According to Realtor.com’s most recent rental report, in June, median rent continued to fall, but nationwide rent are sitting just below 2022 levels, with rents also declining in all size categories.

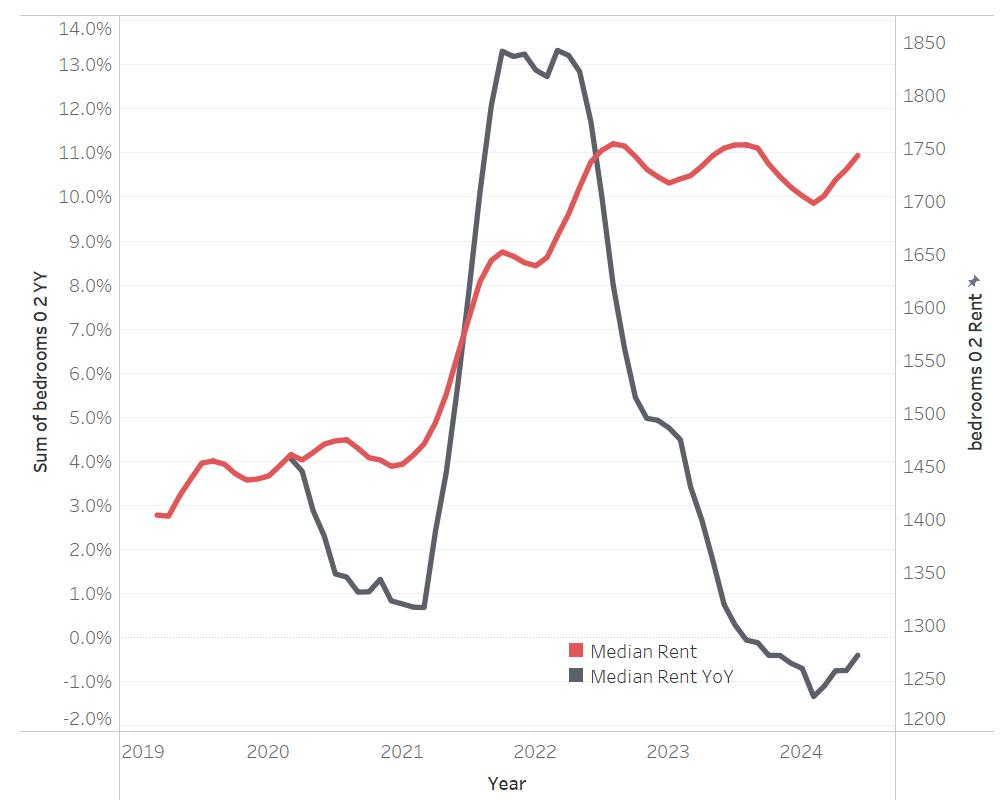

In June, rents decreased once more, with particularly significant drops in the South due to an increase in newly constructed apartments, per a Realtor.com Rental Report that was published recently. For the 11th consecutive month, the median asking rent for 0–2 bedroom units decreased by -0.4% ($7) from June of previous year to $1,743, which is -0.6% ($11) less than its peak from August 2022. Nevertheless, compared to 2019’s pre-pandemic values, several locations have seen rent increases of up to 40%; Tampa, FL, has had the biggest increase over the previous five years.

The top 10 markets experiencing the fastest price growth versus pre-pandemic rents include:

- Tampa-St. Petersburg-Clearwater, FL (+39.5%)

- Miami-Fort Lauderdale-Pompano Beach, FL (+39.2%)

- Indianapolis-Carmel-Anderson, IN (+37.5%)

- Pittsburgh (+37.4%)

- Sacramento-Roseville-Folsom, CA (+35.8%)

- Virginia Beach-Norfolk-Newport News, VA-NC (+32.5%)

- New York-Newark-Jersey City, NY-NJ-PA (+31.3%)

- Cleveland-Elyria, Ohio (+30.6%)

- Raleigh-Cary, NC (29.8%)

- Birmingham-Hoover, AL (+29.3%)

Rents Decline Again, but Nationwide Rent Is Just 0.6% Below 2022 Peak

“Rents have been steadily falling for almost a year, though the pace of the decline has slowed,” said Danielle Hale, Chief Economist at Realtor.com. “But rental costs have risen significantly since before the pandemic and inflation has further strained renters’ budgets, underscoring the need for more supply to meet demand and to keep renters from contributing an increasing percentage of their incomes to housing costs.”

Tampa, Florida Saw Biggest Rent Growth Since Before the Pandemic

In June, the median asking rent for 0–2 bedroom apartments in the top 50 metro regions was $305, which is 21.2% more than it was in June of 2019, prior to the pandemic’s impact on the housing market. Though it is not nearly as much as the total consumer price trend of +22.6% over the same period, the median price-per-square-foot of for-sale home listings increased by 52.6% over the five years ending in June 2024.

The South accounted for half of the ten markets where rent increases as a percentage from June 2019 to June 2024 were highest, with Tampa, FL (39.5%) and Miami (39.2%) leading the way. For instance, in Tampa, the median asking rent in June was $1,752, which was $496 more than it was before to the outbreak. That works out to be around 8.6% of the gross monthly income of an average Tampa household. Indianapolis saw the largest gain in the Midwest, rising 37.5% to $1,353. Sacramento, California led the West with a 35.8% increase in median rent to $2,007, while Pittsburgh witnessed the greatest percentage increase in the Northeast at 37.4% to $1,484.

June saw a mixed bag of trends for rentals in the area. The South saw the largest year-over-year drops, with Austin, Texas (-9.5%), San Antonio (-8.2%), and Nashville, TN (-8.1%) leading the way. There have been significant increases in the number of new rental properties in such localities. The Midwest experienced a rise in rent overall; Indianapolis (+4.4%), Milwaukee (+3.7%), and Minneapolis (+3.7%) saw the highest increases. West Coast major cities with declining rents year over year were Los Angeles (-1.9%) and San Francisco (-4.2%). While this was going on, rental rates began to rise in major Northeastern coastal cities like New York (+0.6%), albeit more slowly than previously.

June saw a mixed bag of trends for rentals in the area. The South saw the largest year-over-year drops, with Austin, Texas (-9.5%), San Antonio (-8.2%), and Nashville, TN (-8.1%) leading the way. There have been significant increases in the number of new rental properties in such localities. The Midwest experienced a rise in rent overall; Indianapolis (+4.4%), Milwaukee (+3.7%), and Minneapolis (+3.7%) saw the highest increases. West Coast major cities with declining rents year over year were Los Angeles (-1.9%) and San Francisco (-4.2%). While this was going on, rental rates began to rise in major Northeastern coastal cities like New York (+0.6%), albeit more slowly than previously.

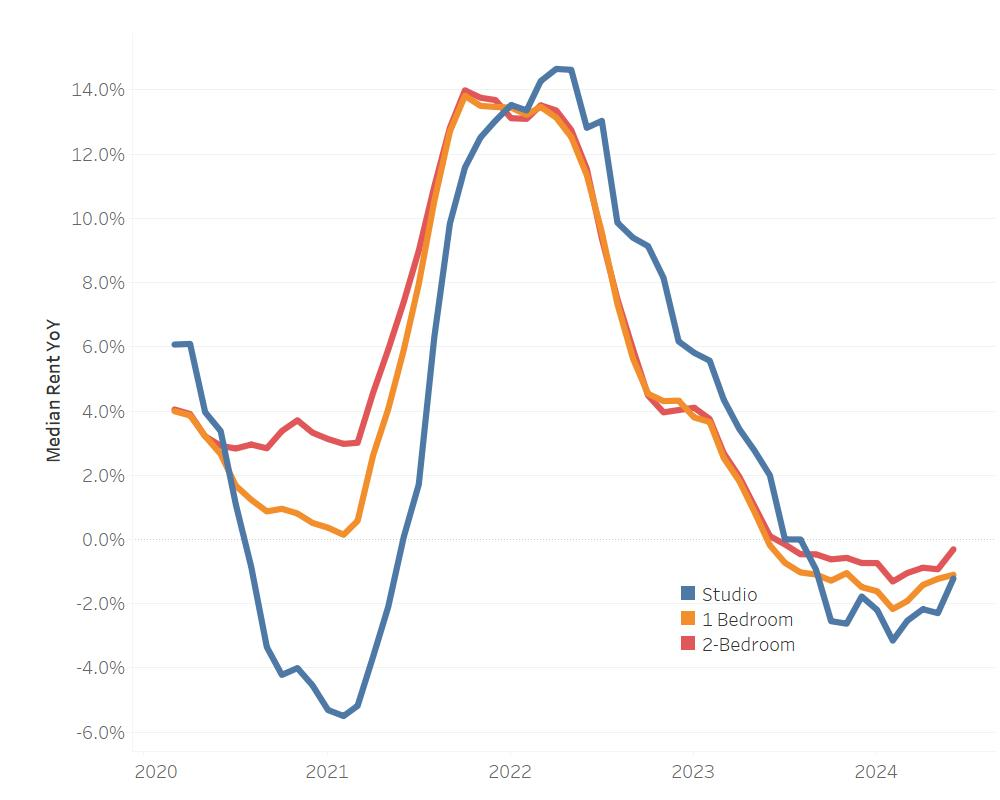

Units of All Sizes Saw Rents Decline

All size groups saw a decrease in median asking rents, with smaller units experiencing greater drops. Year-over-year, the median rent for studios decreased by 1.2% to $1,463. That is 17.6% greater than it was five years ago, but it is -2.0% lower than its top from October 2022. The one-bedroom unit median rent decreased by 1.1% to $1,618—the 13th consecutive year of declines. Even so, that is a 19.5% increase from five years prior. Additionally, although it was a lesser decrease than in May, the median rent for two-bedroom apartments dropped by -0.3% to $1,939 for the 12th consecutive month of yearly reductions. With a 23% growth rate over the previous five years, these larger units had the highest growth rate.

To read the full report, including more data, charts, and methodology, click here.