According to new research from Clever Real Estate, a St. Louis-based real estate company, 60% of those in those considered to be in the Gen Z demographic (now between 7-22-years-old) worry they will never be able to afford fulfill their chances at attaining the American Dream (or owning their own home).

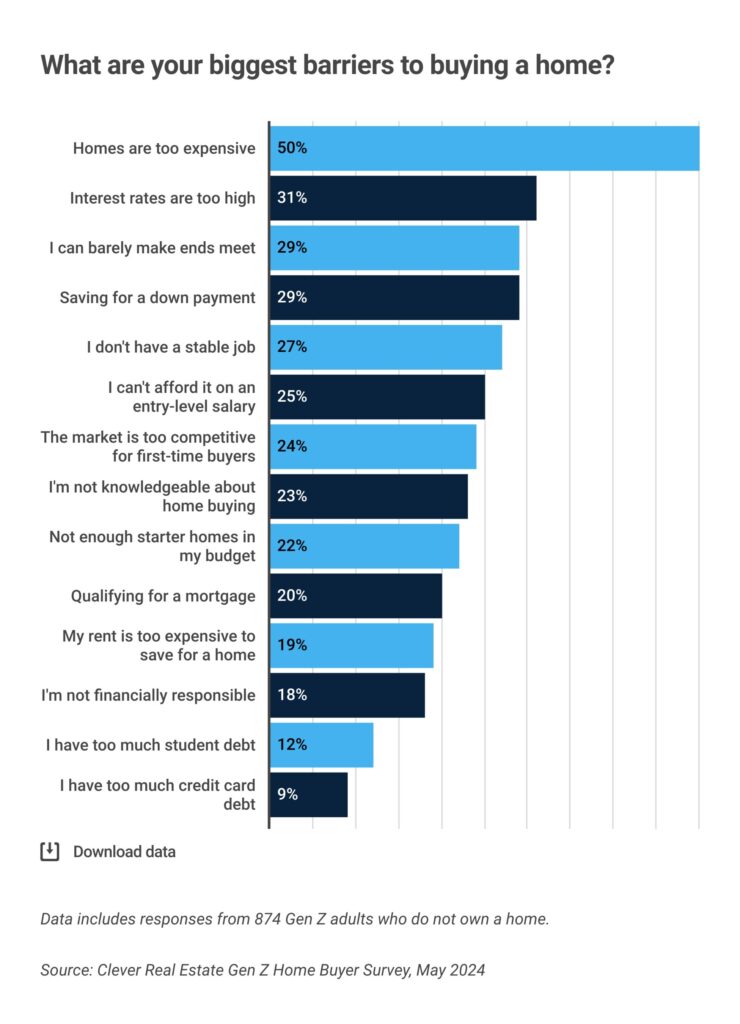

Further nearly all adult Gen Zers (98%) cite significant barriers to homeownership. Breaking that number down, 50% cite the current high cost of buying a single-family dwelling or condominium, 31% cite steep interest rates. This information comes at a time when 61% of non-homeowning respondents told interviewers that they have less than $10,000 in savings towards a home, which would only cover a standard 20% down payment on a property valued at $50,000.

Looking at more of Clever Real Estate’s findings, only 18% of prospective Gen Z buyers believe they can realistically own a home. A majority of Gen Z (52%) anticipate their first home to cost less than $250,000. Nonetheless, 29% anticipate someday owning a home worth over $1 million.

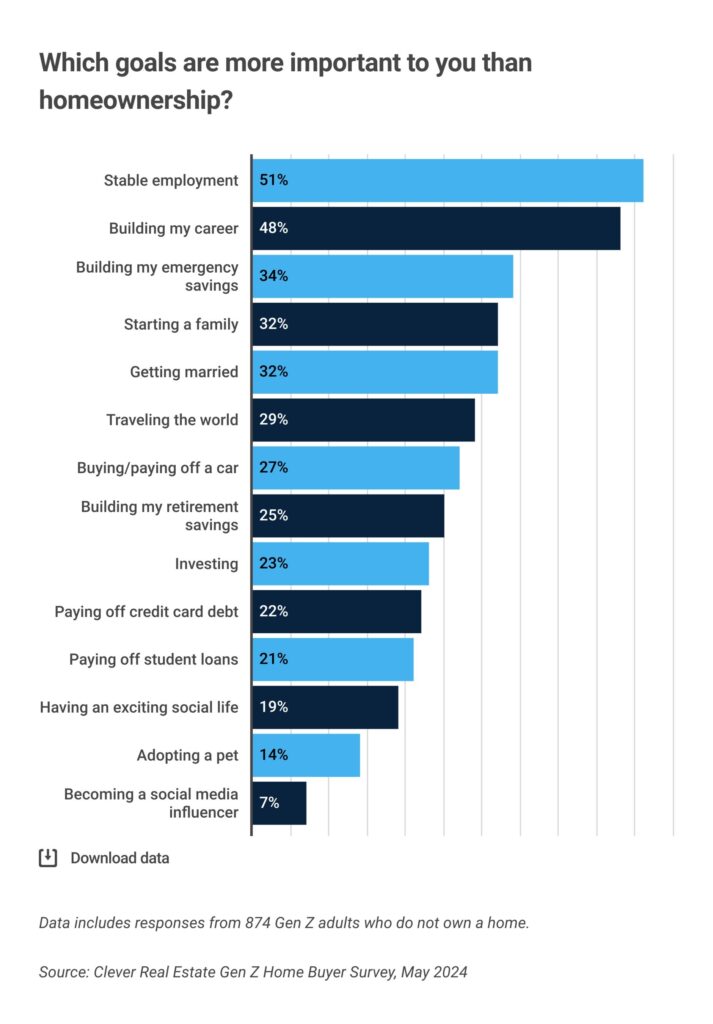

Although 92% of Gen Z say owning a home is important, a whopping 96% prioritize other goals above homeownership, such as stable employment (51%), building a career (48%), and starting a family (32%).

More than three-quarters (79%) of Gen Z homeowners don’t think the average member of their generation could afford a home. Further, 33% received parental assistance for their down payment, and 31% moved in with their parents to save for their home.

The survey also found that 1 in 3 Gen Z homeowners (33%) have struggled to pay their mortgage, and 1 in 8 (13%) regret that their mortgage is too expensive.

Unsurprisingly, two-thirds (68%) of Gen Z homeowners express regrets, with 21% saying they didn’t have sufficient knowledge about the home-buying process — and 38% admitting to obtaining home-buying information from TikTok.

Among Gen Z renters, a majority (52%) have struggled to pay rent. Nearly 1 in 5 (18%) cite financial irresponsibility as a barrier to homeownership, and 35% are concerned about qualifying for a mortgage knowing the current price of an average home.

Despite these challenges and concerns, 90% of Gen Z remain optimistic, believing they will purchase a home before the current U.S. average age of 35, with 33% expecting to own a home by age 25.

Click here for the report in its entirety.