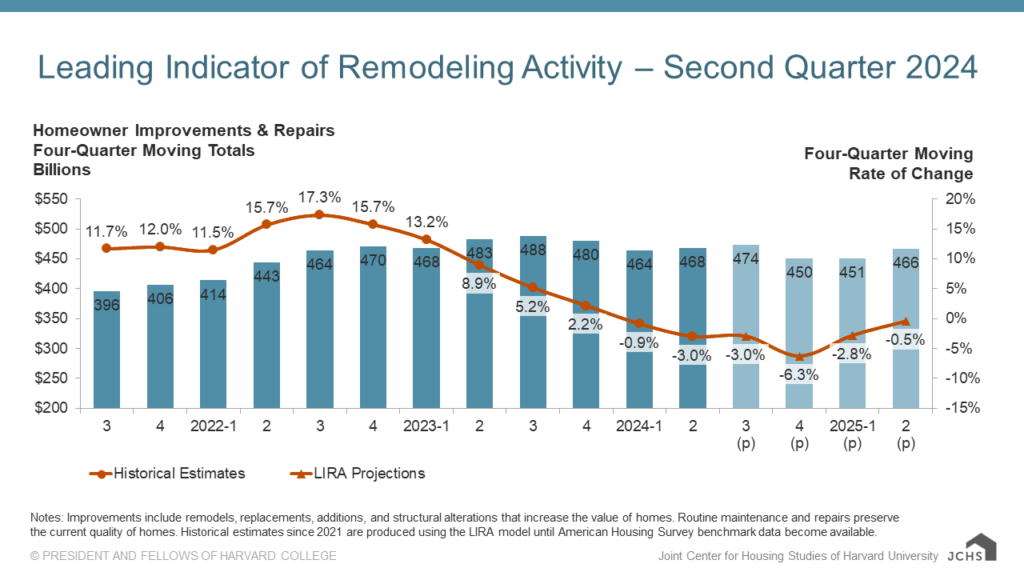

According to the most recent Leading Indicator of Remodeling Activity (LIRA) from the Joint Center for Housing Studies (JCHS), homeowner spending on upgrades and repairs is anticipated to increase through the first half of 2025 following a slight decline. According to the LIRA, through the second quarter of 2025, the yearly drop in spending on owner-occupied home maintenance and improvements is projected to only slide -0.5%.

Residential remodeling is being restrained by economic uncertainty, persistent weakness in home sales, and the sale of building materials, even as many spending drivers are beginning to stabilize. Homeowners are now updating and maintaining their properties at a more sustainable and steady pace, following many years of chaotic activity during the pandemic.

“Economic uncertainty and continued weakness in home sales and the sale of building materials are keeping a lid on residential remodeling, although many drivers of spending are starting to firm up again,” said Carlos Martín, Director of the Remodeling Futures Program at JCHS. “After several years of frenzied activity during the pandemic, owners are now making upgrades and repairs to their homes at a steadier and more sustainable pace.”

Home Maintenance and Renovation Spending Expected to Climb in 2025

Through Q2 of next year, annual spending on homeowner maintenance and improvements is projected to exceed $466 billion, which is comparable to spending over the previous four quarters. The downturn in house remodeling should stay relatively mild, with activity leveling out just short of the heights of the previous year.

“Annual spending on homeowner improvements and maintenance is expected to reach $466 billion through the second quarter of next year, on par with spending over the past four quarters,” said Abbe Will, Associate Director of the Remodeling Futures Program at JCHS. “The home remodeling slowdown should continue to be relatively mild, with activity stabilizing just shy of last year’s peaks.”

To read the full report, including more data, charts, and methodology, click here.