that growth has occurred in the last four years.

Compounding this trend are high interest rates that further amplify the long-term costs of owning a home. So, for many households that want to live the single-family lifestyle, renting is the only financially viable option.

According to Apartment List, single-family rentals are typically operated by a mom-and-pop landlord or a small institutional investor. But the new model that is becoming increasingly common is the “built-for-rent” (BFR) community: a large-scale development of single-family homes that are designed for renter occupancy from the start. BFRs borrow some features of multifamily housing, like professional leasing offices, on-site property management, and community amenities, and are marketed as a middle-ground between renting and homeownership.

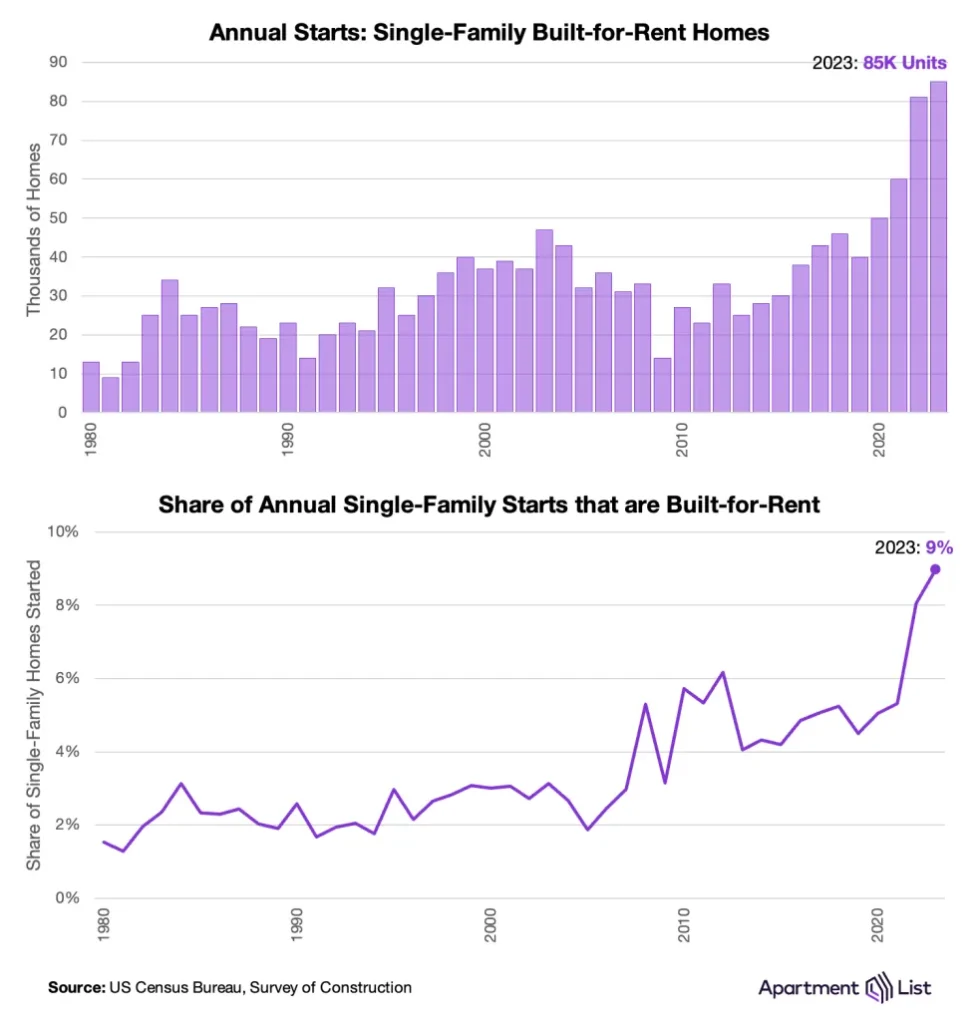

And according to the Census Bureau’s Survey of Construction, BFR development is booming. In 2023 alone, construction started on 85,000 BFR single-family homes, a three-fold increase over the past decade. This accounted for 9% of all single-family starts that year, again an all-time high. Even as top-line home construction has cooled since 2021, built-for-rent construction has continued accelerating.

A large share of renters already live in single-family homes

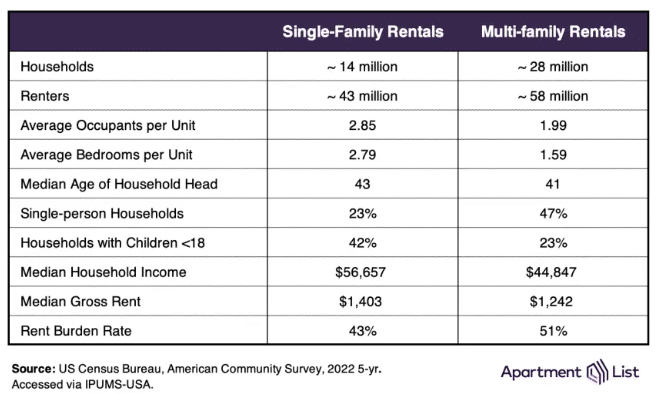

While the purpose-built single-family rental home is in itself a small but growing trend, the broader single-family rental market is quite established. Already there are 43 million Americans living in rented single-family homes, representing over 40% of all renters across the country. An additional 58 million renters live in multi-family rentals (i.e., apartments), and unsurprisingly, the two groups have different geographic and demographic profiles. This is highlighted in the table below, which summarizes data from the Census Bureau’s American Community Survey in 2022.

Apartment List further said that single-family homes are associated with suburban living, while apartments tend to be concentrated in denser metropolitan regions. So as one might expect, the average single-family rental offers more living space (2.8 bedrooms compared to 1.6) and has larger households (2.9 people compared to 2.0). Single-family households are older and include more school-age children, while apartments are more likely to be rented by an individual living alone.

Owing to their larger size, the median rent for a single-family home is 13% higher than an apartment. But this is more than offset by household incomes, which are 26% higher for single-family renters. Rent burden rates—the share of households spending more than the recommended 30% of income on rent—are therefore much lower for single-family households. In this way, single-family rentals are attractive for families as they move up the income ladder, have children, and want more physical space. But the financial gap between renting and owning is still wide; the median household income for single-family renters still trails those of homeowners by a wide margin ($56,657 compared to $93,531).

What does this mean for the future of housing accessibility and affordability?

According to Apartment List, experts are spilt on the long-term effects of this trend. Some say that single-family rentals allow for greater financial flexibility and access to residential neighborhoods, and that the market is simply responding to a consumer need due to demographic shifts from boomers to the latest generations.

On the other hand, others say that the institutional investors that fund these projects, lock out families from buying starter homes in desirable areas, and give their rent money to fund the equity of corporations instead of the tenant themselves. Further, large-scale investor involvement in the single-family sector remains nascent and will surely draw the attention of policymakers in coming years as housing affordability remains a top-of-mind issue for many American households.

Click here to view the report in its entirety, including interactive maps and charts.