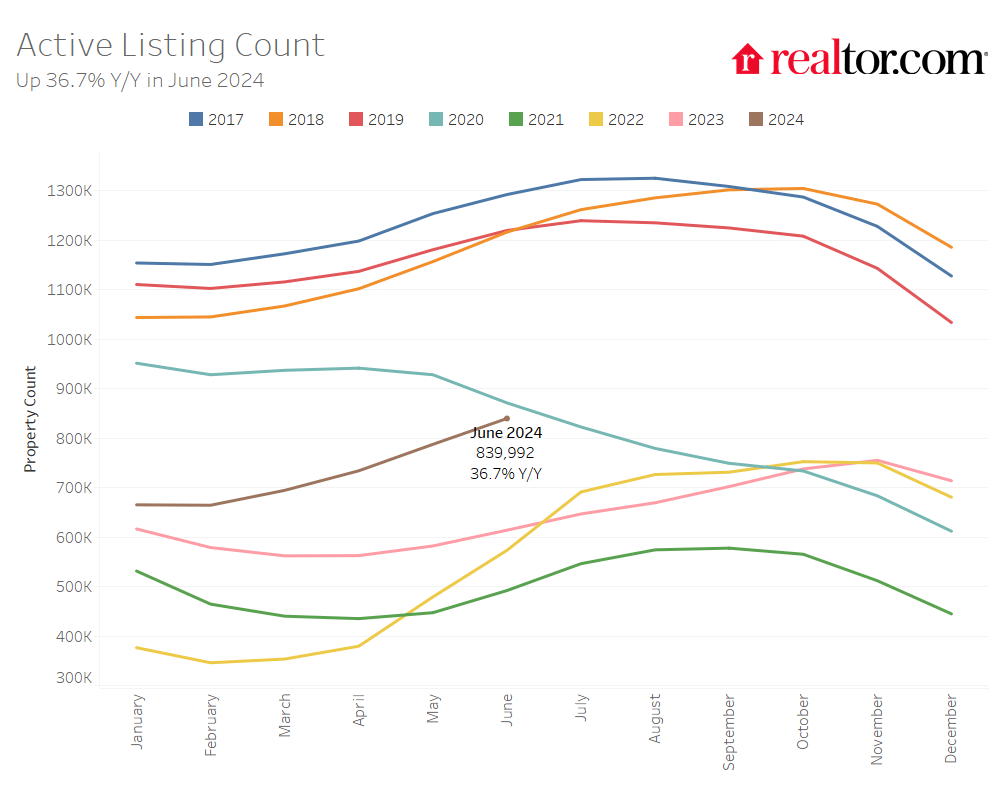

The number of homes currently for sale increased for an eighth consecutive month in June, rising by 36.7% year-over-year, according to Realtor.com June housing data. The median home also spent 45 days on the market, an increase of two days over the previous year. The market is trending slightly in the direction of becoming more buyer-friendly thanks to these factors.

“While the quantity of homes on the market still trails pre-pandemic levels, home buyers are seeing more options to choose from as inventory increases,” said Danielle Hale, Chief Economist for Realtor.com. “The combination of more for-sale homes and longer time on the market is beneficial for home shoppers as they have more selection and don’t need to feel as rushed in picking a place to call home. Whether this translates into more home sales will likely hinge on how mortgage rates impact affordability in the second half of the year.”

June 2024 Housing Metrics – National

Median list price per sq.ft:

- Change over June 2023: (+3.4%)

- Change over June 2019: (+52.6)

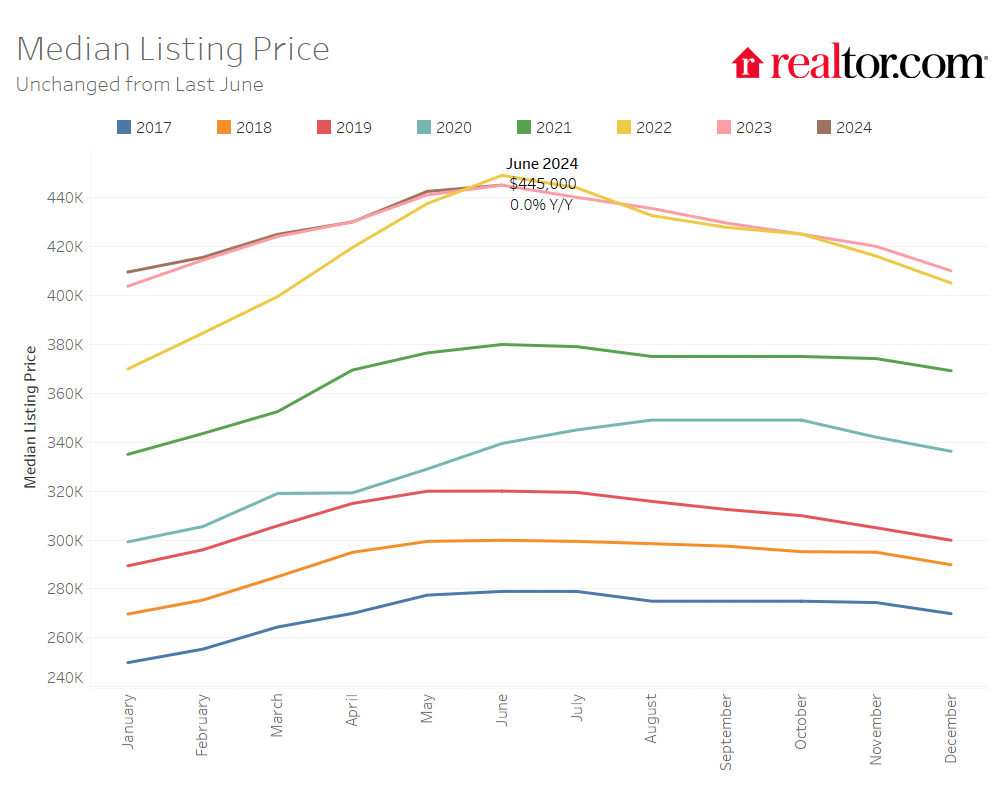

Median listing price:

- (+0.0% to $445,000)

- (+39.1%)

Active listings:

- (+36.7 %)

- (-31.1%)

New listings:

- (+6.3%)

- (-24.4%)

Median days on market:

- (+2 days to 45 days)

- (-8 days)

Share of active listings with price reductions:

- (+4.2 percentage points to 18.3%)

- (+1.3 percentage points)

The South and West Lead the Way for Rising Inventory

All four regions had increases in inventory compared to the prior year, although the West and the South witnessed the most rise, with increases of 36.5% and 48.7%, respectively. Northeast (11.8%) and Midwest (21%) trailed behind. A large portion of the country’s inventory levels are still significantly lower than those from typical 2017–2019 as compared to pre-pandemic levels, with the exception of a few Southern metro areas: Austin, Texas (+41.3%), San Antonio (+24.1%), and Memphis, TN (+22.3%).

“Despite some slightly more buyer-friendly signs, sellers are still engaged and more homes are being listed compared to a year ago,” said Ralph McLaughlin, Senior Economist at Realtor.com. “While sellers are responding to market signals by cutting prices more frequently, data suggests they aren’t calling it quits and pulling their homes off of the market. Despite these cuts, price growth is hanging around at high enough rates to keep sellers in the game.”

List prices also rose in the West, Northeast, and Midwest but fell in the South. List prices in the Northeast (+5.9%), Midwest (3%), and West (+1.3%) are increasing in comparison to June 2023. The largest rises in large metro areas were seen in the median list prices of Cleveland (+15.7%), Philadelphia (+12.8%), and Providence, RI (+9.0%). Prices for homebuyers in the South, however, decreased 1.9% from this time last year; this is good news for the area where inventory has increased the most, giving buyers additional alternatives while also restraining price increases.

Homes Spending More (Too Much?) Time on Market

The average home was on the market for 45 days in June 2024, which is two days longer than it was in the same month the previous year, one day longer than it was in May 2024, and the third consecutive month that this has happened. Despite the West being extremely close, where properties are spending only one day fewer on the market compared with the normal June from 2017 to 2019, other regions are still experiencing time on the market below pre-pandemic levels in light of this increase.

In comparison to pre-pandemic levels, time on the market was still much shorter in the remaining regions, such as the Northeast (15 days), the Midwest (10 days), and the South (8 days).

Meanwhile, when compared to homes posted prior to the pandemic, all 50 major metro regions have seen significant price increases. In the top 50 metro areas, the price per square foot growth rate varied from 24.4% to 81.9% when compared to June 2019. The markets where sellers saw the biggest increases in price per square foot were Tampa, FL (+67.7%), Boston (+67.7%), and the New York metro area (+81.9% vs. June 2019). The three markets with the lowest returns were New Orleans (+25.5%), Baltimore (+24.6%), and San Jose, CA (+24.4%).

In the South (+5.1 percentage points), West (+4.5 percentage points), Midwest (+2.6 percentage points), and Northeast (+2.1 percentage points), the share of price decreases was higher than it was the previous year. The percentage of price reductions increased to 47 out of the 50 largest metro areas from 46 in May to a higher percentage of 37 in June of previous year. The three cities with the biggest increases were Denver (+9.7 percentage points), Jacksonville, FL (+9.7 percentage points), and Tampa, FL (+10.9 percentage points).

To read the full report, including more data, charts, and methodology, click here.