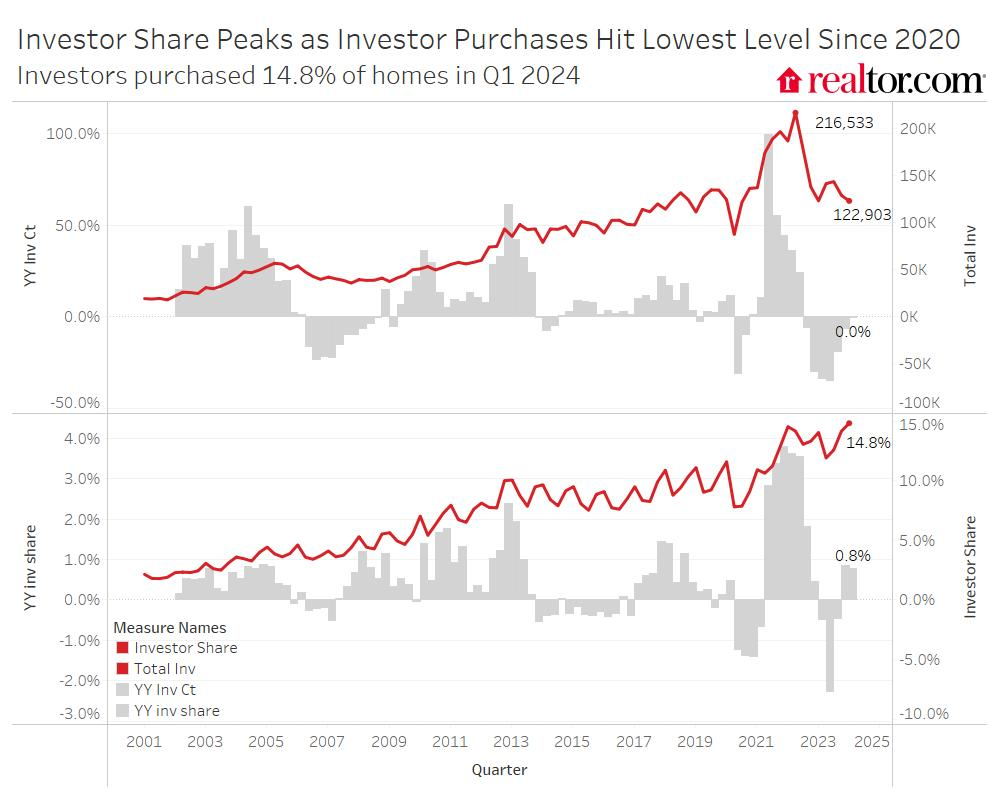

Over the past few years, investors have reduced their homebuying activity, but their activity has continued to outpace the market as a whole. Consequently, even though investors are buying fewer homes, their percentage has increased—according to a new Realtor.com study.

Investor participation in home purchases decreased from 13.8% in 2022 to 13.1% in 2023. A portion of the wind was removed from investors’ sails during the year due to rising home prices and mortgage rates. Nevertheless, compared to the history of the data (which dates back to 2001), 2023 saw the second-highest share of investor purchases.

The number of investor transactions decreased by 25.3% in 2023 compared to the previous year, surpassing the 20.4% decline in non-investor property sales, even though the share of investor buyers fell by less than 1 percentage point. Investors retreated from the property market earlier than non-investor homebuyers did as conditions worsened.

Although investor activity leveled off, home sales continued to fall in Q1 of 2024. During Q1 of 2024, investors bought the most percentage of sold homes ever—14.8%. The pie was substantially smaller even though investors took home a larger portion than in any previous quarter. Due primarily to a decrease in non-investor purchases, overall home sales dropped to their lowest point in over ten years. About the same amount of houses were bought by investors in the first quarter of 2023 as by non-investors, whose purchases decreased 6.1% on an annual basis.

Despite Slowing, Investor Activity Outpaces Pre-Pandemic Levels

Both non-investor and investor purchasers still face difficulties in the property market. As seen in 2023, investors are typically the first to leave the market and the first to return, as we are already witnessing. The rate of reduction in investor transactions has slowed, indicating that they are approaching their post-pandemic low even if investor activity has not started to increase again.

In 2024 Q1 compared to pre-pandemic 2019 Q1, investors bought 10.6% more homes, despite their lowest performance in the previous four years. It appears that this post-pandemic “floor” corresponds with the pre-pandemic “ceiling” in investor purchases.

In other words, although investor sales have slowed down recently, overall investor activity is still trending higher, with more investors buying homes and vying for homes than was typical before the pandemic.

Metros in the Midwest and South See High Investor Share

The Midwest and South typically have the highest percentage of investors among the 150 biggest US metro areas. Due to the rising cost of rent and the generally low cost of homes in Midwest metro areas, investors have strong financial reasons to choose the region.

Three metro areas in Missouri made up the top five markets with the largest investor share in the first quarter of 2024. Of the 150 largest metro areas, Springfield, Missouri had the greatest percentage of home purchases made by investors—nearly one in five. Twenty.1% of purchases in Kansas City, MO, and 18.9% in St. Louis went to investors. The top 5 was completed by the Southern metros of Memphis, TN, and Birmingham, AL, with investor shares of 18.2% and 18.7% of purchases in Q1, respectively.

In the first quarter, investor activity increased most in Montgomery, AL; Youngstown, OH; Peoria, IL; Albany, NY; and Canton, OH. In these domains, investor share increased year over year by 3.6 to 6.4 percentage points. Investor share declined in Montgomery, AL in the first quarter of 2023, which helped to account for the significant annual growth and return investor share to the 2020–2022 range for the metro. In general, since 2020, investor share has increased yearly in the metro areas that saw growth. An annual increase in investor purchases was observed in all of these areas, which helped to explain the increase in investor share.

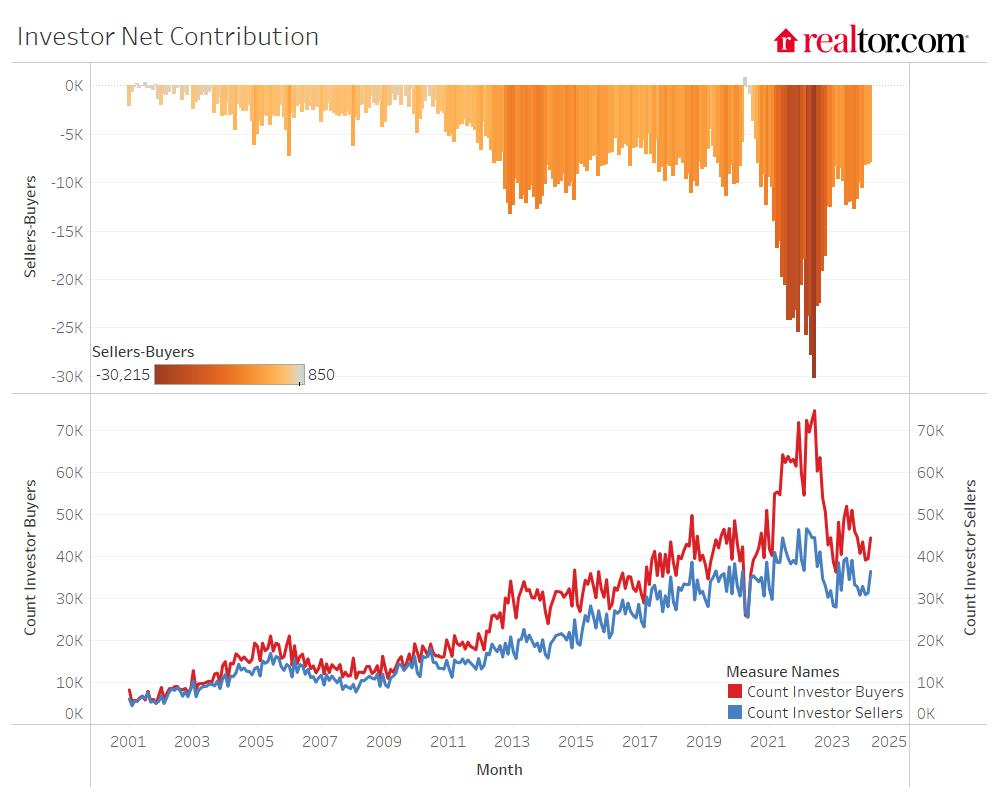

Investors Still Buying More Than They Sell

Despite a notable slowdown in activity, investors are still buying more properties than they are selling. As new rental inventory moved through the pipeline this year, multifamily completions increased nationwide. Still, a lot of the nation has quite low rental vacancy rates and rents that are significantly higher than they were prior to the pandemic. Due to the advantages of high rents and strong rental demand, investors are less likely to liquidate their holdings.

its worst, speculators purchased more properties than they sold—more than 20,000 per month. The latest data showed that this general tendency persisted, but by much smaller margins. Roughly 8,000 more properties were purchased by investors in March 2024 than were sold. Approximately 690,000 more properties were purchased by investors than were sold between March 2020 and March 2024. While these houses add to the rental stock, they further reduce the already limited amount of available residences for sale. The lower difference between the change in rental vacancy from pre-pandemic and the change in homeowner vacancy during the same period of time highlights the surge of rental inventory relative to for-sale inventory.

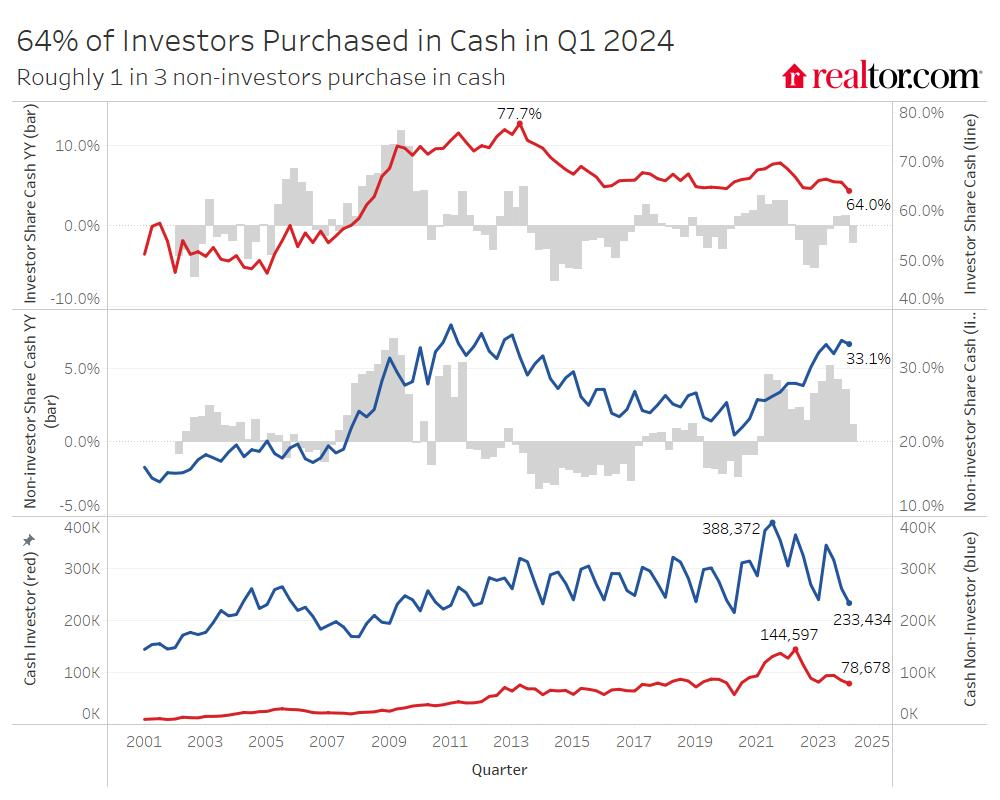

Investor All-Cash Purchase Activity Sees Decline

Both investors and traditional house purchasers used all-cash bids during the pandemic to prevail in multiple-bid situations. Because more investors, particularly larger ones, had access to resources to compete and make cash purchases, investors used this strategy more frequently. When the market peaked in the fourth quarter of 2021, 69.7% of investors paid cash for their purchases, compared to 26.7% of buyers who weren’t investors in the same period. Since then, the percentage of investors making cash purchases has decreased, reaching 64.0% in the first quarter of 2024—a decrease of 2.1 percentage points per year and the lowest investor cash share since 2008. This change is a result of fewer major investors making cash purchases as well as the steady rise of smaller investors, who make cash purchases at a lower rate than large investors.

Cash was used by 64.3% of small investors, 58.5% of medium investors, and 68.3% of large investors to buy real estate in the first quarter of 2024. The large investor cash share was at its lowest point since 2019, while the cash share of small and medium-sized investors stayed roughly in line with previous trends.

Even if a decreasing percentage of investors are making cash purchases, since Q1 2021, the percentage of non-investors taking advantage of all-cash deals has increased annually. 33.1% of non-investors made all-cash purchases in the first quarter of 2024, which is 1.2 percentage points more than the same period the previous year and 6.5 percentage points more than the pre-pandemic Q1 of 2019. The substantial cash buyer share of today is probably a product of high interest rates and huge home equity. Compared to purchasers in a more accommodating market, buyers who are prepared to engage in the high-price, high-rate market of today are probably better able to afford the purchase of a property.

In other words, low sales volumes indicate that many purchasers are priced out of the market, meaning that those who are able to buy a house are probably well-off or have the ability to use the sale of another property as leverage for a purchase, both of which may allow for an all-cash transaction. Because of the current high mortgage rates, buyers are also more inclined to pay cash for their purchases, if at all possible. Recent developments in down payments appear to be driven by similar variables.

Over the course of the data’s history, small investors have made up the largest percentage of all investors. Large and medium-sized investor activity, however, increased throughout the epidemic as larger, more resource-rich corporations successfully fought for and claimed more properties. Bigger investors withdrew once property prices and mortgage rates hit record highs, and the small investor proportion began to rise once more.

The share of small investors who made purchases in Q1 of 2024 was 62.6%, the highest in the history of the record. In addition to increasing their percentage of investments, small investors purchased 6.4% more properties in 2018 than they did the year before, whereas acquisitions by medium and large investors decreased by 3.8% and 13.9%, respectively.

To read the full report, including more data, charts, and methodology, click here.