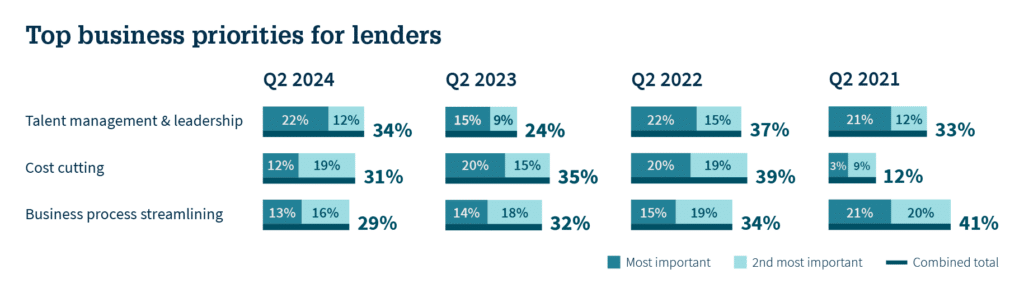

In the most recent Fannie Mae Mortgage Lender Sentiment Survey (MLSS), mortgage lenders listed “cost-cutting” and “talent management and leadership” as their two top business objectives for 2024. Lenders had stated last year that lowering costs was their top goal.

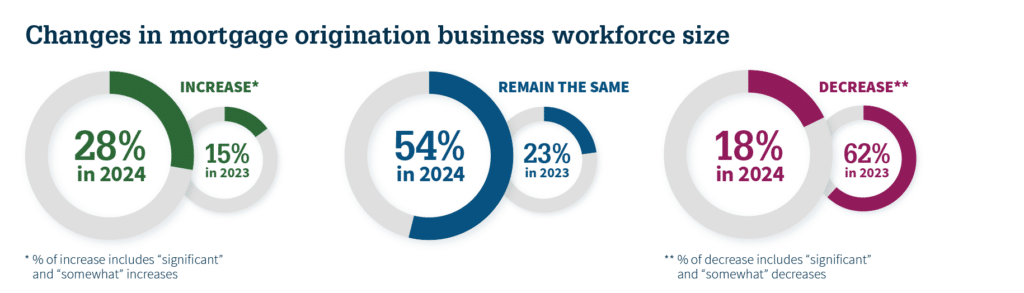

According to the most recent MLSS, almost two-thirds of respondents said they planned to reduce staff in 2023; however, very few said they expected this trend to remain until 2024. Lenders have differing opinions on how interest rates might change in the future. A third do not expect a jump in refinance activity in the near future, whereas nearly three out of five forecast a refinance boom in 2025.

Fannie Mae polled more than 200 senior mortgage executives through the MLSS to gain a better understanding of the top business goals of lenders for the next year and how they might vary from previous years in light of market developments.

Lenders listed cost-cutting and talent management as their main goals for 2024, as was previously mentioned. Since 2022, reducing costs has been one of the top three goals; however, talent management has risen to the top after coming in second the previous two years. For the first time since 2017, “business process streamlining” was once again ranked among the top three priorities, while “consumer-facing technology” fell out of the top three.

Lenders’ opinions on the US economy have greatly improved over the previous year. According to our most recent study, a majority of lenders still believe that the U.S. economy will enter a recession over the next two years, although the number is much lower (66% in 2024 compared to 93% in 2023). Lenders still see the two largest threats to industry growth—a short supply of housing and rising mortgage rates—as they did last year.

Lender forecasts were also inconsistent when it came to the possibility of a short-term refinance boom. While 33% of respondents indicated they don’t see any such boom in the near future, over 60% said they anticipated a refinance boom in 2025. Compared to mortgage banks, depository institutions were much less likely to predict a refinance boom in the near future.

Regarding labor management, about two-thirds of lenders polled stated that they would be cutting staff in 2023. Lenders portrayed a somewhat more positive image for 2024, with 54% stating that they expected no changes, 18% anticipating reductions, and 28% anticipating staff additions. Remarkably, mortgage banks reported expecting a labor force rise in 2024 more frequently than depository institutions did.

Some lenders made remarks about the challenges of attracting and keeping highly qualified employees, as well as the retiring workforce, in relation to talent management and leadership. A lot of people mentioned how crucial great leadership is for navigating market downturns.

Mortgage origination volumes decreased dramatically over the past few years as interest rates rose, especially when contrasted to their historically high levels during the epidemic. This resulted in reduced profit margins for lenders and layoffs in the mortgage sector as a whole. In actuality, job growth in the mortgage sector is at its lowest point since 2014. Mortgage lenders have already had net output losses for eight straight quarters on average, including the first quarter of 2024. Since Q2 2020, the average origination cost per loan has been rising rapidly, with staff making up the majority of lender expenses.

Staff sizes seem to be returning to normal following job cuts in 2023 and a general decrease in lenders’ uncertainty on the state of the economy and the mortgage market trajectory. Numerous companies continue to prioritize talent management, and a few announced intentions to grow their workforce this year. After the historically high quantities of mortgage purchases and refinancing during that era, mortgage activity most likely reached a post-pandemic floor.

Because of this, Fannie Mae believes that certain mortgage lenders are currently gearing themselves to handle an increase in mortgage originations in the event that the housing market’s gradual recovery lasts through the remainder of this year and into 2025.

To read the full report, click here.