This piece originally appeared in the July 2024 edition of MortgagePoint magazine, online now.

The popularity of manufactured housing has ebbed and flowed over the last several decades, after striking an all-time high on shipments in the early 1970s. Since taking a dip in 2009, there has been a slow, but steady climb with more than 100,000 manufactured homes shipped in 2021, and a post-recession high reached in 2022 with 112,000 manufactured homes shipped, according to a 2023 report by the Joint Center for Housing Studies at Harvard University.

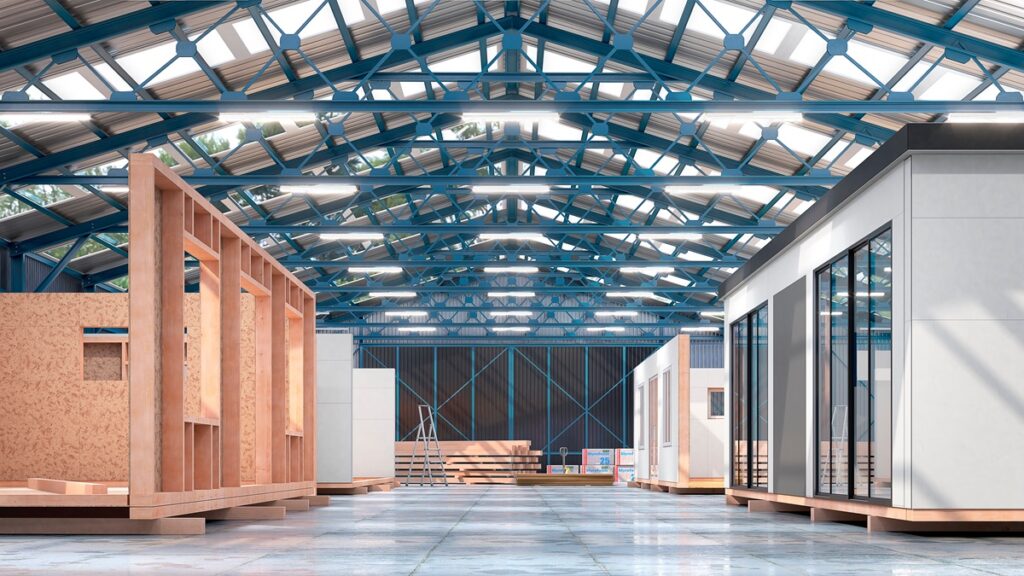

Today, there is a greater emphasis being placed on manufactured homes—both for borrower and lender—as a means for entry-level housing that can help address the steep inventory shortage nationwide. With the addition of new amenities, upgraded finishes and improved quality of aesthetics and construction, in some cases it is hard to tell the difference between a manufactured home and site-built home.

Regulations went into effect in 1976 that require new manufactured homes to meet federal standards defined by the U.S. Department of Housing & Urban Development (HUD). Over the last several years, these homes have become even more modernized.

For potential buyers in the Gen Z and millennials age groups—born between 1981 and 2012—these newly built, visually appealing homes provide another option to become a homeowner at a price they may be able to better afford.

Based on ServiceLink’s 2024 State of Homebuying Report (SOHBR), these younger generations are ready to take that first step to becoming a homeowner, with 63% of Gen Z, and 59% of millennials, surveyed saying they plan to buy this year. And while they have their eyes set on the prize, high housing costs and low availability could curtail their dreams. Of those surveyed—who either purchased or attempted to purchase a home in the last four years—79% of Gen Z and 71% of millennials reported less than $100,000 in annual household income.

This is where manufactured housing becomes another avenue that could lead them to the finish line. With lower costs, shorter build times and all the modern amenities they now offer, Gen Z and millennials are giving them a look. A Freddie Mac survey indicated that 68% of millennials and 61% of Gen Z (along with 62% of Gen X) respondents said they are likely to consider buying a manufactured home. For lenders, this opens up an added market to potentially increase revenue during a trying time.

The Cost Advantage for Buyers

In this volatile market, the cost to purchase a home remains high. In April, the National Association of Realtors (NAR) reported a median sale price of $393,500, up 4.8% year-over-year. For a new build, that cost is even higher, coming in at a median sale price of $430,700 in March, according to the U.S. Census Bureau. A perk of purchasing a manufactured home is the lower-level cost, which the Manufactured Housing Institute reports as $85 per square foot, versus $167.87 per square foot for a site-built home. Manufactured homes can be produced for less, as they’re built in a factory where the process is streamlined and more efficient. A benefit of purchasing a manufactured home is the lower-level cost, which the Manufactured Housing Institute (MHI) reports as $85 per square foot, versus $167.87 per square foot for a site-built home. Manufactured homes can be produced for less, as they are built in a factory where the process is streamlined and more efficient.

Gen Z and millennials who are looking for a starter home with all the bells and whistles—often with lower incomes, as they are earlier on in their careers—are faced with a choice: enter the highly competitive buyers’ market where homes in their price range likely do not come with all the modern amenities and make upgrades themselves, if they can afford it, or buy new. Depending on their situation, manufactured housing could provide that opportunity to purchase a new build at a relatively affordable price.

Energy Efficiency

The cost of a new home does not just come with the initial downpayment and monthly mortgage bills. Operating costs are another area buyers need to consider. How much are they able to afford in upkeep costs?

When it comes to buying a newly built manufactured home versus a likely older traditional home that buyers would get at a similar starter home price, there’s an advantage to new. Replacing the HVAC unit or buying a new hot water tank likely will not need to be done for several years in a new home.

According to Fannie Mae, the median all-in monthly cost for a manufactured home is $925, or $675 less per month than the owners of a site-built home paid. Newer homes also typically come with more energy-efficient appliances, which will help owners save money in the long run. For Gen Z and millennial homebuyers, it is important to consider all costs, and what it will take to keep up with a home prior to purchasing.

A Quicker Build

With a more streamlined process, manufactured homes also are quicker to build than traditional site-built homes. Manufactured homes are constructed in factories and do not experience the weather and seasonal delays that a site-built home may be subject to. While the speed varies based on a variety of circumstances, it is estimated that a manufactured home can be built in 40% of the time that it takes for a site-built home to be completed. Fannie Mae even cited one manufactured home producer as saying it only takes about six production days to complete a typical home build. Delivery and installation add additional time, but it is still feasible for a homeowner to move in within 90 days. A site-built home, on the other hand, can take up to six months to build, the Fannie Mae study found.

Modern Amenities

According to ServiceLink’s 2024 SOHBR, Gen Z and millennials know what they are looking for in a home. Gen Z’s biggest desire is a larger house with more space, and millennials want a home with plenty of technology upgrades and amenities.

Homebuyers today might be surprised with the amount of square footage and amenities that can be packed into a manufactured home. For example, some manufactured home builders offer models with four to five bedrooms and 2,000-plus square feet to move around in. What’s more, these home types also offer modern amenities similar to what can be found in site-built homes. Today’s manufactured homes are not what you remember from your grandma. They often come with a choice of layout. Some even offer appliance upgrade packages, open floor plans, and vaulted ceilings.

Moving into a manufactured housing community can provide even greater offerings. Sometimes there are amenities including community pools, fitness centers, or playgrounds.

Why Lenders Are Taking Notice

For lenders, a difficult, competitive market means it is time to get creative. That could include offering financial incentives to attract borrowers or finding ways to bring in new customers. Lenders have to find a way to either be more successful selling in the market they are already in, or expand and find new markets and new customers.

In today’s market, lenders are doing both, and the proliferation of manufactured housing provides another avenue not just for borrowers, but also for lenders as an area of great opportunity.