First American Data & Analytics, a division of First American Financial Corporation specializing in property-centric information and valuation solutions, unveiled its latest Home Price Index (HPI) report July 16. The report—a key indicator of national housing market trends—provides detailed insights into home price fluctuations across various geographic levels and market segments.

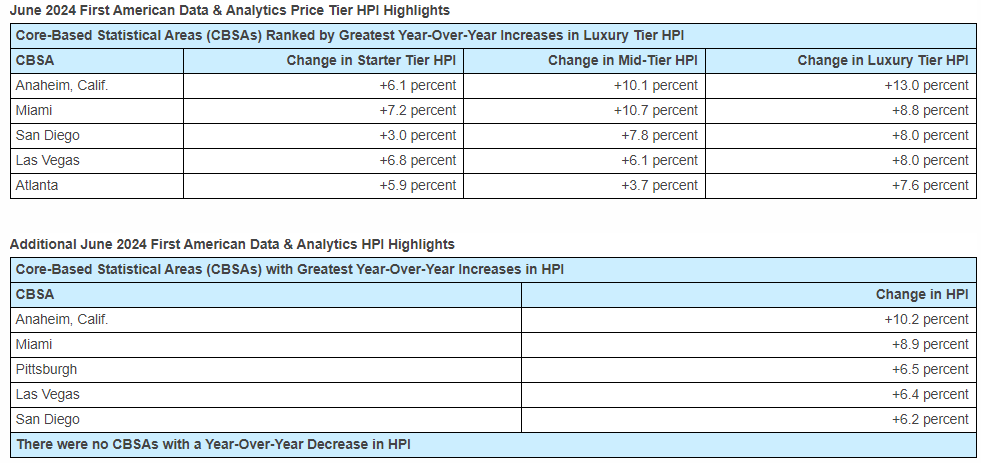

The June 2024 report, which tracks home price changes at the national, state, and metropolitan areas (Core-Based Statistical Areas as set by the U.S. Census Bureau), includes segmentation into starter, mid, and luxury price tiers. According to the findings, house prices nationwide have surged by 54.7% compared to pre-pandemic levels in February 2020.

Also, an adjustment was made to the previous month’s data, with the house price growth reported from April 2024 to May 2024 revised downward by 0.1 percentage points, from 0.5% to 0.4%.

Chief Economist analysis

“In June, home prices continued their upward trend and hit another record high, but annualized house price appreciation slowed for the sixth consecutive month. Elevated mortgage rates continue to keep homeowners rate locked-in, while reducing affordability for potential first-time home buyers,” said Mark Fleming, Chief Economist at First American. “The resulting pullback in demand coincided with an uptick in supply, which is cooling price growth. However, housing remains fundamentally undersupplied nationally, which will keep a floor on how low house price appreciation can fall.”

“High-end home buyers are more immune to mortgage rate fluctuations, and many existing homeowners are sitting on substantial equity that can be used to finance a bigger and better property. As a result, house prices in the luxury price tier increased on an annual basis in all 30 markets tracked.”

The HPI by First American Data & Analytics categorizes metropolitan home price changes into three tiers based on local market sales data: starter tier (bottom third of market price distribution), mid-tier (middle third), and luxury tier (top third). Notably, the luxury tier has seen significant annual price increases across all 30 markets tracked, attributed to factors such as stability among high-end home buyers and substantial equity among existing homeowners.

Established in 1980, the First American Data & Analytics HPI is updated monthly and encompasses single-family home prices, incorporating distressed sales. It utilizes a repeat-sales methodology, analyzing over 46 million paired transactions to generate accurate indices. In states where sales data is limited (non-disclosure states), the HPI employs a comprehensive approach using public sales records, MLS listings, and appraisal data.

While the report provides preliminary estimates for the month prior (e.g., July transactions reported in August), it emphasizes the potential for revisions as additional transaction data becomes available.

The release of the June 2024 HPI report underscores First American Data & Analytics’ commitment to delivering robust insights into the dynamic housing market landscape, offering stakeholders critical data for informed decision-making.

For more information and detailed market segment indices, visit First American Data & Analytics’ official website.