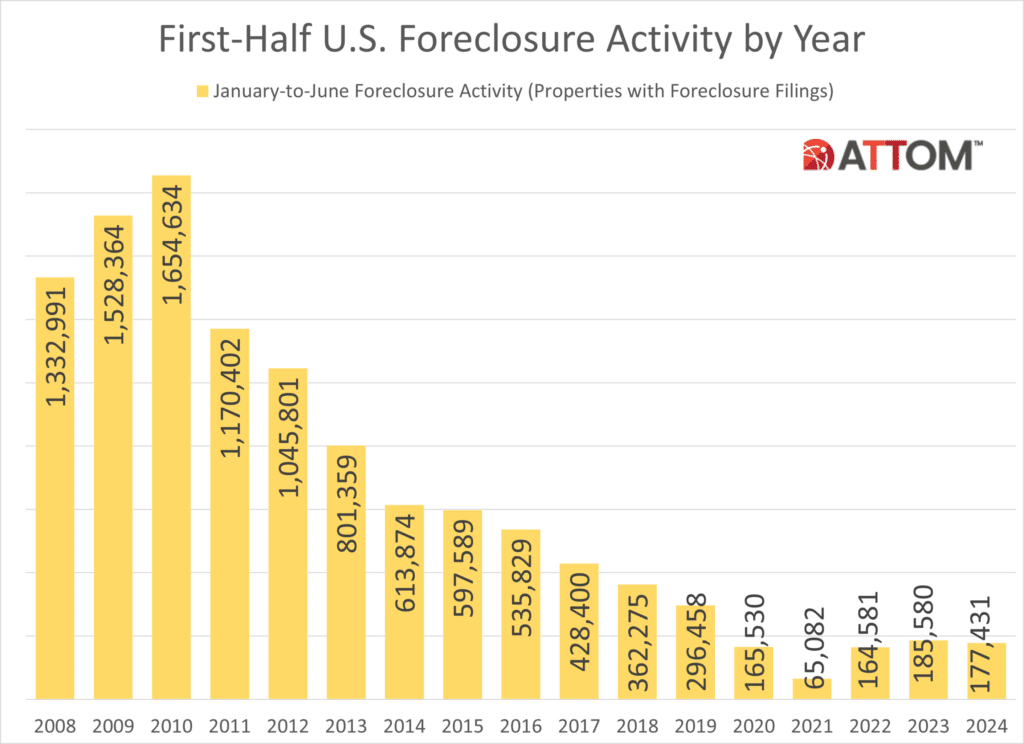

ATTOM Data has released its Midyear 2024 U.S. Foreclosure Market Report which shows that 117,431 residential properties had some sort of foreclosure filing against them—be it a default notice, an auction, or a bank repossession—during the first six months of the year.

The 117,000-some-odd adverse actions that were taken during the first half of the year is down 4.4% from the same time period last year but is up 7.8% from two years ago.

“In contrast to the first half of 2023, foreclosure activity across the United States experienced a decline in the first half of 2024,” stated Rob Barber, CEO of ATTOM. “In addition, U.S. foreclosure starts also decreased by 3% in the first six months of 2024. These shifts could suggest a potential stabilization in the housing market; however, monitoring these evolving patterns remains crucial to understanding the full impact on the real estate sector.”

States that saw the greatest increases in foreclosure activity compared to a year ago in the first half of 2024 included South Dakota (up 93%); North Dakota (up 86%); Kentucky (up 73%); Massachusetts (up 46%); and Idaho (up 30%).

New Jersey, Illinois, and Florida post highest state foreclosure rates

Nationwide, 0.13% of all housing units (one in every 794) had a foreclosure filing in the first half of 2024.

According to ATTOM, states with the highest foreclosure rates in the first half of 2024 were New Jersey (0.21% of housing units with a foreclosure filing); Illinois (0.21%); Florida (0.20%); Nevada (0.19%); and South Carolina (0.19%).

Q2 2024 foreclosure activity below pre-recession averages in 79% of major markets

ATTOM further said that there were a total of 89,466 U.S. properties with a foreclosure filings during the second quarter of 2024, down 6% from the previous quarter and down 8% from a year ago.

The national foreclosure activity total in Q2 2024 was 68% below the pre-recession average of 278,912 per quarter from Q1 2006 to Q3 2007.

Second quarter foreclosure activity was below pre-recession averages in 177 out 224 (or 79%) metropolitan statistical areas with a population of at least 200,000 and sufficient historical foreclosure data, including New York, Los Angeles, Chicago, Dallas, Houston, Miami, Atlanta, San Francisco, Riverside-San Bernardino (California), Phoenix, and Detroit.

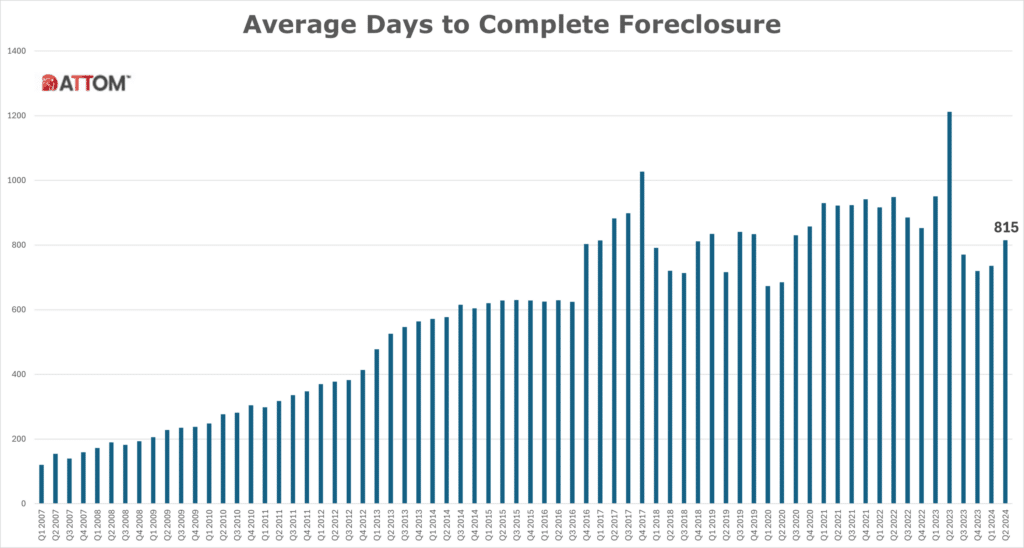

Average time to foreclose increases for second quarter in a row

Properties foreclosed in Q2 2024 had been in the foreclosure process an average of 815 days. That figure was up 11% from the previous quarter and down 33% from Q2 2023.

States with the longest average foreclosure timelines for homes foreclosed in Q2 2024 were Louisiana (3,686 days); Hawaii (2,597 days); New York (2,034 days); Georgia (1,929 days); and Nevada (1,852 days).

States with the shortest average foreclosure timelines for homes foreclosed in Q2 2024 were New Hampshire (82 days); Texas (147 days); Minnesota (151 days); Oregon (206 days); and Montana (212 days).

Other notable takeaways from the report include:

- Nationwide in June 2024, one in every 5,071 properties had a foreclosure filing.

- States with the highest foreclosure rates in June 2024 were Illinois (one in every 3,041 housing units with a foreclosure filing); New Jersey (one in every 3,042); Florida (one in every 3,202); South Carolina (one in every 3,346); and Maryland (one in every 3,486).

- 18,574 U.S. properties started the foreclosure process in June 2024, down 17% from the previous month and down 22.7% from June 2023.

- Lenders completed the foreclosure process on 2,891 U.S. properties in June 2024, up 0.4% from the previous month and down 10% from June 2023.

Click here for the report in its entirety.