Veros Real Estate, an enterprise risk management and collateral valuation company, has released it second quarter VeroFORECAST, which projects an average nationwide home price forecast for the forthcoming year. The most recent forecast, which is published every quarter, predicts an average appreciation rate of 3.2% year-over-year, which is a slight increase from the first quarter forecast of 2.9%.

VeroFORECAST evaluates home prices in over three hundred of the nation’s largest housing markets, and the company is committed to the data science of predicting home value based on rigorous analysis of the fundamentals and interrelationships of numerous economic, housing, and geographic variables pertaining to home values.

But despite deepening affordability concerns and a growing available inventory, home price growth remains soundly in positive territory. While rising inventory provides more options for buyers compared to that in 2023, prices remain stubbornly high. This is partly due to the limited impact of the inventory increase, considering the pre-pandemic levels. Additionally, the rise in available properties might be in less desirable categories, leaving a shortage of the most sought-after homes in many markets.

On the other side of the fence, the number of homes sold ever month has consistently been decreasing on a monthly and yearly basis. Veros attributes this to elevated mortgage rates and high home prices which are impacting affordability. This highlights a key market shift: increasing options for buyers, but continued pressure on affordability from high prices and interest rates. While demand has cooled slightly, a backlog of unmet demand, particularly among first-time buyers, remains a significant factor supporting price levels. Additionally, a robust job market with rising wages can further support price levels, even as mortgage rates remain elevated.

It is important to remember that housing markets are localized, and national trends do not necessarily translate into accurate data for specific cities and states. While some areas might see price stabilization or even slight decreases, others could remain very competitive with high prices.

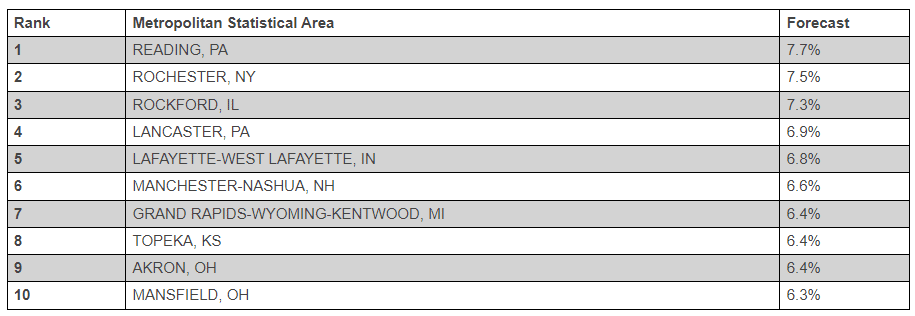

In the Northeast and Midwest home prices are rising the at the fastest quip in comparison to the West Coast and Sunbelt because of its relatively affordable housing options which are attracting first-time buyers priced out of other popular metropolitan areas.

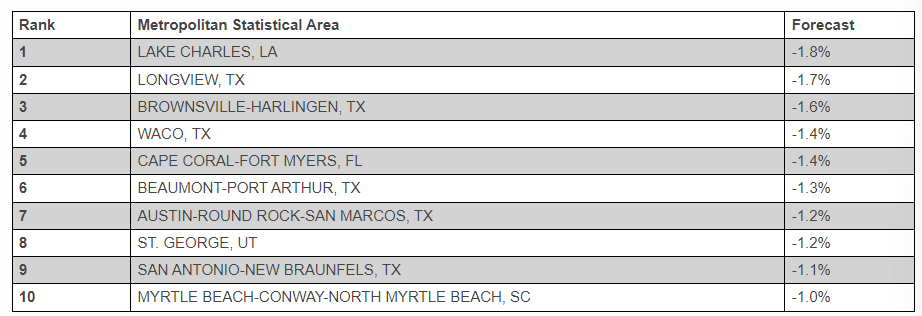

The Northeast and Midwest dominate the list of top housing markets for the next year, with projected appreciation ranging from 6.3% to 7.7%. The ten weakest housing markets are expected to see modest price declines (-1.0% to -1.8%) over the next year. These markets are diverse: some face high unemployment and struggle to attract residents, while others grapple with an oversupply of new construction dampening bidding wars. Additionally, rising property damage and insurance costs due to natural disasters in some Florida metros, coupled with potential affordability concerns in areas like Austin, are deterring buyers.

Click here for the report in its entirety.