However, over a third of Americans are in financial distress, according to LendingTree‘s 2024 Household Financial Insecurity Report.

We looked into the challenges Americans face in covering typical household expenses, such as food, housing, and medicine, using data from the U.S. Census Bureau Household Pulse Survey. We discovered that financial insecurity has increased 6.7% since 2022, and it has increased to 25.0% among the youngest demographic (18 to 24).

Key Findings

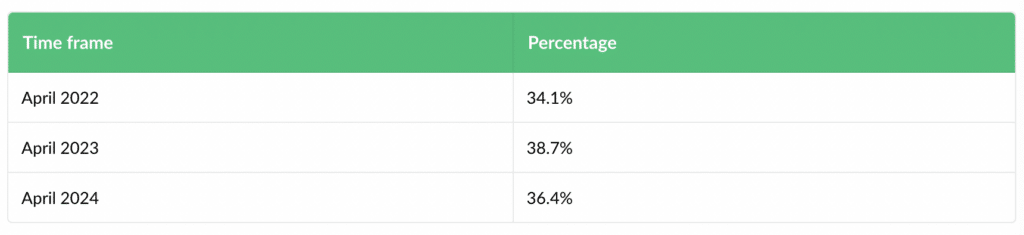

- More than 1 in 3 American households are financially insecure in 2024. 36.4% of households reported in April that they had a somewhat or very difficult time paying their usual household expenses in the past week. That’s up 6.7% from 34.1% during the same period in 2022.

- Changes in household financial insecurity decrease with age. Americans ages 18 to 24 saw the biggest increase (25.0%) in difficulty paying expenses between 2022 and 2024, but that lowered with each age range examined. In fact, Americans 65 and older saw a 4.1% decrease in difficulty in this period.

- 31 states have seen an increase in difficulty paying household expenses. Between 2022 and 2024, three Western states — Washington (41.6%), Wyoming (33.4%) and Montana (30.7%) — saw the most dramatic increases in difficulty.

- Three different states report the highest financial insecurity in 2024. More than 4 in 10 households in Alabama (43.9%), Mississippi (43.6%) and Nevada (42.2%) reported difficulties in April 2024. Only D.C. reported that less than 1 in 4 households (24.9%) said the same.

According to data from April 2024, 36.4% of Americans said they were having a lot of trouble making ends meet. This includes “food, rent or mortgage, car payments, medical expenses, student loans and so on,” according to the Household Pulse Survey. Comparing that to the 34.1% who reported the same difficulty in 2022, it is 6.7% greater.

“It’s troubling that 1 in 3 American households are financially insecure,” says LendingTree chief credit analyst Matt Schulz, “but it shouldn’t be terribly surprising. The perfect storm of record debt, sky-high interest rates and stubborn inflation has resulted in many Americans’ financial margin of error shrinking to virtually zero.”

Percent of Households Having Difficulty Paying Typical Household Expenses

It’s interesting to note that the most recent number is marginally lower than the 38.7% of households who reported financial insecurity in 2023. This could imply that some households have managed to bounce back in spite of the ongoing problems with inflation and high interest rates. (The median weekly earnings of full-time, salaried employees increased from $1,059 in 2022 to $1,117 in 2023, according to the Bureau of Labor Statistics, or BLS.)

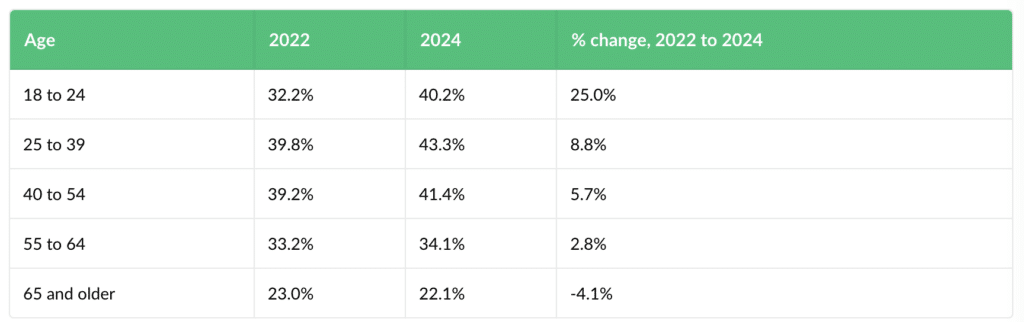

Changes in Household Financial Insecurity to Decrease With Age

Despite the fact that significant degrees of financial instability affect every age group under study, there is a negative correlation between age and rises between 2022 and 2024. Americans who are 18 to 24 years old reported a 25.0% rise in trouble making ends meet, while those who are 25 to 39 years old reported a very modest gain of 8.8%.

The pattern persisted: between those two years, financial instability increased by 5.7% for Americans aged 40 to 54 and by 2.8% for those aged 55 to 64. Those 65 and older, the final study group, experienced a 4.1% drop in financial insecurity throughout that time.

Experience in the workplace typically comes with growing older, and this can lead to more lucrative prospects as well as improved cash flow and stability. Younger Americans may also still be adjusting to life without parental assistance. When combined with the current economic downturn, that might make achieving independence challenging.

Even yet, the general trend is concerning, since over one-third of all age groups—aside from the oldest—report significant challenges meeting their normal expenses. The percentage rises to 43.3% among those between the ages of 25 and 39, alarmingly close to half.

Percent of U.S. Households Having Difficulty Paying Usual Household Expenses — By Age

Additionally, other demographics were examined. Over the course of the two-year study period, gains were similar for men (7.2%) and women (6.1%). In general, nevertheless, women (38.6%) are still more likely than men (34.0%) to be financially insecure.

Given the growing expense of raising a child in America, it should come as no surprise that households with children under the age of 18 (44.3%) are far more likely than those without children (32.1%) to suffer financial insecurity in 2024. Over the two study years, they also saw a marginally more pronounced increase (8.8% versus 5.9%).

Positive news: between 2022 and 2024, Black Americans’ financial instability decreased significantly, by 12.1%. Sadly, unfortunately, they were the only race that was the subject of study to notice this pattern. Over the course of the two years, Asian American households experienced the largest increase in financial insecurity at 16.5%, followed by Hispanic or Latino households at 9.2% and White households at 8.9%.

31 States See Increase in Difficulty Paying Household Expenses

In general, between 2022 and 2024, financial insecurity increased in most U.S. states, with the West leading the way. Washington had the highest rate of rise in bill payment difficulties among the 31 states that experienced it over that time period (41.6%), followed by Wyoming (33.4%) and Montana (30.7%).

While the exact causes of certain states’ extreme rises in financial instability remain unknown, rising housing costs, particularly in already expensive locations like Seattle, may have contributed to Washington’s sharp rise in financial insecurity. Seattle has the seventh-highest median monthly gross rent ($1,848) and seventh-highest median monthly housing costs ($2,638) among the 50 largest U.S. metro areas, resulting in the eighth-greatest cost differential between renting and owning.

Additionally, since a large number of professionals were able to relocate to wide-open areas following the pandemic-era transition to remote work, housing costs have skyrocketed. This may be the reason for some of the changes observed in places like Wyoming, Montana, and Idaho.

Conversely, certain states had a decline in financial instability within the same time frame. Louisiana is in the lead with 13.0%, followed by New Mexico (8.3%) and Maine (12.1%).

Again, it’s hard to guess why some states had these drops, but it’s important to remember that many of the states have lower-than-average cost of living, which may make it easier for households to handle inflation and other financial difficulties.

According to the Missouri Economic Research and Information Center (MERIC), Maine’s cost of living is 11.3 points more than the national average, but Louisiana and New Mexico are both among the 20 states with the lowest prices of living in the first quarter of 2024.

To read the full report, including more data, charts, and methodology, click here.