According to new Redfin research, a buyer on a $3,000 monthly budget may purchase a $447,750 house with a 6.85% mortgage rate, which is the daily average as of July 11. Since mortgage rates peaked five months ago in April, when they could have purchased a $425,500 property at an average rate of 7.5%, the buyer’s purchasing power has increased by $22,500.

With the stock of properties for sale increasing and mortgage rates at their lowest point since March in Thursday’s inflation report, buyers have a great opportunity before competition heats up.

An alternative measure of affordability is the monthly mortgage payment of $2,647 at the current 6.85% rate on the average U.S. home, which is approximately $400,000 in cost. That is less than $200 from $2,814 at a 7.5% interest rate.

Mortgage rates have dropped as a result of the most recent CPI data, which increased the likelihood that the Fed will lower interest rates by September and revealed that inflation is declining more quickly than anticipated.

Mortgage rates are probably going to keep going down a little bit ahead of the anticipated interest rate decreases, but it’s unlikely that they’ll go below 6% before the year is over.

Sale prices are still at record highs and overall housing expenditures are historically high, despite the fact that mortgage rates are dropping. It is unlikely that prices would decrease significantly very soon.

“Now is a good time–at least compared to the recent past–for serious house hunters to get under contract on a home,” said Daryl Fairweather, Chief Economist at Redfin. “The combination of declining mortgage rates, rising supply and a lot of inventory growing stale means buyers have a window where they have more purchasing power than earlier in the year and more homes to choose from. But it’s hard to say how long the window will last.”

More Good News for Buyers: More Homes to Shop Around

Growing inventory is encouraging for purchasers as well: The number of properties for sale is almost at its highest point since late 2020, with new listings up 7% year-over-year.

A growing number of homeowners, many of whom are tied into extremely low mortgage rates, are listing more properties on the market because they are fed up with waiting for rates to plummet before doing so. For almost two years, rates have been at twice the levels seen before the epidemic, and homeowners are accepting that they could have to wait a few years if they hold off on selling and moving into their next property until rates fall to 3% or 4%. The current small decline in rates may encourage more potential sellers to come off the sidelines.

Additionally, homes are being listed for longer than normal. Compared to 50% two years prior, over 60% of properties advertised in May had been on the market for at least 30 days without entering into a deal. Compared to 28% two years prior, 40% of the residences on the market had been listed for at least two months without receiving a contract.

Many of the less desirable homes on the market are struggling to find a buyer as a result of the increase of homes for sale and the fact that many listings are becoming stale. In certain areas, this allows purchasers to purchase a property for less than the asking price and bargain for additional cost savings, such as assistance with home repairs or closing costs.

Declining rates should bring many homebuyers back to the market soon, which means competition would tick up and home prices would increase even faster than they already are,” Fairweather said. “It’s also possible rates drop further in 2025, which would make monthly costs decline more and increase competition even more. One thing is for sure: lower rates will lead to more home sales.”

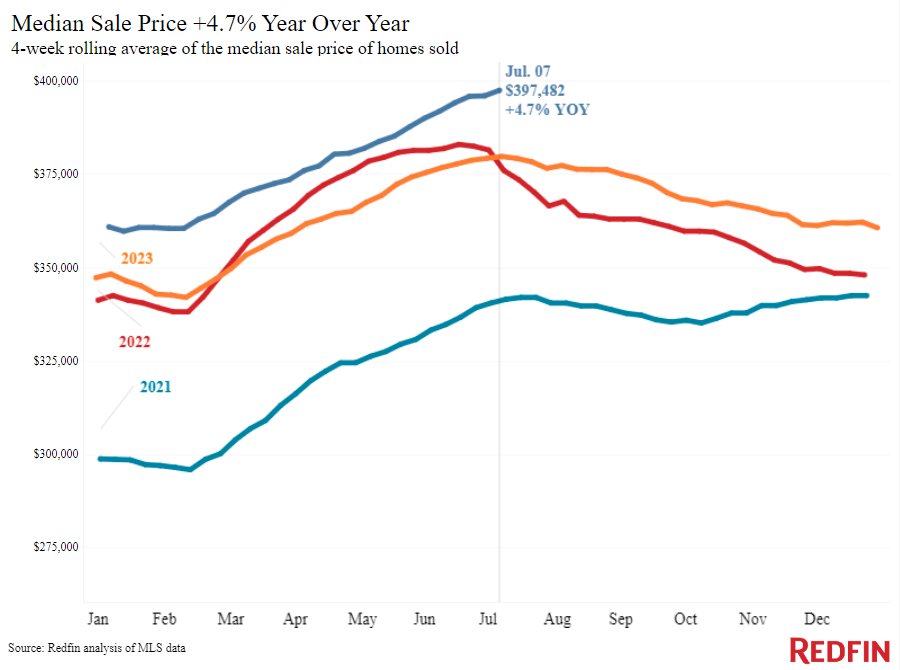

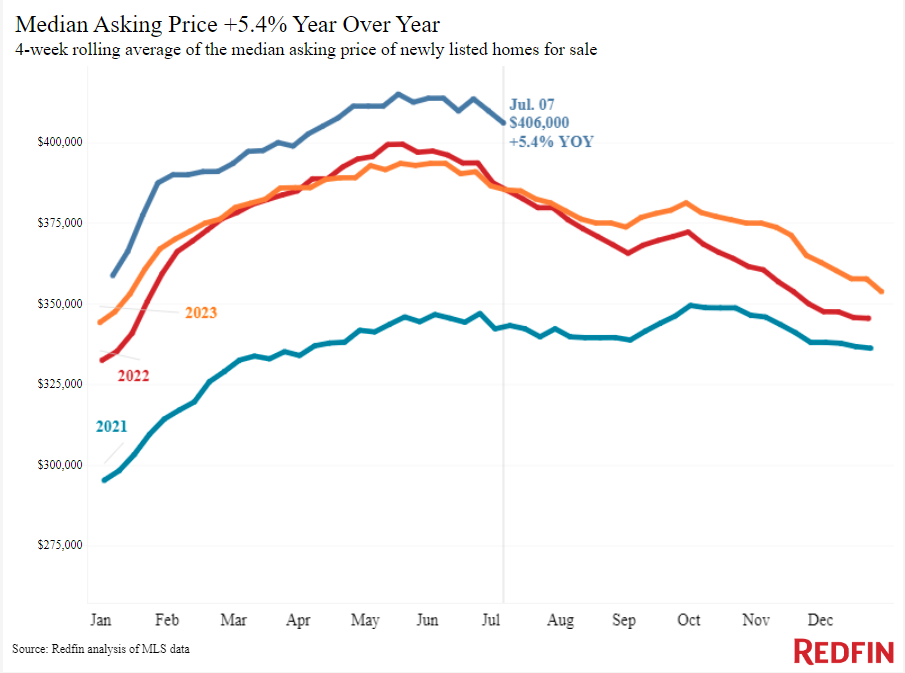

During the four weeks ending July 7, the median price of a home sold in the U.S. reached an all-time high of $397,482, up 4.7% year over year—the largest gain in over four months. This is supported by a recent analysis from the tech-driven real estate company Redfin (redfin.com). The median sale price has risen to a new all-time high for the ninth week in a row.

Home Sale Prices Hit a Record High For the 9th Straight Week

Despite the fact that rising mortgage rates are discouraging people from buying homes, sale prices have stayed stubbornly high; pending house sales are down 3.5% year over year and mortgage-purchase applications are down 13%. This is partially due to historically low inventories, which drives up costs and decreases sales. Additionally, a contributing factor is that final transaction prices are a lagging signal, reflecting agreements reached a month or more ago between buyers and sellers.

There are indications that the price increase may shortly slow down. For the first time since 2020, when the pandemic’s beginnings almost completely shut down the housing market, the average house is selling for 0.4% less than what it was listed for at the beginning of July. Furthermore, only 32% of properties are selling for more than the asking price, which is the lowest percentage at this time of year since 2020 and a decrease from 36% a year earlier.

Inventory is increasing year over year even if it is still historically low, which is another indication that price rise may slow down in the upcoming months. The number of properties for sale has increased by 18.3% overall and by 7.3% for new listings, with the majority of them becoming stale: Over 60% of properties are on the market for at least a month without a contract being signed. Part of the reason for the increase in home sales is that mortgage rates have been at double pandemic-era lows for almost two years, and sellers are fed up with waiting for rates to go down before buying a new property.

“Homes are sitting longer than they usually do this time of year, which has led to some–but not all–homes selling for a little bit less,” said Julie Zubiate, a Redfin Premier agent in the Bay Area. “The longer rates stay high, the pickier buyers are getting. Buyers will jump ship or try to negotiate the price down with any sort of tiny problem; sellers should take the time to prep, price and promote their homes correctly to find the right buyer. That being said, there is one segment of the market that is still moving fast, with homes going over asking price with multiple offers: Move-in ready homes with big backyards located in desirable school districts.”

To read the full report, including more data, charts, and methodology, click here.