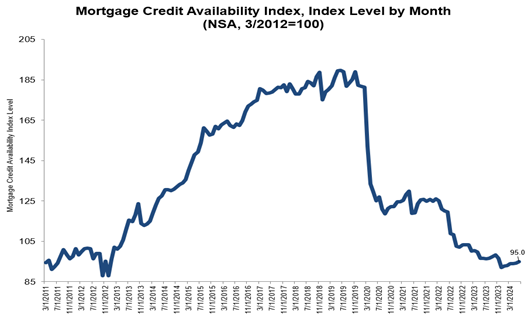

The Mortgage Credit Availability Index (MCAI), a survey from the Mortgage Bankers Association (MBA) that examines information from ICE Mortgage Technology, indicates that mortgage credit availability rose in June.

In June, the MCAI increased by 1.0% to 95.0. While increases in the index point to looser credit, a decrease in the MCAI suggests tighter lending requirements. In March 2012, the index was benchmarked at 100. While the Government MCAI fell by 0.1%, the Conventional MCAI climbed by 2.0 percent. The Conforming MCAI decreased by 0.3%, while the Jumbo MCAI climbed by 3.1% among the Conventional MCAI’s component indices.

“Mortgage credit availability increased in June for the sixth consecutive month, as lenders expanded their offerings of cash-out refinance loan programs,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The recent growth in credit availability is encouraging, but the index is still hovering near 2012 lows. The jumbo index increased to its highest level since August 2022, but the conforming and government indices continue to indicate tight credit conditions, driven mainly by reduced industry capacity.”

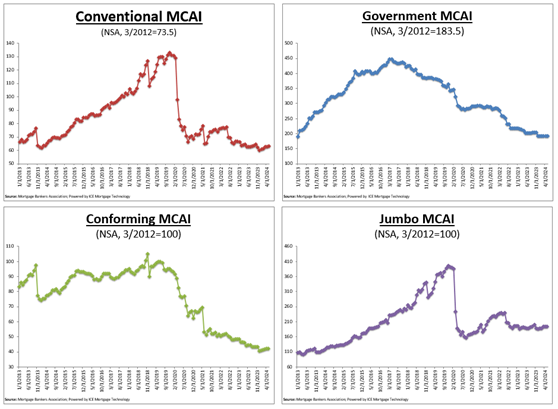

Conventional, Government, Conforming, & Jumbo MCAI Component Indices

Using the same process as the Total MCAI, the Conventional, Government, Conforming, and Jumbo MCAIs are created to display the relative credit risk and availability for each index. The population of credit programs that the Component Indices and the Total MCAI both analyze is the main distinction between them. While the Conventional MCAI looks at non-government loan programs, the Government MCAI looks into FHA, VA, and USDA loan programs.

FHA, VA, and USDA loan offerings are not included in the Jumbo and Conforming MCAIs, which are subsets of the normal MCAI. Conventional lending programs that are not subject to conforming loan restrictions are examined by the Jumbo MCAI, whereas those that are are examined by the Conforming MCAI.

While the Conventional and Government indices have modified “base levels” as of March 2012, the Conforming and Jumbo indices maintain the same “base levels” as the Total MCAI (March 2012=100). In order to more accurately depict each index’s potential range in March 2012 (the “base period”) in relation to the Total=100 benchmark, MBA calibrated the Conventional and Government indices.

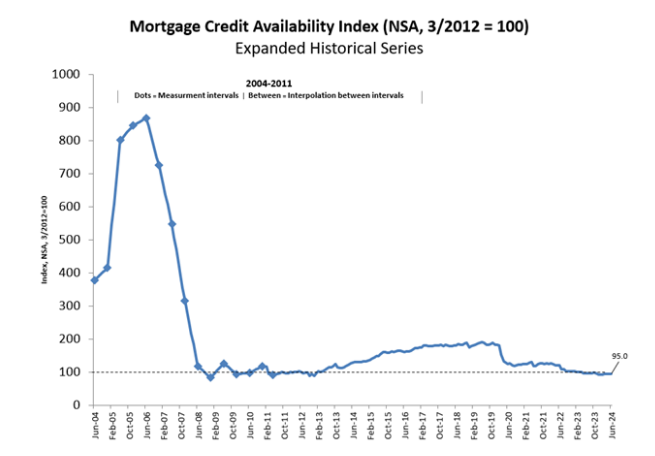

Expanded Historical Series

A longer historical series for the Total MCAI provides perspective on credit availability dating back around ten years; the expanded historical data excludes Conventional, Government, Conforming, and Jumbo MCAI. The expanded historical series, which spans 2004 to 2010, was developed to give the current series historical context by illuminating changes in loan availability during the previous ten years, including the housing crisis and recession that followed.

Less complete and less frequent data were used to construct the data previous to March 31, 2011, which were measured at 6-month intervals and interpolated for charting purposes in the months in between. The expanded historical series from 2004 to 2010 does not include updated methodology.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

To read the full report, including more data, charts, and methodology, click here.